Cryptos for 2027 isn’t about chasing the loudest meme of the week. It’s about finding digital assets with staying power—networks that can survive multiple market cycles, keep shipping real product upgrades, and attract real users. By 2027, the crypto market will likely look more institutional, more regulated, and far more integrated into everyday finance than it does today. That shift changes what “best” means. The most compelling cryptos for 2027 won’t just be popular; they’ll be useful.

At the same time, the opportunity remains asymmetric. Crypto is one of the few markets where a strong thesis can still outpace traditional assets—if you choose projects with durable network effects, clear tokenomics, and a credible path to adoption. That’s why the best cryptos for 2027 tend to cluster around three categories: the reserve asset of the space, the settlement and application layer that powers most of the ecosystem, and a high-upside altcoin that’s still undervalued relative to its long-term ambition.

In this guide, we’ll break down three cryptos for 2027 with real long-term upside: Bitcoin, Ethereum, and one altcoin below $1—Cardano. We’ll also cover key catalysts that could matter between now and 2027, the risks you should actually take seriously, and how to think about long-horizon allocation without falling into hype.

Quick note: This article is for education and research. It isn’t financial advice, and crypto is volatile—always do your own due diligence.

How to Evaluate Cryptos for 2027 Without Getting Lost in Noise

The phrase cryptos for 2027 sounds simple, but the strategy behind it is not. Long-term upside comes from fundamentals that compound: adoption, developers, liquidity, security, and regulation-resilient design. Short-term pumps don’t matter if a network can’t keep users, can’t scale, or can’t maintain trust.

Adoption, Utility, and the Pull of Real Use Cases

When evaluating cryptos for 2027, ask what the chain is for and whether that “for” is growing. Networks win when they become the default place for activity—smart contracts, DeFi, stablecoins, tokenized assets, payments, identity, and cross-border transfers. Utility shows up as rising on-chain activity, rising developer engagement, and meaningful integrations with wallets, exchanges, and real-world businesses.

By 2027, the most valuable cryptos for 2027 may be the ones that quietly became infrastructure—settling value, verifying ownership, and enabling programmable finance with minimal friction. In other words, look for blockchain adoption that doesn’t require constant marketing to remain relevant.

Tokenomics, Security, and the “Can It Survive?” Test

A long-horizon pick must survive. For cryptos for 2027, the survival test includes security assumptions, decentralization, validator health, upgrade cadence, and supply dynamics. Assets with credible scarcity, transparent issuance, or strong fee dynamics tend to attract long-term capital, particularly as institutional demand grows.

Also watch how value accrues. Some networks capture value via fees, staking demand, burns, or collateral utility. Others struggle to route value to the token even if the ecosystem grows. For cryptos for 2027, you want credible mechanisms that align usage with token demand, not just theoretical narratives.

Regulatory Clarity and Institutional Access

Regulation is a wild card, but it matters. The cryptos for 2027 that thrive are likely to be the ones that can be held by institutions, integrated into compliant products, and used without constant legal uncertainty. That doesn’t mean “centralized” wins—it means “clear positioning” wins.

In practical terms, the best cryptos for 2027 often have deep liquidity, global exchange support, strong custody infrastructure, and a robust ecosystem of tooling that makes them easier to use in the real economy.

Bitcoin (BTC): The Reserve Asset Thesis for Cryptos for 2027

If you’re building a shortlist of cryptos for 2027, Bitcoin still belongs at the top. Not because it’s trendy, but because it occupies a unique role: digital scarcity with the strongest brand, the deepest liquidity, and the longest security track record in crypto.

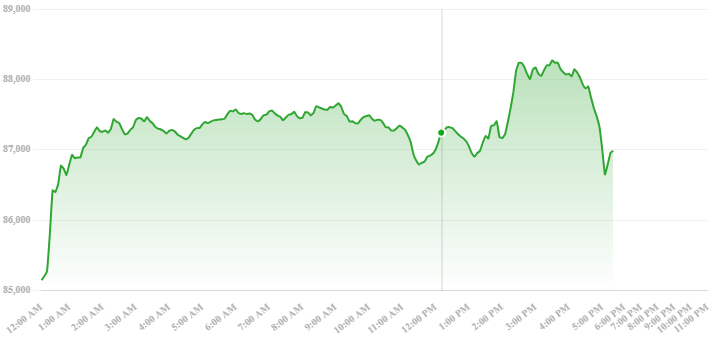

Bitcoin’s price changes daily, but the long-term thesis is structural: a globally portable, censorship-resistant asset with predictable supply. As of recent market data, Bitcoin trades around the mid–five-figure range in USD terms.

Why Bitcoin Could Keep Compounding Into 2027

Bitcoin’s core advantage for cryptos for 2027 is that it doesn’t need a million use cases to succeed. It needs credibility as a store of value—an asset investors hold when they want exposure to crypto without betting on a specific application ecosystem. That role becomes more valuable as capital markets mature around BTC, including more sophisticated custody, derivatives, and regulated investment vehicles.

