Decentralized finance has evolved rapidly over the last few years. What began as a niche experiment in permissionless lending and token swaps has grown into a complex financial ecosystem handling billions of dollars in value. Yet despite this growth, one challenge has remained constant: finding reliable, long-term yield that does not depend entirely on speculation or short-lived incentives.

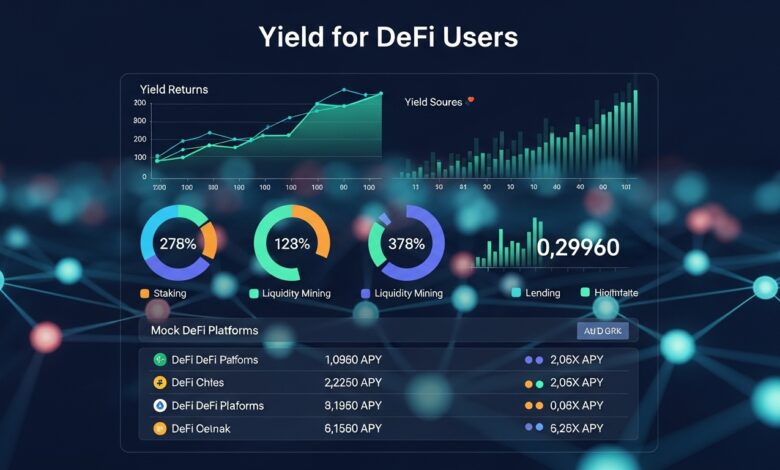

Many early DeFi yield strategies relied heavily on token emissions, leverage, or cyclical trading activity. While these approaches generated impressive returns during bull markets, they often collapsed just as quickly when market conditions shifted. As a result, DeFi users have become more selective. Today, they are searching for yield sources that feel more stable, predictable, and connected to real economic activity.

This shift in mindset has brought real world asset yield into the spotlight. By linking onchain capital with offchain income-generating assets, real world asset yield offers a way to diversify returns beyond crypto-native mechanisms. However, until recently, accessing these opportunities has been complicated, fragmented, and intimidating for many DeFi participants.

The Gate DEX and Plume integration addresses this problem directly. By simplifying how DeFi users access real world asset yield, the integration removes friction, improves usability, and brings RWAs closer to everyday onchain activity. Instead of navigating unfamiliar systems, users can engage with real world asset yield through tools and workflows they already understand.

In this article, we’ll explore why real world asset yield matters, how the Gate DEX and Plume integration improves accessibility, what benefits it offers to DeFi users, and how it could shape the future of decentralized finance.

