When users download a trusted investing platform, they expect security, professionalism, and clear financial guidance—not a message that looks like it came straight from a criminal playbook. Yet that’s exactly the fear sparked when Betterment’s financial app sends customers a $10,000 crypto scam message, leaving many confused, alarmed, and wondering whether their accounts were compromised.

Crypto scams are no longer limited to shady emails from unknown senders. They now appear through highly believable channels, sometimes even mimicking well-known brands or arriving through legitimate communication systems. The moment a customer sees a message mentioning a large amount—like $10,000—and crypto, it triggers urgency. And urgency is one of the strongest psychological tools scammers use.

This incident raises major questions: Was Betterment hacked? Did scammers exploit a messaging provider? Was it a spoofed notification that only looked legitimate? And most importantly, what should customers do if they receive something similar?

In this article, we’ll unpack what it means when Betterment’s financial app sends customers a $10,000 crypto scam message, how these scams work, why fintech platforms are increasingly targeted, and what users can do immediately to protect their personal and financial information. We’ll also look at what Betterment—and similar apps—should do to rebuild customer trust after a scam message incident, even if they weren’t directly at fault.

What Happened When Betterment Users Received the Scam Message?

The phrase “Betterment’s financial app sends customers a $10,000 crypto scam message” became a headline-style shocker because it combines two things people don’t expect to see together: a regulated financial service and a crypto fraud attempt. Users reportedly received a message implying they had received $10,000 or could claim it through crypto-related instructions—something that resembles common phishing and social engineering scams.

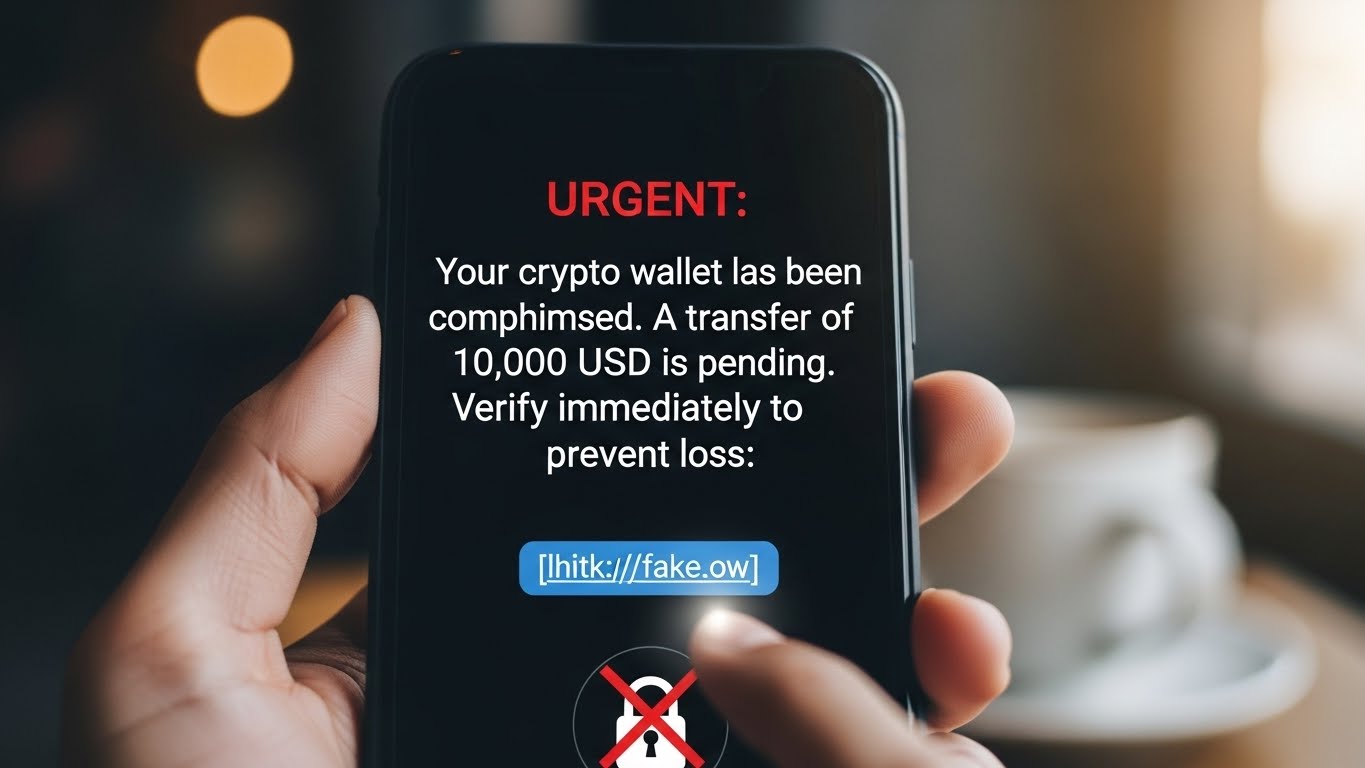

The most unsettling part of these messages is how credible they can look. Fraudsters often craft scam alerts to mimic the tone and branding of legitimate financial platforms. In many cases, they include official-sounding terms like “verification,” “security check,” “account lock,” or “fund release.” They may even include short links that look like official domains but redirect to fraudulent sites designed to steal login credentials or personal data.

