The crypto market has slipped into classic event-risk mode: tighter ranges, spikier wicks, and unusually elevated attention on central-bank language. As the Federal Reserve prepares to release its policy decision later today, Crypto Today, and XRP are creeping higher, with traders positioning around key levels in case a dovish surprise turns into a broader risk rally. Markets widely expect a 25-basis-point cut at the October 28–29 FOMC meeting, with the press conference to follow shortly after the statement. The Fed’s official meeting calendar lays out the schedule, and the CME FedWatch Tool remains the reference for real-time odds.

At a macro level, the U.S. dollar index (DXY) has drifted off recent lows but stayed bid into the event, a tell that FX desks are hedging against hawkish nuances in Chair Jerome Powell’s remarks. This morning’s coverage noted a dollar bounce from a one-week low as traders priced a quarter-point reduction with an eye on the guidance for December and early 2026. For crypto, that dollar path matters: a softer greenback and easing Crypto Today often coincide with risk-on flows into digital assets.

Zooming into crypto, majors pulled back modestly yesterday after a brisk prior-week advance; Bitcoin cooled from recent gains but remained near the mid-$110K area, leaving the market finely balanced between consolidation and breakout if liquidity improves post-Fed. Broader coverage framed the dip as a pause in a trend still buoyed by easing expectations.

Why the Fed matters for crypto right now

The Fed’s interest-rate policy sets the global cost of capital. When the policy rate declines, financial conditions tend to loosen, risk-taking rises, and duration-sensitive assets—from high-beta tech to digital assets—often catch a bid. Conversely, when guidance leans restrictive or the terminal rate path is pushed higher, the U.S. dollar typically strengthens and liquidity tightens, pinching speculative appetite. Markets into this meeting are priced for a cut and a cautiously dovish tone, but the fine print is crucial: Powell’s emphasis on data dependence versus confidence in disinflation can flip the market’s first reaction in minutes. Recent reporting underscores that traders are primed for a cut, with the magnitude of follow-through hinging on the press-conference tone.

Another reason monetary policy resonates across crypto: the sector is increasingly institutionally owned. As allocators calibrate exposure across equities, bonds, commodities, and crypto, the relative appeal of Bitcoin’s scarcity, ETH staking yields, and on-chain cash flows shifts alongside front-end rates and real yields. In easing cycles, beta tends to concentrate first in BTC before rotating into ETH and then into higher-volatility altcoins—a pattern many traders will be watching if the Fed validates the glide path that futures pricing implies.

The state of the market in the decision

The total crypto market cap set fresh records earlier in October, then consolidated as participants waited for macro clarity. Estimates from market dashboards place the aggregate value near multi-trillion territory after peaking above the $4T mark earlier in the month—evidence of durable demand even as intraday volatility persists. More recent aggregators peg the market near the high-$3T to low-$4T band, with Bitcoin dominance hovering in the high-50s. Those figures reflect an environment where majors lead and smaller tokens tend to take direction from BTC.

Liquidity conditions are typical for a policy-day setup. Funding rates and perp basis have cooled from local extremes, and options markets show elevated implied volatility into the announcement. This combination often produces a three-act pattern: subdued drift pre-event, a headline-driven knee-jerk, and then a directional move that aligns with where DXY and yields settle after Powell’s Q&A. If the dollar fades and front-end rates bleed lower, the third act frequently favours crypto bulls. If the dollar firms and guidance dampens hopes for a quick easing campaign, any initial pop can fizzle.

Bitcoin today: structure, catalysts, and the “second-day move”

BTC’s tactical map

Into the Fed, Bitcoin has been orbiting familiar magnet levels, with liquidity thickening around psychologically round handles and prior local highs. Yesterday’s minor pullback after a brisk ascent left spot and perps finely balanced, and dealers’ gamma positioning suggests that clean breaks can extend if order books thin out after the statement. The most useful tells are often the 1-hour and 4-hour candle closes after the press conference; that is, when positioning noise gives way to trend. Coverage earlier in the day framed BTC’s retreat as modest in the context of the month’s strong advance.

Macro linkages that matter for BTC

BTC’s beta to the dollar tends to intensify around FOMC decisions. A weaker DXY usually accompanies improved risk sentiment as global liquidity conditions ease. Meanwhile, the front end of the Treasury curve (which embeds policy expectations) filters directly into discount rates used by cross-asset allocators. Into this meeting, FX reporting noted the dollar edging up from a one-week low as traders looked for confirmation of a cut but hedged the possibility of guarded guidance—exactly the mix that can produce choppy first reactions on the BTC tape.

