Once upon a time, the market for Cryptocurrency attracted world attention with Bitcoin. Despite a recent price adjustment, the top digital asset in the world finds mining challenges increasing. This evolution emphasizes, despite market volatility, the resilience and adaptability of the Bitcoin network. While miners fight for block payouts and keep spending on more sophisticated hardware, the network’s mining difficulty has escalated, posing potential as well as difficulties for the sector.

Bitcoin Mining Difficulty

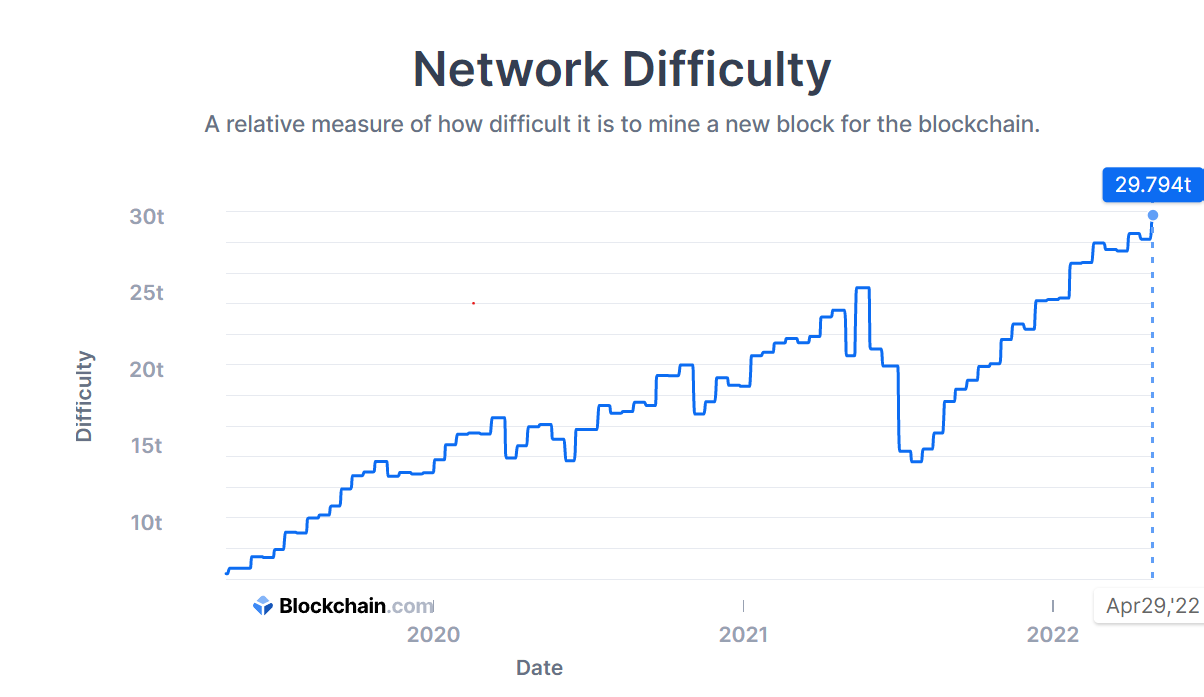

Measuring the difficulty of finding a new block on the Bitcoin blockchain helps one understand the state of Bitcoin mining. This statistic changes around every two weeks to guarantee constant block mining at about one every ten minutes. The entire computational power, or hash rate, committed to the network directly determines the difficulty level. More miners connecting the network or upgrading their gear raises the hash rate, causing mining difficulty to climb in line as well.

According to the most recent statistics, Bitcoin’s mining difficulty has exceeded past records and reached a fresh all-time high. This rise occurs in spite of a recent price drop, which saw the coin fall from its recent peaks. The growing difficulty emphasizes how competitive Bitcoin mining is since participants fight for the rich block rewards, which at present are set at 6.25 BTC each block (around $170,000 at current rates).

Factors Driving

A number of elements have led to the current increase in difficulty mining Bitcoin. First and most importantly, the continuous growth in mining infrastructure. Particularly in areas with access to inexpensive electricity, large-scale mining activities have substantially funded modern mining rigs. Compared to past models, these devices—including the most recent ASIC (Application-Specific Integrated Circuit) miners—offer notably better hash rates and energy economy.

Another important aspect is the mining sector’s comeback after the Chinese government banned crypto mining in 2021. This crackdown obliged many miners to move to more advantageous countries such as Canada, Kazakhstan, and the United States. The general hash rate of the Bitcoin network has rebounded as these operations have stabilized and grown, increasing mining difficulty.

Furthermore, the recent price explosion in Bitcoin has encouraged more people to enter the mining environment. For those with access to reasonably priced energy and efficient technology, mining Bitcoin is a viable endeavor even with the current decline since its price still much exceeds its lows in 2022.

Miners and the Network

For Bitcoin miners, the rising mining difficulty offers both possibilities and problems. Higher difficulty forces miners to spend more in hardware and energy to keep their competitive edge on one hand. As the difficulty increases, smaller businesses—especially those with obsolete equipment—may struggle to remain viable. This could cause more mining industry consolidation as bigger businesses take front stage.

Conversely, the increasing challenge is evidence of the Bitcoin network’s security and robustness. Since compromising the blockchain would require a lot of processing capacity, a greater hash rate helps the network be more resistant to attacks. This increased security makes Bitcoin a more appealing distributed and trustless financial tool.

The rise in mining difficulty for the larger Bitcoin market demonstrates increasing faith in the coin’s long-term viability. Miners are counting on the digital asset’s ongoing acceptance and appreciation despite transient pricing swings. Institutional interest and legislative changes that might open the path for more general adoption help to support this attitude even further.

Road for Bitcoin Mining

The sector will probably witness more innovation and change as Bitcoin’s mining difficulty rises. Miners will increasingly seek renewable energy sources to save costs and address environmental issues. Particularly in areas with plenty of natural resources, mining activities already show a rising tendency toward using solar, wind, and hydroelectric power.

Furthermore, developments in mining technologies are predicted to propel efficiency increases. Companies including Bitmain, MicroBT, and Canaan are constantly creating new ASIC models with better hash rates and reduced energy usage. These developments will help mines remain competitive even when challenging levels increase.

Another possible development is the growing use of mining pools, where individual miners combine their computational capabilities to increase their chances of obtaining block rewards. Through resource pooling, miners can get more regular payouts—even in the face of growing difficulty.

Conclusion

Notwithstanding a price adjustment, the latest increase in Bitcoin mining difficulty highlights the dynamic and strong character of the cryptocurrency ecosystem. The Bitcoin network gets stronger and safer as miners spend on sophisticated hardware and extend their activities. Higher difficulty symbolizes the growing trust in Bitcoin’s future, even though it presents difficulties for fewer participants.

Sustainability and invention will be key topics influencing the direction of Bitcoin mining as the sector develops. The next halving event is set for 2024, which will lower block payouts. Miners of 3.125 BTC will have to change with the times to stay lucrative. One is reminded in the meantime of the growing difficulty of mining. This is an always shifting and competitive terrain of the bitcoin universe.