Even if the message didn’t originate from Betterment directly, the perception can be damaging. When customers believe Betterment’s financial app sends customers a $10,000 crypto scam message, their trust in the platform can drop instantly. Trust is currency in fintech. Once shaken, it takes significant time and transparency to restore.

Scammers aren’t randomly picking numbers like $10,000. That amount is large enough to feel life-changing, but not so huge that it seems impossible. It’s the perfect bait for impulsive engagement, especially when paired with crypto, which many users associate with fast money and high returns.

When Betterment’s financial app sends cust

Why a $10,000 Crypto Scam Message Is So Effective

omers a $10,000 crypto scam message, the scam’s power comes from three psychological triggers:

Urgency and Fear

Messages often include warnings like “Respond now,” “Account action required,” or “Funds will expire.” Even smart users can panic when a financial message suggests money is at risk.

Reward Bias

A “free $10,000” claim plays directly into the brain’s reward response. People are more likely to click before thinking critically.

Authority Effect

When the message appears to come from a known brand, users assume legitimacy. That’s why scam messages tied to reputable companies often outperform generic scams.

The combination of urgency, reward, and authority is why these incidents spread quickly, especially on social media. Once people begin sharing screenshots, the narrative that Betterment’s financial app sends customers a $10,000 crypto scam message gains traction—and fear spreads faster than facts.

Was Betterment Hacked or Was It Spoofing?

One of the first questions users ask is whether Betterment was breached. In many scam incidents, the answer is not always straightforward. There are several possibilities when messages like this appear:

Messaging System Exploitation

Some fintech companies use third-party providers for SMS, push notifications, or email delivery. If scammers exploit a provider system—or hijack sender IDs—they can deliver fraudulent messages that appear tied to the brand.

Sender Spoofing

Spoofing is when criminals fake the sender name or number to make it look legitimate. Even if Betterment’s systems were perfectly secure, spoofing can still create the impression that Betterment’s financial app sends customers a $10,000 crypto scam message.

Credential Stuffing and Account Takeovers

If users reuse passwords across services, criminals can gain access to accounts using stolen credentials from unrelated breaches. A compromised account might trigger communications, depending on how systems are configured.

Data Leaks and Targeted Phishing

Even without direct hacking, scammers can obtain user contact data from other breaches and send highly targeted messages pretending to be Betterment.

The key point is this: an app doesn’t always have to be hacked for customers to receive scam messages that look official. However, customers will still associate the incident with the brand, and that’s why quick and transparent communication matters.

How Crypto Scam Messages Typically Work

To understand why this matters, it helps to see the playbook scammers often use—especially in crypto-related attacks. When Betterment’s financial app sends customers a $10,000 crypto scam message, the scam likely follows a familiar pattern:

Step One — Hook With a Big Amount

A message claims you received $10,000, earned a reward, or have a pending payout.

Step Two — Push You to Click a Link

The link often leads to a fake login page that resembles Betterment or a crypto wallet provider.

Step Three — Capture Sensitive Data

The site may ask for login credentials, one-time passcodes, or personally identifying information. Sometimes it asks for wallet seed phrases, which is essentially giving scammers full control.

Step Four — Fast Theft

Once scammers have access, they move quickly—changing passwords, transferring funds, or draining crypto wallets. The reason crypto scams are so appealing to criminals is simple: crypto transactions are often irreversible, harder to trace than traditional bank transfers, and cross-border enforcement is difficult.

Why Fintech and Investing Apps Are Prime Targets

Betterment is not alone. Across the financial industry, scammers increasingly target digital wealth platforms, robo-advisors, and banking apps because they know customers keep money there and trust the brand.

When people believe Betterment’s financial app sends customers a $10,000 crypto scam message, it highlights a bigger industry trend: fintech brands are now a major battlefield for fraudsters.

Fintech Users Are Highly Engaged

Users frequently check balances, deposits, and investment performance. This makes them more likely to open messages from the brand.

Notifications Create Habitual Trust

People get used to receiving verification codes, trade confirmations, and account alerts. Scammers exploit this familiarity.

Crypto Language Is Easy to Weaponize

Even if Betterment itself isn’t a crypto exchange, scammers can still use crypto buzzwords to confuse users, especially those who are less experienced.

Growing Attack Surface

More services, more integrations, more vendors, and more communication channels mean more potential vulnerabilities.

Immediate Steps to Take If You Received the Message

If you received a message that makes you think Betterment’s financial app sends customers a $10,000 crypto scam message, your first priority is to avoid reacting emotionally. You want to slow down and verify everything.

Don’t Click Any Links

Even one click can expose your device to tracking or lead you to a credential-harvesting page.

Verify Through Official Channels Only

Open Betterment through the app or type the official website address manually. Do not use the link inside the message.

Change Your Password Immediately

Use a strong, unique password. If you used the same password elsewhere, update those too.

Enable Two-Factor Authentication (2FA)

If Betterment offers 2FA, enable it. Prefer authenticator apps rather than SMS-based codes when possible.

