Crypto market crash nations placed high tariffs on semiconductors and electric vehicles; investors fled risk assets. The changes could destabilize crypto markets by disrupting supply networks, causing inflation, and slowing economic growth.

Bitcoin’s six-week low shows its growing ties to traditional finance. Once called “digital gold,” BTC now tracks stocks, with the S&P 500 and Nasdaq down 2-3% this week. Ethereum’s decline below 2,000 and XRP’s tumble to 0.42. The Crypto Fear & Greed Index dropped to 28, indicating traders’ concern.

Trade War Impact

The U.S. imposed 25% tariffs on 18 billion dollars worth of goods. The 2018 edition of the book is now available for download. China reacted to American agricultural exports by imposing tariffs on 18 billion Chinese solar panels. Bitcoin, which had stabilized near 38,000, broke essential support levels, causing investors to fear a 2018-style trade war. Over $400 million in leveraged liquidations and other transactions.

EthereumandXRPfacedsharperdeclinesduetothinnerliquidity. Institutions are sheltering in cash and bonds. “Crypto is no longer a hedge,” said BlockTower Capital’s Clara Wu. Tariffs hurt global growth and digital assets. Retail traders followed, with Coinbase reporting 30% more sell orders.

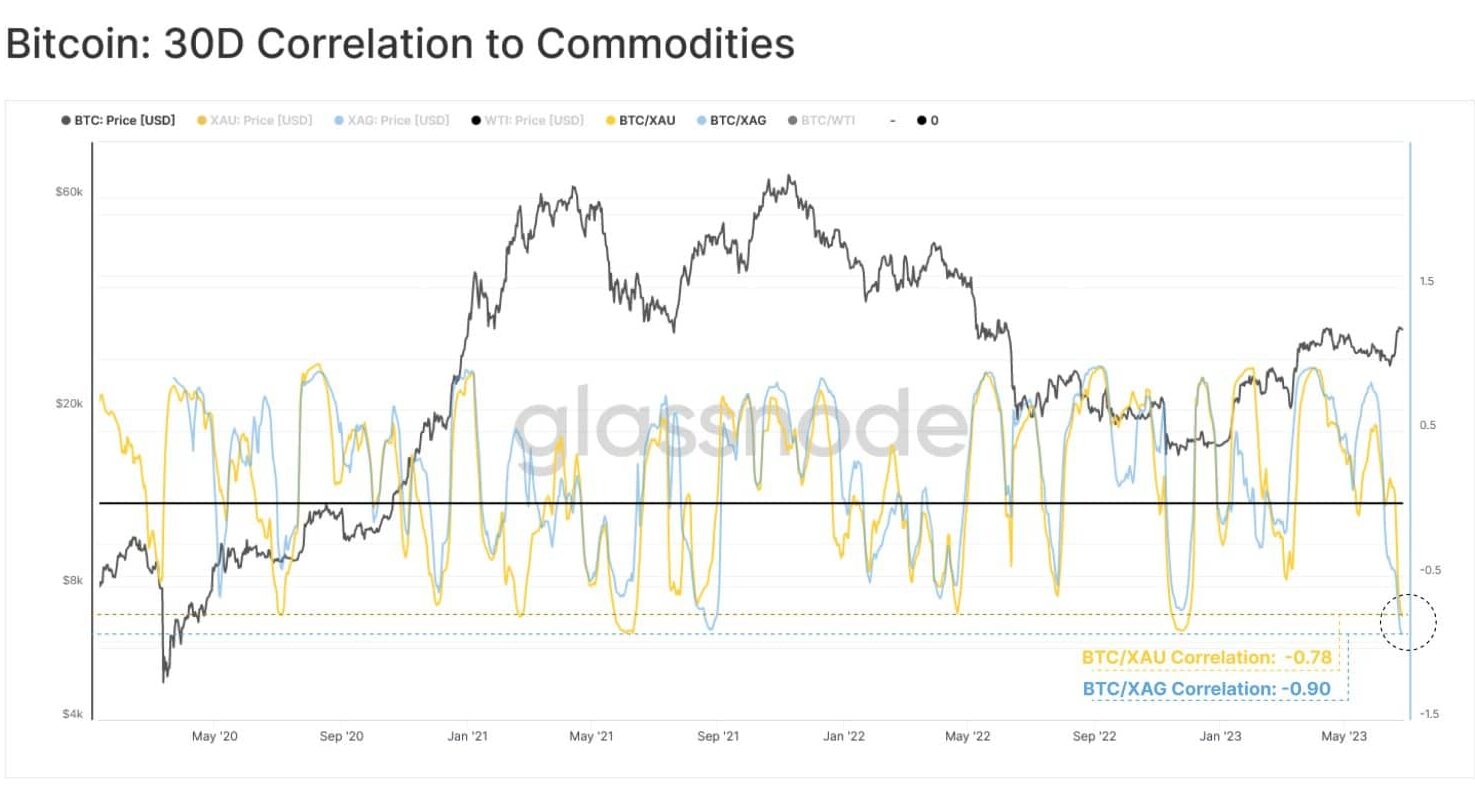

Bitcoin’s Rising Correlation

Bitcoin’s 90-day Nasdaq correlation reached 0.78 this week, surpassing the record set in 2022. Over 40% of BTC’s trading volume is macroeconomic ETFs and futures. Bitcoin suffered from the Federal Reserve’s hawkish stance, signaling only one rate drop in 2024, strengthening the dollar. The DXY index reached 105.5, a five-month high. Blockchain shows whales sold. The company plans to invest USD 70 million in BTC to recoup losses elsewhere.

Long-term holders are unaffected, with 7035,000, its 200-day moving average, preventing a drop to $30,000. Ethereum plunged 12% to $1,950. The article is divided into two parts: a brief introduction and a detailed explanation of each part. In Q22024, demand exceeds supply.

DeveloperspostponedthehardforktoQ22024duetounresolvedbugs,dentingconfidenceinETH’snear−termutility. The Validators prioritized liquidity, unstaking over 800 million ETH this week. XRP fell 15% to $0.42 on allegations of a renewed SEC inquiry into Ripple Labs’ cross-border payments. The court ruling that XRP isn’t a security in secondary sales. “Regulatory uncertainty is XRP’s Achilles’ heel,” said Eleanor Terrett of Fox Business.