There’s also the macro narrative. Bitcoin is increasingly discussed alongside gold, especially during periods when investors worry about monetary debasement or financial instability. Whether you agree or not, the market treats Bitcoin as a “risk-on + scarcity” hybrid, and that positioning can draw flows in a world where digital ownership keeps expanding.

For cryptos for 2027, Bitcoin also benefits from simplicity. No complicated roadmap is required to validate the thesis—security, liquidity, and scarcity are the product.

Potential Catalysts for BTC Before 2027

The biggest catalyst for Bitcoin as one of the core cryptos for 2027 is institutional plumbing: more on-ramps, more regulated exposure, more integration into portfolios. Another catalyst is global adoption in regions where local currencies are unstable or capital controls are strict—Bitcoin’s portability has real value.

Network-level innovation still exists, too, including developments around transaction efficiency and second-layer approaches. Even if Bitcoin remains conservative, the ecosystem around it can evolve in ways that expand utility without compromising the base layer’s stability.

Risks to Take Seriously With Bitcoin

No cryptos for 2027 discussion is complete without risk. Bitcoin can underperform in risk-off macro environments. It can face regulatory friction. It can also disappoint investors who want high-growth product innovation rather than a scarcity asset. And despite its maturity, Bitcoin remains volatile—price drawdowns can be severe.

Still, among cryptos for 2027, BTC is often considered the “lowest volatility” crypto benchmark—not low volatility in absolute terms, but relative to the rest of the market.

Ethereum (ETH) Settlement Layer Powering Most Cryptos for 2027

If Bitcoin is the reserve asset, Ethereum is the programmable settlement layer that powers a massive share of crypto’s economic activity. For cryptos for 2027, Ethereum stands out because it anchors ecosystems: DeFi, stablecoins, tokenized assets, and the broader Ethereum ecosystem of scaling networks.

Ethereum’s market position is reflected in its size and liquidity; it has consistently ranked among the largest crypto assets by market cap. Recent market data places ETH in the low-thousands USD range.

Ethereum’s Long-Term Upside Comes From Being “The Default”

Ethereum’s strongest argument as one of the top cryptos for 2027 is that it has become the default place for developers to build. That developer gravity matters more than almost anything else in crypto, because apps bring users, and users bring fees, and fees support security and sustainable economics.

Ethereum also benefits from an expanding constellation of layer-2 scaling networks that reduce costs and improve user experience while still using Ethereum as the settlement and security anchor. This layered model can help Ethereum scale without requiring every user action to happen on the expensive base layer.

In a 2027 world where tokenized real-world assets, stablecoin payments, and compliant on-chain finance are larger, Ethereum’s role as a neutral settlement layer could become even more valuable. That makes it a cornerstone pick among cryptos for 2027.

DeFi, Stablecoins, and Real-World Assets

Ethereum’s most important tailwinds for cryptos for 2027 are tied to use cases that already work: stablecoin transfers, lending/borrowing, decentralized exchanges, and increasingly real-world assets (RWA) like tokenized treasuries or funds.

You don’t need every user to understand cryptography. You need them to experience faster settlement, lower friction, and global access. Ethereum-based systems are already moving in that direction, especially as UX improves and on-chain activity becomes easier through better wallets and account abstraction-like experiences.

Risks: Fees, Competition, and Complexity

Ethereum’s biggest risks as one of the core cryptos for 2027 are competition and complexity. Alternative smart contract platforms can offer cheaper base-layer transactions and a simpler narrative. Ethereum’s multi-layer ecosystem can also confuse newcomers.

There’s also the question of value capture. Ethereum’s economics depend on sustained usage and fee dynamics, and activity can migrate across layers in ways that shift where fees accrue. Still, Ethereum’s deep liquidity, developer network, and institutional familiarity make it hard to replace—an advantage that matters a lot for cryptos for 2027.

Cardano (ADA): The Altcoin Below $1 With 2027 Upside

Now for the “below $1” part of the thesis. Among cryptos for 2027, Cardano is one of the more established large-cap networks that has frequently traded under $1 and still offers meaningful upside if its ecosystem accelerates. Recent market data shows ADA around the ~$0.39 range, clearly below $1.

Cardano is often described as research-driven, with an emphasis on formal methods, careful upgrades, and long-term scalability. Whether you love or hate that approach, it creates a distinctive positioning among cryptos for 2027: a platform aiming to be highly resilient, methodical, and globally adoptable over time.

Why Cardano Can Be a High-Conviction “Slow Build” Bet

Cardano’s upside case for cryptos for 2027 hinges on ecosystem maturity. If the network continues improving throughput, developer tooling, and app diversity, ADA can benefit from the same forces that drive other smart contract platforms: more apps, more users, more transaction demand, and stronger token utility.