The derivatives overlay

Options dealers matter on days like this. Skew tends to steepen into macro events as hedgers pay for downside protection and opportunists reach for call spreads. If the statement leans dovish, vol sellers are likely to step in, compressing implied volatility and helping BTC trend rather than chop. If guidance trims the market’s easing hopes, gamma hedging can amplify a downside wick before liquidity refills. That’s why tight risk controls and staggered profit-taking are favoured by short-term traders during central-bank weeks.

Ethereum today: utility meets macro

ETH’s setup in the decision

Ethereum continues to move broadly with BTC, but carries its own idiosyncratic drivers: staking dynamics, L2 throughput, and restaking incentives shape flows at the margin. For many holders, ETH is a cash-flowing asset through staking yields; as policy rates fall, the relative appeal of staking can improve, especially if real yields soften alongside nominal cuts. In short: a gentle easing cycle can channel more capital into smart-contract exposure, magnifying ETH’s beta after BTC establishes direction.

The network angle

On-chain activity has remained healthy, with layer-2 solutions absorbing transaction load and keeping gas fees relatively contained. Builders continue shipping upgrades to settlement, data availability, and rollup architectures, even as headlines focus on macro. During easing regimes, those structural improvements help ETH participate more fully in risk-on windows by reducing friction for both users and DeFi protocols. From a trading lens, ETH often over- or under-shoots BTC’s percentage move depending on how quickly funding reacts to a direction change. A calmer post-decision funding picture usually favours ETH outperformance into the New York afternoon, while funding spikes can force intraday de-risking and relative underperformance.

XRP today: payments narrative, liquidity, and catalysts

XRP’s positioning

XRP has carved out support in recent weeks and rallied alongside majors into the Fed window. While XRP’s tokenomics and escrow release cadence are well known, event days like this tend to be dominated by macro beta rather than asset-specific headlines. That said, any incremental progress on cross-bordepaymentts rails, bank integrations, or speculation about regulated products can add fuel to a move that BTC and ETH have already started.

What could move XRP post-decision

For XRP today, watch two channels. First, the broad dollar/yields impulse sets risk appetite. Second, the liquidity pockets around prior weekly highs and local ranges often act as accelerants when order flow thins. If the market reads the Fed as opening the door to additional easing into December, XRP can benefit from the beta rotation that typically follows an initial BTC-led impulse. If guidance lands heavier, XRP’s higher intraday elasticity can cut both ways.

Scenarios to watch after the announcement

Dovish cut, softer dollar, risk rallies

In this path, the statement acknowledges progress on inflation, Powell expresses confidence that policy is still restrictive, and the door remains open to another cut by year-end. DXY slips, the front-end edges lower, and crypto grinds higher with BTC leadership followed by ETH and then select altcoins. Global desks have framed this as the base case heading into today’s decision, and the tone of the press conference will determine whether the market extrapolates a series of cuts or treats October as a one-off recalibration.

Dovish cut with hawkish-leaning guidance.

Here, the Fed delivers a widely priced 25-bp move but emphasises data dependence and risks linked to sticky services inflation or labour resilience. Markets may pop on the headline, then fade as the dollar stabilises higher. Elevated implied vol into the event can then decay unevenly, producing two-way price action in crypto as open interest unwinds. This is the most “trappy” setup for short-term longs.

Hawkish surprise

A smaller-than-expected shift in guidance—or a clear pushback against additional cuts—would likely boost the dollar and lift yields, a combination that tightens financial conditions and pressures crypto. The odds appear low given market pricing and broad commentary, but tails matter, which is why options hedging has been active in the run-up to the meeting.

The cross-asset lens: what DXY and yields are signalling

On most Fed days, the first 15 minutes in crypto are noisy; the real tell emerges as FX and rates settle after Powell’s Q&A. Traders watch whether DXY breaks or rejects key intraday levels and whether 2-year and 10-year yields grind lower in unison or diverge. Coverage this morning highlighted the dollar nudging up ahead of the decision; if that reverses into the close, post-press-conference follow-through in BTC and ETH typically has better stamina.

Structure and flows: stablecoins, ETPs, and options

The maturing market structure matters more with each cycle. Stablecoin balances act as a rough proxy for dry powder, while spot ETP flows in key jurisdictions can add persistent demand on green days. Options now play a larger role in shaping intraday paths; into macro events, both buy-side and dealers tend to carry more gamma, which can dampen volatility once the initial shock is absorbed. If the statement lands dovish and funding doesn’t overheat, vol sellers often step in, turning what might have been a jagged surge into a more orderly trend.