Crypto Market Crash

The cryptocurrency market cap fell 20%, with Solana (SOL) and Cardano (ADA) down 18-25%. MEMECOINS like PEPE and BONK fell 30-40% as speculators fled. Tether (USDT) briefly lost its dollar peg, trading at 0.997 a.m.i.d. amid $3 billion in redemption requests. DeFi protocols lost $4 billion in TVL, and Uniswap volumes fell 40%. Lido Finance’s ETH deposits fell 15%. “Altcoins need hype and liquidity—both evaporated.”

BitMEX’s Arthur Hayes said. TON rose 12% as Telegram incorporated TON wallets for 900 million users, defying the trend. Tariffs target blockchain infrastructure businesses like mining rig semiconductors. With $200 million in inflows, Hong Kong’s Bitcoin ETF launch failed to overcome adverse sentiment.

Gold Surpasses Crypto

Gold reached a record $2,450/ounce, attracting investors. “Crypto’s hedging narrative is broken,” said Raoul Pal of Real Vision. International trade and cross-border payment projects like XRP and Stellar (XLM) are losing demand.

Fed policies, regulatory clarity, and technical milestones may spark markets. A recession or lower inflation could compel rate decreases, increasing liquidity.

An SEC spot Ethereum ETF decision is due in May, with a 35% likelihood of approval. Bitcoin’s April halving of miner incentives tends to precede bull runs. The Ripple-SEC settlement might lift XRP and set a precedent for crypto regulation. Cautious optimism among derivatives traders: Bitcoin open interest surged 8% amid price drops.

Conclusion

The crypto market crash meltdown today shows the maturity and risks of the asset class. Once ignored, Bitcoin and Ethereum’s link with stocks drives short-term price activity. Sector-specific risks like regulatory disputes and technical delays hurt more. The trade war’s economic impact showed crypto’s dependence on global liquidity and risk sentiment.

The long-term foundations persist. Bitcoin’s scarcity, Ethereum’s improvements, and blockchain’s disruption persist. Fed pivots take off, or geopolitical tensions ease, and markets may stabilize. Investors are currently tested by volatility.