Cryptocurrency enthusiasts are constantly monitoring the market for signs of opportunity and risk, but there is one date that many are overlooking, and it could spell disaster for your crypto portfolio. December 19th holds the potential for a seismic shift in the cryptocurrency landscape, with far-reaching consequences that could catch many investors off guard. In this article, we will explore why December 19th is a crucial date that could lead to significant volatility, and what you can do to prepare your portfolio for any potential fallout.

The Crypto Market’s Vulnerability to External Forces

Cryptocurrencies are unique in their ability to generate massive returns and, at times, massive losses. The volatility of the crypto market is largely driven by several external and internal factors, ranging from government regulations to investor sentiment. One of the most influential external forces that affect crypto is regulatory developments, and on December 19th, there is a particular event that could trigger significant price movements and potentially cause a crypto crash.

While many investors may have their eyes on the latest market trends, the December 19th event represents a critical regulatory decision that could set the stage for future crypto regulations. The actions taken on this date could cause a sharp shift in market behavior, resulting in either a boost or a crash of cryptocurrency prices.

What’s Happening on December 19th?

To understand the gravity of December 19th, we need to examine the key event that’s scheduled to take place. On this date, the U.S. Federal Reserve is expected to make a significant announcement or take action that directly impacts the financial markets, including the cryptocurrency sector. These actions are often related to interest rates, monetary policy, or broader economic concerns, which can have far-reaching effects on speculative markets like cryptocurrency.

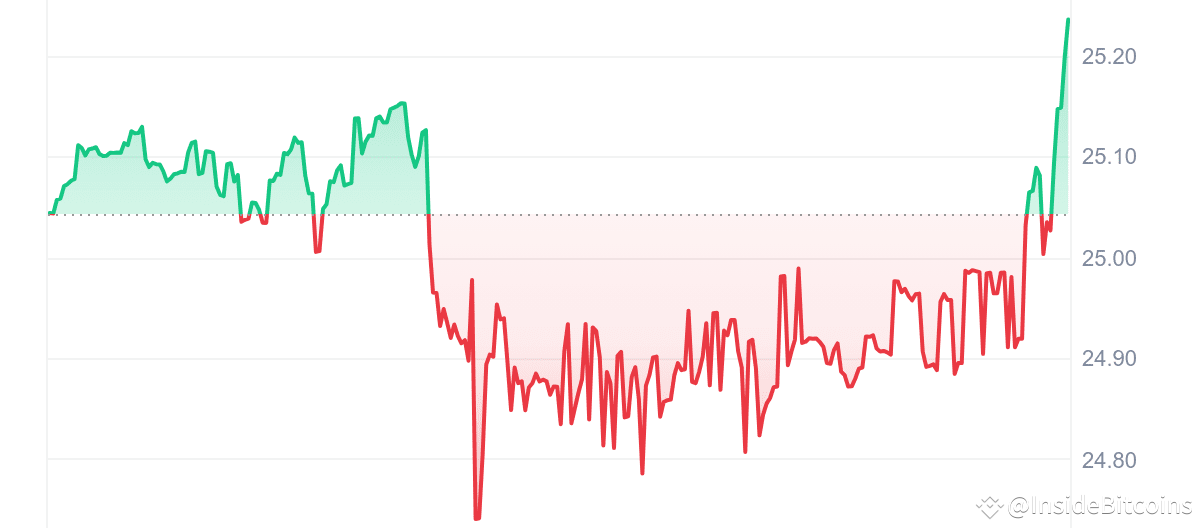

The Federal Reserve’s decisions on interest rates are known to influence global markets, and cryptocurrency is no exception. A rate hike, for instance, typically signals tightening financial conditions, which can lead to a decrease in speculative investments like Bitcoin and other altcoins. This is because higher interest rates make traditional investments (stocks, bonds) more attractive compared to riskier assets like cryptocurrencies.

This announcement could lead to a massive sell-off in the crypto market, as investors move their capital from high-risk assets to more stable investments. Conversely, a rate cut or a dovish statement could provide short-term relief for the crypto market, leading to a potential rebound. However, even positive news for crypto could be overshadowed by broader economic factors at play.

How Federal Reserve Actions Have Affected Crypto

To truly understand how significant the Federal Reserve’s actions are for cryptocurrency, we must look at past instances when the Fed took similar steps. For example, back in 2018, when the Federal Reserve raised interest rates, there was a noticeable downturn in Bitcoin and other cryptocurrencies. During that period, Bitcoin experienced a prolonged bear market, and many altcoins saw their values plummet by over 90%.

Fast forward to 2020, when the Fed initiated massive quantitative easing programs, flooding the market with liquidity. This action led to an explosive rise in crypto prices, with Bitcoin hitting new all-time highs. Investors poured money into the crypto market, seeing it as a hedge against the devaluation of fiat currencies.