Cardano also appeals to long-term holders because it has maintained a large community, high visibility, and ongoing protocol development. In a market where many projects fade, survival itself is a signal—and survival is a key filter when choosing cryptos for 2027.

Importantly, “below $1” creates a psychological and accessibility angle, even if price per coin is not a fundamental metric. Retail investors often gravitate toward lower nominal prices, which can amplify demand during bull phases. For cryptos for 2027, that dynamic can matter when sentiment shifts from risk-off to risk-on.

Where Cardano Fits: Identity, Governance, and Global Use

Cardano’s long-term narrative often includes governance, sustainability, and solutions that could support real-world deployment. If regulatory clarity improves by 2027, networks that can support compliant applications—without compromising decentralization—may be well-positioned.

Cardano’s ability to compete will depend on attracting builders and liquidity. The technology alone isn’t enough; you need a thriving application layer. But for a curated shortlist of cryptos for 2027, ADA stands out as a “quality altcoin” that still offers asymmetric upside relative to its current price level.

Risks: Ecosystem Momentum and Competitive Pressure

Cardano’s main risk as one of the cryptos for 2027 is execution pace and ecosystem momentum. Crypto is competitive. Users and developers often go where liquidity and opportunities are richest. If Cardano fails to accelerate its app ecosystem, it can lag even if the tech improves.

That said, long-term investors often choose a basket of cryptos for 2027 precisely because no single chain is guaranteed to win. Cardano’s “below $1” pricing and established brand make it a reasonable contender in that basket, as long as you treat it as higher risk than BTC or ETH.

How to Think About Building Exposure to Cryptos for 2027

Owning cryptos for 2027 is not the same as trading crypto today. A 2027 horizon rewards patience, thesis clarity, and risk control—because volatility will test you long before the thesis plays out.

A practical way to approach cryptos for 2027 is to balance foundational assets with higher-upside exposure. Bitcoin can act like the reserve anchor, Ethereum can represent the programmable settlement layer, and an altcoin like Cardano can provide asymmetric upside if a specific ecosystem accelerates.

Position sizing matters. The higher the uncertainty, the smaller the allocation should be relative to the “core.” Also remember that long-term holding only works if you can actually hold through drawdowns. If your allocation is so large that a 50% drop forces you to sell, you don’t own cryptos for 2027—you’re just renting them.

Finally, keep your thesis updated. Long-term doesn’t mean set-and-forget. For cryptos for 2027, you should periodically check whether adoption, development, and ecosystem health are improving or stalling. The goal is to avoid clinging to a narrative after the facts change.

Conclusion

Choosing cryptos for 2027 is ultimately a bet on which networks will matter in a more mature, more regulated, more utility-driven crypto economy. Bitcoin earns its place through scarcity, liquidity, and reserve-asset positioning. Ethereum earns its place by powering the largest share of programmable finance and applications. Cardano earns its place as the “below $1” altcoin pick with a long-term, research-driven approach—and the potential to surprise if its ecosystem momentum accelerates.

No list of cryptos for 2027 is guaranteed, and volatility will remain the price of admission. But if you want a tight, thesis-driven approach instead of a random token basket, these three assets offer a strong blend of durability and upside—especially when you pair conviction with disciplined risk management.

FAQs

Q: Are these cryptos for 2027 “safe” investments?

No crypto is truly “safe.” Even the best cryptos for 2027 can experience large drawdowns, regulatory shocks, or unexpected competition. “Safer” in crypto usually means deeper liquidity, stronger security history, and broader adoption—traits more associated with BTC and ETH than most altcoins.

Q: Why include an altcoin below $1 for cryptos for 2027?

A “below $1” altcoin like Cardano can offer psychological accessibility and potentially higher percentage upside if adoption accelerates. For cryptos for 2027, that upside comes with higher risk, so it typically makes sense as a smaller allocation compared to BTC or ETH.

Q: What matters more for cryptos for 2027: price today or fundamentals?

Fundamentals matter more. Price today is a snapshot; long-term upside for cryptos for 2027 is driven by adoption, developer growth, liquidity, security, and sustained real-world utility. Price can follow fundamentals over time—but it rarely feels smooth along the way.

Q: How often should I review my cryptos for 2027 thesis?

A simple cadence is quarterly or semi-annually. For cryptos for 2027, check whether development is active, the ecosystem is growing, and the network is maintaining relevance. If a project stops shipping, loses users, or becomes structurally disadvantaged, the long-term thesis may weaken.

Q: Could Ethereum be overtaken by another smart contract platform by 2027?

It’s possible, but Ethereum’s advantage is its developer gravity, liquidity, and entrenched network effects. For cryptos for 2027, Ethereum remains a top contender because it’s not just a chain—it’s an ecosystem of layers, applications, and infrastructure that’s difficult to replicate quickly.

Also More: Ethereum Signal $1.06B Whale Move in Days