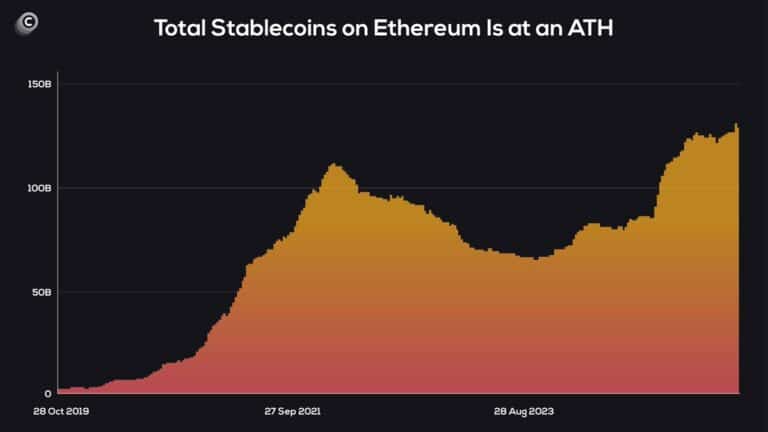

Ethereum stablecoin supply hits record $166B milestone, marking a defining moment in the evolution of blockchain-based finance. This historic level underscores Ethereum’s continued dominance as the primary settlement layer for stablecoins, even as competition from alternative blockchains intensifies. Stablecoins, designed to maintain price stability while leveraging blockchain efficiency, have become the backbone of decentralized finance, crypto trading, cross-border payments, and increasingly, real-world financial applications.

The $166 billion milestone is more than just a headline number. It reflects growing trust in Ethereum’s infrastructure, smart contract capabilities, and security model. At a time when volatility still defines much of the cryptocurrency market, stablecoins offer a crucial bridge between traditional finance and digital assets. Their expansion on Ethereum signals that institutions, developers, and users continue to view the network as the most reliable environment for large-scale financial activity.

This article explores how Ethereum stablecoin supply reached this record level, why Ethereum remains the dominant blockchain for stablecoins, and what this growth means for decentralized finance, global payments, regulation, and Ethereum’s long-term future. By examining technical, economic, and macro-level factors, we gain a deeper understanding of why this milestone matters for the broader crypto ecosystem.

Stablecoins and their role in crypto markets

Stablecoins are digital assets pegged to the value of fiat currencies, commodities, or other reference assets. Their primary function is to provide price stability while maintaining the speed, transparency, and programmability of blockchain transactions.

Why stablecoins are essential to crypto adoption

Stablecoins solve one of crypto’s biggest challenges: volatility. By maintaining a relatively stable value, they enable traders to move funds efficiently, allow users to store value without exposure to price swings, and support everyday use cases such as payments and salaries. On Ethereum, stablecoins form the liquidity foundation of DeFi protocols, decentralized exchanges, and lending platforms.

As Ethereum stablecoin supply hits record $166B, it highlights how deeply embedded these assets have become in the crypto economy. Without stablecoins, much of today’s on-chain financial activity would be impractical or inaccessible to mainstream users.

Different types of stablecoins on Ethereum

Ethereum hosts a diverse range of stablecoins, including fiat-backed, crypto-collateralized, and algorithmic models. Fiat-backed stablecoins dominate supply due to their simplicity and perceived reliability, while decentralized alternatives appeal to users seeking censorship resistance. This diversity strengthens Ethereum’s position as a neutral financial layer capable of supporting multiple monetary models.

Ethereum’s dominance in the stablecoin ecosystem

Why Ethereum remains the primary stablecoin network

Despite higher transaction fees compared to some newer blockchains, Ethereum continues to dominate stablecoin issuance and usage. Its first-mover advantage, extensive developer ecosystem, and battle-tested security make it the preferred choice for large-scale financial deployments.

When Ethereum stablecoin supply hits record $166B, it reflects sustained confidence from issuers and institutions. Ethereum’s smart contract flexibility allows stablecoins to integrate seamlessly with DeFi applications, custodial services, and enterprise systems, creating powerful network effects.

