Understanding the bitcoin mining rig setup cost is crucial for anyone considering entering the cryptocurrency mining industry in 2025. With Bitcoin’s continued growth and evolving mining difficulty, calculating the total investment required for a profitable mining operation has become more complex than ever. The bitcoin mining rig setup cost encompasses not just the initial hardware purchase but also ongoing operational expenses, facility preparation, and auxiliary equipment needed to run a successful mining farm.

Whether you’re a beginner exploring your first mining venture or an experienced investor scaling up operations, this comprehensive guide will break down every aspect of bitcoin mining rig setup cost. From ASIC miners and cooling systems to electricity infrastructure and maintenance expenses, we’ll provide you with the detailed financial roadmap needed to make informed decisions about your mining investment.

What Determines Bitcoin Mining Rig Setup Cost?

The total cost of setting up a bitcoin mining rig varies significantly based on several key factors. Scale plays the most critical role – a single ASIC miner for home use costs dramatically less than an industrial-scale mining farm. Location impacts both equipment pricing and ongoing operational expenses, particularly electricity rates which can make or break mining profitability.

Hardware selection represents the largest upfront expense in your bitcoin mining rig setup cost calculation. Premium ASIC miners like the Antminer S19 Pro or Whatsminer M30S+ command higher prices but offer superior hash rates and energy efficiency. Market demand fluctuates constantly, causing mining hardware prices to swing dramatically based on Bitcoin’s price movements and mining difficulty adjustments.

Current market conditions in 2025 show mining hardware prices stabilizing after the volatile periods of 2022-2024. However, supply chain considerations and manufacturer production capacity continue to influence pricing structures across different mining equipment tiers.

Hardware Costs: The Foundation of Your Mining Investment

ASIC Mining Hardware Pricing

The centerpiece of any bitcoin mining rig setup cost breakdown is the ASIC mining hardware. Entry-level miners like the Antminer S9 (14 TH/s) can be found for $200-$400 on the secondary market, but their low efficiency makes them unsuitable for profitable mining in most regions. Mid-range options such as the Antminer S19 (95 TH/s) typically cost $2,500-$4,000 depending on market conditions and availability.

High-end mining equipment dominates profitable operations. The Antminer S19 XP (140 TH/s) ranges from $8,000-$12,000, while the latest Whatsminer M50S (126 TH/s) commands similar pricing. These premium miners offer the best performance-per-watt ratios, crucial for long-term profitability.

Industrial-grade miners designed for large-scale operations include specialized cooling integration and enhanced durability features. These units often require minimum order quantities and direct manufacturer relationships, with prices varying based on volume commitments and delivery timelines.

Supporting Hardware and Infrastructure

Beyond the mining hardware itself, your bitcoin mining rig setup cost must account for supporting infrastructure. Power supply units (PSUs) capable of handling high-wattage ASIC miners cost $200-$500 per unit. Industrial mining operations often integrate PSUs directly into facility power distribution systems, requiring professional electrical installation.

Cooling systems represent another significant expense category. Home miners might use standard fans costing $50-$200, while commercial operations require industrial exhaust fans, air conditioning systems, and specialized cooling infrastructure that can add $1,000-$5,000 per mining unit to the overall setup cost.

Network equipment including routers, switches, and monitoring systems typically add $500-$2,000 to smaller operations. Large-scale mining farms require enterprise networking infrastructure with redundancy and monitoring capabilities that can exceed $10,000 for comprehensive installations.