Tactical playbook: traders and long-term allocators

For active traders

During central-bank weeks, edge is more about process than prediction. Many intraday traders prefer to let the first impulse play out, then use VWAP recaptures, prior-day high/low, and consolidation breaks as risk anchors. Keeping position sizes modest around the announcement, deploying hard stops, and resisting the urge to chase the first wick can improve expectancy when liquidity is thin. It’s also wise to track funding spreads and basis; if those metrics blow out too quickly, it can presage a mean-reversion snap that punishes late longs.

For long-term investors

If your horizon is measured in quarters and years, the question is whether a durable easing cycle improves the backdrop for store-of-value and smart-contract assets. History suggests that a softer dollar and easier policy correlate with better risk-asset performance, though the path can be messy. Prudent allocators tend to rebalance into weakness and scale in on volatility rather than chase breakouts on policy day.

Beyond the Fed: medium-term drivers to watch

Policy and regulation

The macro shadow might be long today, but policy and regulation will shape medium-term adoption arcs. Jurisdictions that have clarified custody, market-making, and ETP frameworks are already seeing healthier institutional participation. As compliance rails mature, liquidity deepens and bid-ask spreads tighten, making the asset class more investable for conservative mandates.

Technology and on-chain economics

On the technology front, the industry is mid-stride in a shift toward modular architectures: data availability layers, validity proofs, and shared sequencing are becoming mainstream topics. These improvements don’t move price on Fed Day, but they compound over time by enhancing user experience and enabling new on-chain business models, from decentralised finance to tokenised real-world assets.

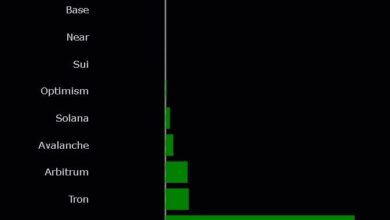

Flows and investor mix

The investor base has broadened. Alongside crypto-native funds sit macro hedge funds, asset allocators, and corporate treasuries experimenting with BTC as a balance-sheet asset or ETH for on-chain operations.

What to watch into the close

After the statement and press conference, monitor three signals. First, where DXY and the 2-year settle relative to the session’s extremes. Second, whether BTC can hold a higher low on the 1-hour chart once the first flurry passes.

The bottom line

Heading into today’s Fed decision, Bitcoin, Ethereum, and XRP are cautiously bid, with derivatives markets paying up for optionality and stablecoin balances suggesting dry powder stands ready. The market has priced a 25-bp cut; what matters now is how Powell characterises the road ahead. If he signals comfort with inflation progress and leaves the door open to more easing by December, the dollar could drift lower, and crypto may have room to run. If he stresses data dependence and underscores upside inflation risks, the first pop could fade as positioning resets.

FAQs

Q: What time is the Fed decision, and why does it move crypto?

The October FOMC meeting spans October 28–29, 2025, with the policy statement followed by Chair Powell’s press conference. Crypto is highly sensitive to the U.S. dollar and rates; any surprise in the statement or guidance can quickly alter risk appetite and liquidity conditions, which spill into digital-asset prices.

Q: How are Bitcoin and majors trading into the event?

Majors eased modestly after a robust prior-week run; BTC dipped from intraday strengths but remained near the mid-$110K region in recent trade, a typical posture before policy announcements. The immediate path will depend on how DXY and front-end yields react to Powell’s tone.

Q: What’s the base case for the Fed, and how could that impact crypto?

Consensus expects a 25-bp cut, with attention on whether Powell hints at additional easing by year-end. A softer dollar and lower yields would generally be risk-positive, supporting flows into BTC and ETH. If guidance tempers easing hopes, the reaction could be two-way as leverage resets.

Q: Where is the overall crypto market in context?

The total crypto market cap set an all-time high earlier in October before consolidating ahead of the Fed. Aggregators now place it just below the peak, with Bitcoin dominance in the high-50s—implying majors still steer the ship.

Q: What’s the single best tell after the announcement?

Watch the second-day move and how DXY behaves into the New York close. If the dollar fades and implied vol compresses, crypto trends tend to be smoother and more durable. If the dollar firms, expect chop and the potential for mean-reversion until a new equilibrium is found.

Read more: Why is the Price of Bitcoin Crashing Today?