Network effects and liquidity concentration

Liquidity attracts liquidity. Ethereum’s deep pools of capital, extensive exchange integrations, and composability between protocols make it difficult for competitors to replicate its ecosystem. Stablecoin issuers benefit from this concentration, as it ensures high transaction volumes and widespread adoption.

Key drivers behind the $166B stablecoin milestone

Institutional adoption and on-chain finance

Institutional participation has accelerated stablecoin growth on Ethereum. Asset managers, payment processors, and fintech firms increasingly use stablecoins for settlement and treasury operations. Ethereum’s transparent and programmable environment aligns well with institutional requirements for auditability and compliance.

This influx of institutional capital is a major factor behind why Ethereum stablecoin supply hits record $166B, reinforcing Ethereum’s role as the backbone of on-chain finance.

DeFi’s continued evolution

Decentralized finance remains a major driver of stablecoin demand. Lending platforms, automated market makers, and derivatives protocols rely on stablecoins as base assets. As DeFi matures and attracts more users, the need for stable, liquid assets grows, pushing stablecoin supply higher.

Major stablecoins contributing to Ethereum’s growth

USDT, USDC, and market leadership

The majority of Ethereum’s stablecoin supply comes from leading fiat-backed stablecoins. These assets are widely used for trading, payments, and liquidity provisioning. Their continued issuance on Ethereum reflects trust in the network’s reliability and global acceptance.

As Ethereum stablecoin supply hits record $166B, it underscores how dominant these stablecoins have become within the Ethereum ecosystem.

Decentralized stablecoins and innovation

Alongside centralized issuers, decentralized stablecoins continue to play an important role. These assets demonstrate Ethereum’s capacity for financial experimentation and resilience. While their market share is smaller, they contribute to diversity and decentralization within the stablecoin landscape.

Impact on decentralized finance and Web3

Liquidity expansion and protocol growth

Rising stablecoin supply directly benefits DeFi by increasing available liquidity. More stablecoins mean deeper markets, lower slippage, and improved efficiency for users. This environment encourages innovation and attracts developers building new financial products on Ethereum.

Ethereum stablecoin supply hitting record $166B strengthens the foundation upon which the entire Web3 economy operates.

Stablecoins as DeFi’s unit of account

Stablecoins function as the primary unit of account in DeFi. Prices, loans, and yields are often denominated in stablecoins rather than volatile cryptocurrencies. This standardization simplifies user experience and accelerates adoption among non-technical participants.

Ethereum Layer-2 solutions and stablecoin scalability

Reducing costs and increasing accessibility

Layer-2 networks built on Ethereum have significantly reduced transaction costs while maintaining security guarantees. Stablecoins are among the most actively used assets on these scaling solutions, enabling microtransactions, remittances, and high-frequency trading. The expansion of stablecoins across Layer-2 networks supports Ethereum’s long-term scalability and explains part of the growth behind the $166B milestone.

Interoperability within the Ethereum ecosystem

Layer-2 solutions remain closely integrated with Ethereum’s mainnet, preserving liquidity and composability. This interoperability ensures that stablecoin growth benefits the entire ecosystem rather than fragmenting across isolated chains.

Regulatory considerations surrounding stablecoin growth

Increasing scrutiny from global regulators

As stablecoin supply grows, regulatory attention intensifies. Governments and financial authorities are focused on reserve transparency, consumer protection, and systemic risk. Ethereum’s public ledger offers transparency that can support compliance efforts.

While regulation presents challenges, clear frameworks could further legitimize stablecoins and encourage broader adoption.

Ethereum’s neutral infrastructure advantage

Ethereum itself remains neutral infrastructure rather than a financial issuer. This distinction allows stablecoin issuers to adapt to regulations without fundamentally altering the network. As Ethereum stablecoin supply hits record $166B, this neutrality becomes a strategic advantage.