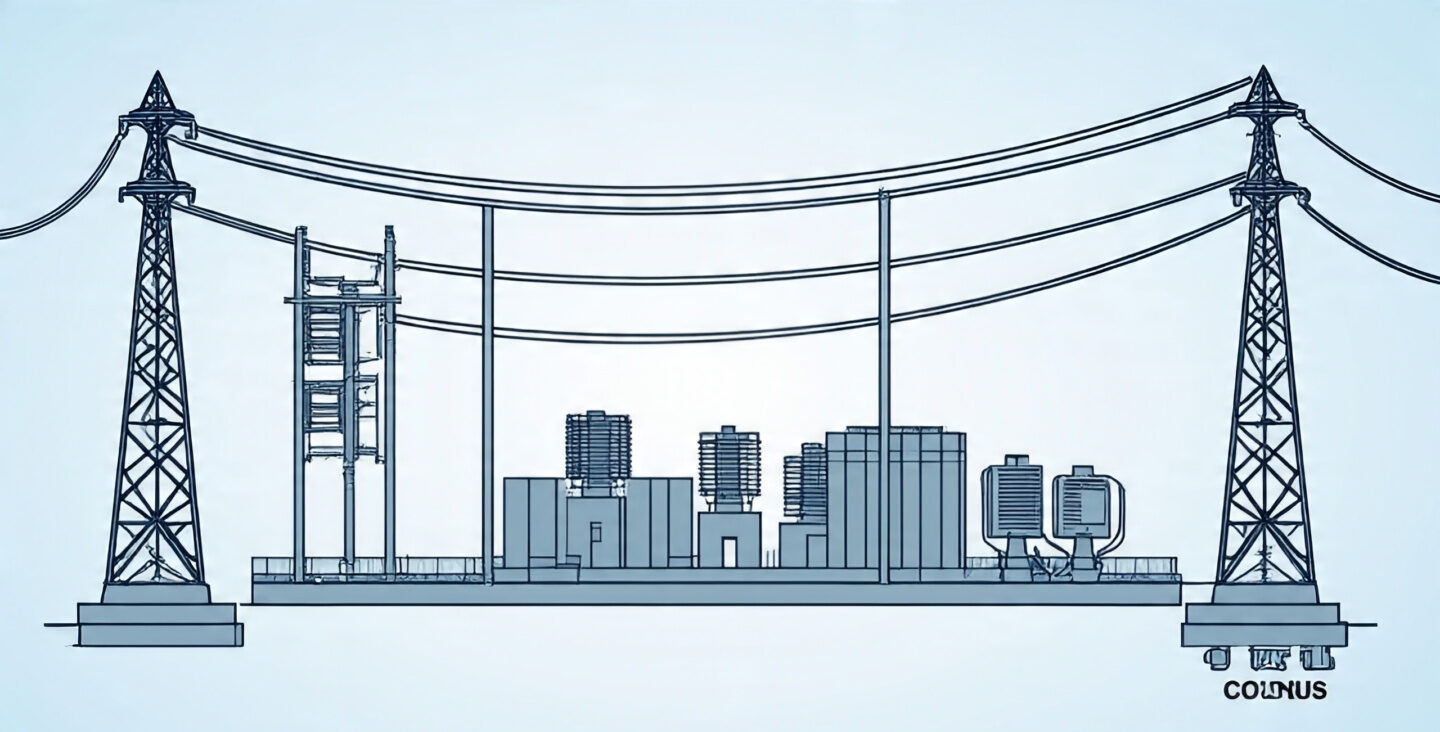

Electricity Infrastructure and Setup Expenses

Electrical System Upgrades

Proper electrical infrastructure often represents the most overlooked component of bitcoin mining rig setup cost calculations. Home installations typically require electrical panel upgrades, dedicated circuits, and professional electrician services costing $2,000-$8,000 depending on existing infrastructure and local electrical codes.

Commercial mining operations require industrial electrical installations including transformers, switchgear, and power distribution systems. These installations range from $20,000 for small warehouse setups to over $500,000 for large-scale mining facilities. Professional electrical engineering and permit acquisition add additional costs varying by jurisdiction.

Backup power systems and surge protection equipment protect mining investments from power grid instabilities. Uninterruptible power supplies (UPS) and surge protection add $500-$2,000 per mining rig, while generator backup systems for larger operations can cost $50,000-$200,000 depending on capacity requirements.

Ongoing Electricity Costs

While not part of the initial bitcoin mining rig setup cost, electricity expenses represent the primary ongoing operational expense. Residential electricity rates averaging $0.10-$0.15 per kWh make profitable mining challenging with current hardware. Industrial electricity rates of $0.05-$0.08 per kWh are typically necessary for sustainable mining operations.

Monthly electricity costs vary dramatically based on mining hardware efficiency and local utility rates. A single Antminer S19 consuming 3,250 watts costs approximately $70-$350 monthly in electricity depending on local rates. Scaling this calculation across multiple miners quickly demonstrates how electricity costs can eclipse hardware investments over time.

Location and Facility Preparation Costs

Facility Selection and Preparation

Mining facility costs vary enormously based on location and scale. Home mining might require garage modifications costing $1,000-$5,000 for ventilation and electrical upgrades. Warehouse facilities suitable for medium-scale mining typically lease for $3-$8 per square foot annually, with additional renovation costs of $10-$30 per square foot.

Purpose-built mining facilities offer optimal conditions but require significant upfront investment. Construction costs for mining-specific buildings range from $100-$300 per square foot, including specialized electrical infrastructure, cooling systems, and security features designed for cryptocurrency mining operations.

Permitting and regulatory compliance add additional costs varying by jurisdiction. Some locations require special licensing for cryptocurrency mining operations, environmental impact assessments, or additional insurance coverage that can add thousands to the initial setup investment.

Security and Monitoring Systems

Physical security systems protect valuable mining hardware from theft. Basic security camera systems cost $1,000-$3,000 for small operations, while comprehensive security installations for larger facilities can exceed $50,000. Fire suppression systems designed for electrical equipment add $5,000-$20,000 depending on facility size and local fire codes.