Monitor Transactions and Account Activity

Check trade activity, withdrawals, new linked bank accounts, or changes to contact information.

Contact Support and Report the Scam

Reporting helps Betterment track the issue and warn other customers. It also strengthens internal security monitoring.

How to Tell a Legit Betterment Alert From a Scam

It’s not always obvious. That’s why scams work. But there are red flags users can watch for whenever they suspect Betterment’s financial app sends customers a $10,000 crypto scam message:

Strange Language or Typos

Poor grammar, missing punctuation, or awkward phrasing often signals fraud. Legit platforms usually have polished messaging.

Unusual Crypto Claims

If an investing platform suddenly mentions crypto giveaways, wallet deposits, or token rewards, pause and verify.

Shortened Links or Odd Domains

Fraud messages often use “bit.ly” links or domains that look similar to the official one, like small spelling changes.

Requests for Sensitive Data

No legitimate financial app will ask for your password, full security code, or authentication code via text message.

Pressure to Act Quickly

Fraudsters rely on urgency. Legitimate security alerts may be urgent, but they won’t demand you “act in 5 minutes or lose $10,000.”

The Role of Betterment and What Customers Expect Next

Whether Betterment’s internal systems were breached or not, customers will look to the company for clarity. When the public hears Betterment’s financial app sends customers a $10,000 crypto scam message, they expect Betterment to respond with three things: speed, transparency, and user protection.

Clear Communication

Betterment should explain what happened in plain language, without technical vagueness. Customers want to know: Was my account at risk? Was user data exposed?

Safety Guidance

Customers expect Betterment to provide step-by-step instructions on how to stay safe, including what to do if they clicked.

System Improvements and Vendor Checks

If a third-party messaging system was involved, users expect Betterment to audit and improve vendor security controls.

Ongoing Updates

Silence creates rumors. Frequent updates reduce speculation and reassure customers that the situation is being actively managed.

Crypto Scams Are Evolving Fast

Scams tied to financial brands are part of a broader pattern: criminals constantly evolve tactics faster than most users can keep up. When people read that Betterment’s financial app sends customers a $10,000 crypto scam message, it’s not just a Betterment story—it’s a warning about the entire digital finance world.

Scammers now use AI-generated messages, realistic brand tone mimicry, and cloned customer support pages. They target victims through SMS, push notifications, email, and even social media DMs pretending to be official support.

The rise of crypto has intensified the problem because scammers don’t need access to bank infrastructure to steal money. They can lure users into transferring funds voluntarily or surrendering access to wallets. This is why consumer education and strong authentication practices matter more than ever.

How to Protect Yourself Long-Term From Scam Messages

Once you’ve experienced a scam attempt, it’s worth adjusting your personal security habits. Even if you only saw the message and ignored it, the incident that Betterment’s financial app sends customers a $10,000 crypto scam message is a reminder to level up digital defenses.

Use a Password Manager

A password manager makes it easier to use unique passwords across every platform.

Turn On Account Alerts

Enable notifications for logins, password changes, withdrawals, and account changes.

Lock Down Your Email

Your email is the gateway to password resets. Secure it with strong 2FA and a unique password.

Be Cautious With SMS

SMS is widely used but not the most secure. If the app offers authenticator-based security, use it.

Never Share Verification Codes

If someone asks for a verification code, that’s almost always fraud—especially when tied to crypto.

Conclusion

The fear caused when Betterment’s financial app sends customers a $10,000 crypto scam message is understandable. Scam attempts that appear tied to trusted financial platforms can shake confidence, trigger panic, and lead to costly mistakes. Whether the message was caused by spoofing, third-party vulnerabilities, or targeted phishing, the lesson is the same: scam detection must become a core digital skill for every investor.

Customers should treat any unexpected crypto message—especially one promising $10,000—as suspicious until verified through official app channels. Meanwhile, fintech companies must respond quickly, communicate clearly, and strengthen messaging security to prevent repeat incidents. In today’s environment, trust is earned not just through performance and returns, but through security, transparency, and rapid action when customers are targeted.

FAQs

Q: Was Betterment actually hacked if customers got a scam message?

Not necessarily. Even if users believe Betterment’s financial app sends customers a $10,000 crypto scam message, it could be spoofing or a third-party messaging issue. Only Betterment can confirm the root cause.

Q: What should I do if I clicked the scam link?

Immediately change your Betterment password, enable 2FA, check account activity, and contact Betterment support. If you entered credentials, assume your account could be compromised.

Q: Can a scam message steal money without me logging in?

Yes. Some scam pages can install tracking scripts or lead to further deception. The biggest risk occurs when users enter passwords, authentication codes, or crypto wallet details.

Q: Why do scammers use crypto in these messages?

Crypto transfers are often irreversible and harder to recover. That’s why scammers use it even when targeting users of traditional investing platforms.

Q: How can I confirm a Betterment message is real?

Open the Betterment app directly and look for the same alert inside your account. Avoid links inside texts or emails and rely on official support channels.

Also More: Cryptocurrency Slump Wipes Out 2025 Gains and Optimism