Stablecoins, payments, and real-world use cases

Cross-border payments and remittances

Stablecoins on Ethereum enable fast, low-cost cross-border transactions. This utility is particularly valuable in regions with limited banking access or expensive remittance services. As usage grows, stablecoins increasingly compete with traditional payment rails.

Corporate treasuries and digital dollars

Businesses are beginning to hold stablecoins as part of treasury management strategies. Ethereum’s programmable environment allows firms to automate payments, manage liquidity, and integrate with decentralized services.

What the $166B milestone means for Ethereum’s future

Strengthening Ethereum’s economic security

High stablecoin activity contributes to network usage and fee generation, supporting Ethereum’s economic security model. As stablecoin transactions increase, they reinforce the value of Ethereum as a settlement layer.

Long-term outlook for Ethereum’s ecosystem

The record stablecoin supply signals confidence in Ethereum’s long-term relevance. Despite competition from alternative blockchains, Ethereum continues to attract capital, developers, and users at scale.

Risks and challenges ahead

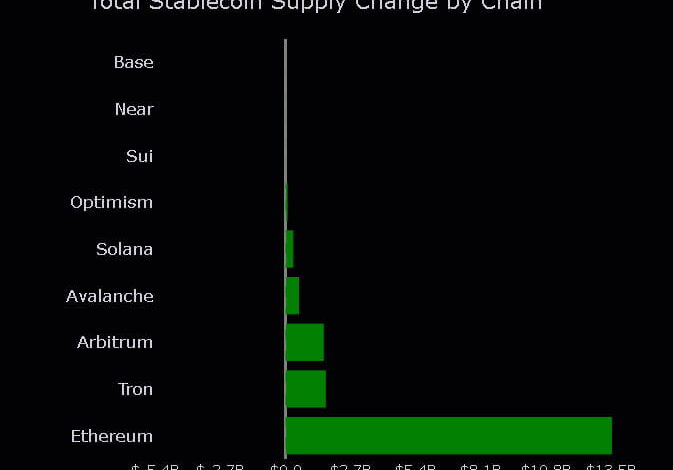

Competition from other blockchains

Other networks aim to capture stablecoin market share by offering lower fees or specialized features. While Ethereum remains dominant, maintaining leadership requires continuous innovation and scalability improvements.

Systemic risks within stablecoins

Stablecoins themselves carry risks, including reserve management and counterparty exposure. A major failure could impact the broader ecosystem, though diversification across issuers helps mitigate this risk.

Conclusion

Ethereum stablecoin supply hits record $166B milestone, highlighting Ethereum’s unmatched role in the global crypto economy. This achievement reflects deep trust in Ethereum’s infrastructure, the continued expansion of DeFi, and the growing importance of stablecoins in payments and financial markets. As stablecoins bridge traditional finance and blockchain technology, Ethereum stands at the center of this transformation.

Looking ahead, stablecoin growth will likely remain a key driver of Ethereum’s adoption and economic relevance. While challenges persist, the $166B milestone underscores Ethereum’s position as the foundational layer for digital finance in an increasingly on-chain world.

FAQs

Q. Why is Ethereum the leading blockchain for stablecoins?

Ethereum offers strong security, deep liquidity, and extensive DeFi integration, making it the preferred network for stablecoin issuance and usage.

Q. What does the $166B stablecoin supply indicate?

It signals growing trust, adoption, and reliance on Ethereum as a settlement layer for digital dollars and financial activity.

Q. Are stablecoins on Ethereum safe to use?

While risks exist, Ethereum’s transparency and established infrastructure provide a strong foundation for stablecoin operations.

Q. How do Layer-2 networks affect stablecoin growth?

Layer-2 solutions reduce costs and improve scalability, making stablecoins more accessible and practical for everyday use.

Q. Will stablecoin supply on Ethereum continue to grow?

If adoption trends persist and regulation becomes clearer, stablecoin supply on Ethereum is likely to expand further over time.