Remote monitoring systems enable miners to track performance and identify issues without physical facility visits. These systems range from $200 DIY solutions to $10,000+ enterprise monitoring platforms offering comprehensive analytics and automated alert systems.

Additional Equipment and Miscellaneous Costs

Tools and Maintenance Equipment

Professional mining operations require specialized tools and maintenance equipment. Basic tool kits for ASIC maintenance cost $200-$500, while comprehensive repair facilities require oscilloscopes, multimeters, and specialized testing equipment costing $5,000-$20,000.

Spare parts inventory ensures minimal downtime when equipment failures occur. Maintaining 10-20% of hardware value in spare parts (fans, hash boards, control boards) is recommended for larger operations, significantly impacting initial investment calculations.

Professional Services and Consulting

Many miners underestimate professional service costs in their bitcoin mining rig setup cost planning. Electrical contractors charge $75-$150 per hour for installation work. HVAC specialists for cooling system design and installation command similar rates. Legal and accounting services for business structure setup and tax planning add $2,000-$10,000 to initial costs.

Mining consultants and facility management services offer expertise but add ongoing costs. These services typically charge 5-15% of mining revenue or flat monthly fees ranging from $1,000-$10,000 depending on operation size and complexity.

Bitcoin Mining Rig Setup Cost Breakdown by Scale

Home Mining Setup ($3,000 – $15,000)

Small-scale home mining operations represent the entry point for many miners. A basic setup including one Antminer S19, electrical upgrades, basic cooling, and miscellaneous equipment typically costs $5,000-$8,000. More comprehensive home installations with multiple miners, professional electrical work, and enhanced cooling systems can reach $10,000-$15,000.

Home mining faces significant profitability challenges due to higher residential electricity rates and limited scalability. However, these setups offer valuable learning experiences and can remain profitable in favorable market conditions.

Small Commercial Setup ($50,000 – $200,000)

Small commercial mining operations typically deploy 10-50 mining units in warehouse or industrial facilities. Total bitcoin mining rig setup costs range from $75,000-$150,000 including hardware, facility preparation, electrical infrastructure, and initial operating capital.

These operations achieve better electricity rates and operational efficiency compared to home mining while remaining manageable for individual operators or small partnerships. Professional consultation becomes more valuable at this scale to optimize facility design and operational procedures.

Large-Scale Mining Farm ($500,000 – $5,000,000+)

Industrial mining operations require substantial capital investment but achieve optimal operational efficiency. Facilities housing 200-2,000+ miners require comprehensive electrical infrastructure, industrial cooling systems, and professional management.

Large-scale operations benefit from volume hardware pricing, industrial electricity rates, and operational efficiencies that smaller operations cannot achieve. However, they also face increased regulatory scrutiny, insurance requirements, and complexity that smaller operations avoid.

Calculating Return on Investment (ROI)

Profitability Analysis Methods

Accurate ROI calculations require comprehensive modeling of all costs versus projected mining revenue. Bitcoin mining profitability depends on Bitcoin price, network difficulty, hardware efficiency, and operational costs. Online calculators provide basic estimates, but detailed spreadsheet modeling offers better accuracy for investment decisions.

Break-even analysis should account for hardware depreciation, difficulty increases, and potential Bitcoin price volatility. Conservative projections assuming gradual difficulty increases and stable Bitcoin prices provide more realistic investment timelines than optimistic scenarios.

Market Variables Affecting Profitability

Bitcoin price volatility significantly impacts mining profitability and ROI timelines. Mining revenue scales directly with Bitcoin price, while operational costs remain relatively fixed. This creates substantial leverage that can dramatically improve or destroy mining investment returns.

Network difficulty adjustments occur every 2,016 blocks (approximately two weeks) and directly impact mining rewards. Increasing difficulty reduces individual miner rewards, while decreasing difficulty improves profitability. Historical difficulty trends inform future projections but cannot predict sudden changes.

Conclusion

Understanding the complete bitcoin mining rig setup cost is essential for making informed investment decisions in the cryptocurrency mining industry. From initial hardware purchases and electrical infrastructure to ongoing operational expenses and maintenance costs, successful mining operations require comprehensive financial planning and realistic profitability projections.

The key to profitable bitcoin mining lies in securing low-cost electricity, investing in efficient hardware, and maintaining realistic expectations about market volatility and competition. Whether you’re considering a small home mining setup or planning a large-scale commercial operation, thorough cost analysis and professional consultation will significantly improve your chances of success.

Ready to start your bitcoin mining journey? Begin by calculating your specific bitcoin mining rig setup cost using current hardware prices and local electricity rates. Consider starting with a small-scale operation to gain experience before scaling up to larger investments. Contact local electrical contractors and mining consultants to get accurate quotes for your specific situation and location.