Thus, the Federal Reserve’s influence over the crypto market is undeniable. The decisions made on December 19th could either fuel a continued bull run or trigger a major correction that could damage many investors’ portfolios.

Why December 19th Is Different: The Confluence of Factors

What makes December 19th unique is the alignment of several factors that could lead to a volatile market environment. In addition to the Federal Reserve’s decision, the crypto market is still feeling the effects of previous regulatory actions, especially in the United States and other major economies.

For instance, the SEC’s stance on cryptocurrencies and the ongoing scrutiny of major crypto exchanges have created an air of uncertainty that hangs over the market. If the Federal Reserve announces measures that further tighten financial conditions or if other government bodies introduce new regulations, the crypto market could see a significant downturn.

Moreover, December 19th also coincides with end-of-year market dynamics. Traditionally, the weeks leading up to the end of the year see increased market volatility as investors take profits, adjust portfolios, and prepare for the new year. This added layer of uncertainty could amplify any sudden changes in the market.

Preparing Your Crypto Portfolio for Potential Risk

Given the potential for heightened market volatility around December 19th, it’s crucial to take steps to protect your crypto portfolio. While no one can predict exactly what will happen on this date, there are several strategies you can employ to reduce risk and prepare for potential downside.

Diversify Your Investments

One of the most effective ways to protect your portfolio from sudden crashes is to diversify your investments. Don’t put all your funds into a single cryptocurrency. Instead, spread your investments across different coins and tokens to minimize the impact of a market-wide crash. Additionally, consider allocating a portion of your portfolio to more traditional investments, like stocks, bonds, or real estate, to cushion against the volatility of the crypto market.

Implement Stop-Loss Orders

Another strategy is to set stop-loss orders on your crypto investments. These orders automatically sell your assets when they reach a predetermined price point, helping to limit losses in case of a major downturn. For example, if you own Bitcoin and the price falls below a certain threshold, your stop-loss order will trigger an automatic sale, helping to protect your portfolio from further losses.

Stay Informed and Be Ready to Act

The key to navigating market volatility is staying informed about the latest developments. Leading up to December 19th, pay close attention to news regarding the Federal Reserve and any regulatory updates related to cryptocurrencies. You can use this information to make informed decisions about buying, selling, or holding your positions.

Being able to act quickly can make the difference between riding out the storm and getting caught in a crash. For this reason, it’s important to set up alerts and follow reliable sources for real-time information on crypto markets.

The Broader Impact of Regulatory Actions on Crypto Prices

While the December 19th event is likely to have a direct impact on the crypto market, it is part of a broader trend of increasing government regulation in the cryptocurrency space. In recent months, many governments worldwide have been cracking down on crypto trading, introducing stricter regulations, and even considering the creation of central bank digital currencies (CBDCs). These regulatory moves are often seen as a double-edged sword.

On one hand, regulation can provide a sense of legitimacy and security to the market, attracting institutional investors and new capital. On the other hand, overly restrictive regulations can stifle innovation and limit the growth potential of the market, leading to decreased investor confidence.

The interplay between regulatory policies and the crypto market is complex, and it is likely that the events on December 19th will only be one piece of a larger puzzle that will continue to shape the crypto market in the coming years.

Conclusion

December 19th is shaping up to be a pivotal day for the cryptocurrency market. Whether the Federal Reserve announces a policy change that triggers a market crash or provides reassurance that supports the market’s growth, the impact on your portfolio could be significant.

The volatility of the crypto market means that investors must stay vigilant, adapt quickly to changing conditions, and employ strategies that help protect against sudden downturns. By diversifying your portfolio, setting stop-loss orders, and staying informed about regulatory developments, you can minimize your exposure to potential losses and make the most of any opportunities that arise.

Remember, the crypto market is highly unpredictable, but being proactive and prepared will give you a better chance of weathering the storm. So, don’t ignore December 19th take the necessary steps to protect your crypto investments today.

FAQs

Q.Why is December 19th such an important date for crypto investors?

December 19th is a key date due to a major announcement or action expected from the U.S. Federal Reserve. These decisions could significantly affect financial markets, including cryptocurrency.

Q.How could the Federal Reserve’s decision impact cryptocurrency prices?

If the Federal Reserve raises interest rates or takes a hawkish stance, it could cause a sell-off in riskier assets like crypto. Conversely, a dovish stance could support higher crypto prices.

Q.What should I do to protect my crypto portfolio from a crash on December 19th?

Consider diversifying your investments, setting stop-loss orders, and staying informed about developments that may influence the market.

Q.Will government regulations affect the crypto market in the long term?

Yes, increasing regulation can either boost investor confidence by providing legitimacy or decrease innovation if the rules are too restrictive. It’s important to monitor these changes.

Q.Is it too late to adjust my crypto portfolio before December 19th?

It’s never too late to make adjustments. While there are no guarantees, taking steps to protect your investments now can help reduce potential risks.