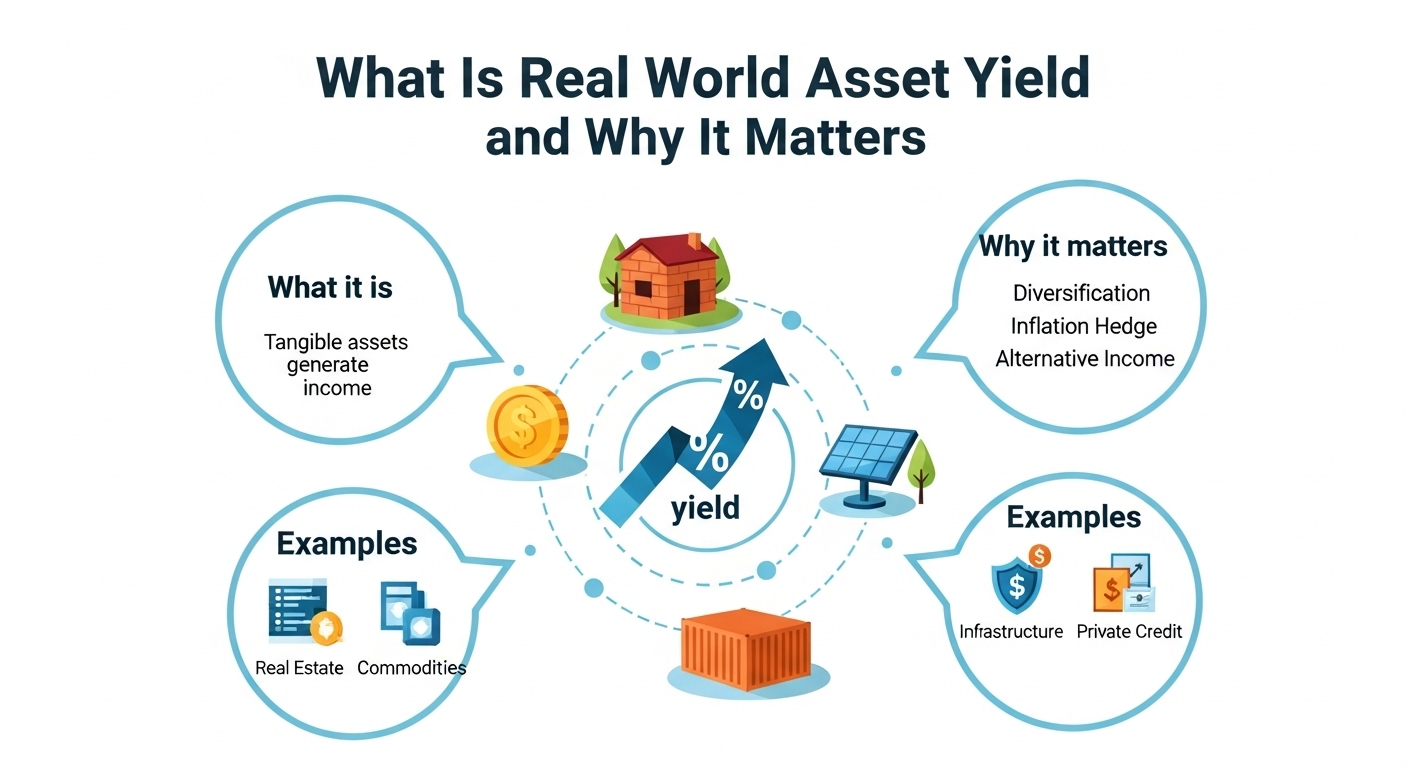

What Is Real World Asset Yield and Why It Matters

Real world asset yield refers to returns generated from assets tied to traditional financial activity, such as credit, interest-bearing instruments, or revenue-producing agreements. These assets exist outside the blockchain but are represented onchain so that DeFi users can gain exposure to their yield.

Unlike crypto-native yield, which often depends on trading fees, liquidation events, or inflationary token rewards, real world asset yield is typically driven by contractual cash flows. This difference is important. It means returns are linked to real economic demand rather than market speculation alone.

For DeFi users, this creates an opportunity to balance portfolios. When crypto markets are volatile or risk appetite declines, real world asset yield may continue to perform because it is not directly tied to token prices. This makes it attractive for users seeking income, capital preservation, or diversification.

That said, RWAs are not automatically low risk. They introduce new considerations such as borrower reliability, legal enforceability, and operational transparency. The key is not avoiding risk entirely but understanding it and ensuring the yield offered is appropriate for that risk.

Why Accessibility Has Been a Major Barrier

Despite strong interest, adoption of real world asset yield has been slower than expected. One of the biggest reasons is accessibility. Many RWA platforms require users to go through unfamiliar processes, such as manual onboarding, complex documentation, or separate interfaces that do not feel like traditional DeFi.

For experienced onchain users, this friction can be discouraging. For newcomers, it can be a complete dealbreaker. Even when the yield opportunity is compelling, complexity often prevents capital from flowing in.

Another challenge has been liquidity. Without easy access through established DeFi venues, RWA markets can feel illiquid or opaque. Users may worry about pricing fairness or whether they can exit positions efficiently.

The solution is not simply creating more RWA products. It is integrating them into the existing DeFi infrastructure in a way that feels intuitive and familiar. This is where the Gate DEX and Plume integration plays a critical role.

Gate DEX and Plume Integration Explained Simply

At its core, the Gate DEX and Plume integration is about making real world asset yield easier to use. Instead of forcing users to leave their normal DeFi environment, the integration brings RWA exposure into a decentralized exchange context where users already feel comfortable.

Gate DEX serves as the access layer. It provides onchain liquidity, transparent pricing, and familiar swap-based interactions. Plume provides the infrastructure that connects real world assets to the blockchain in a structured and compliant way.

Together, they reduce the distance between DeFi capital and real world yield. Users no longer need to think of RWAs as a separate category requiring special knowledge. Instead, they can approach real world asset yield as another onchain opportunity, evaluated with the same discipline they apply to other DeFi assets.

How a DEX-Based Model Improves User Experience

Decentralized exchanges are one of the most widely used tools in DeFi. Users understand how they work, trust their transparency, and rely on them daily. By enabling access to real world asset yield through a DEX environment, the integration dramatically improves usability.

Price discovery becomes clearer, as trades occur in an open market. Execution becomes faster, as users interact directly with smart contracts. Most importantly, the experience feels familiar, reducing hesitation and uncertainty.

This familiarity encourages broader participation, which in turn supports healthier liquidity and more efficient markets.

Plume’s Role in Bridging Onchain and Offchain Assets

Plume focuses on making real world assets compatible with onchain systems. This involves structuring how assets are represented, how yield flows are managed, and how transparency is maintained.

Rather than treating RWAs as static tokens, the goal is to make them dynamic, usable components of DeFi. When combined with Gate DEX, this approach allows real world asset yield to move more freely within the onchain ecosystem.

Key Benefits for DeFi Users

The most immediate benefit of the Gate DEX and Plume integration is simplicity. However, the long-term advantages go much further.

Easier Entry Into Real World Asset Yield

By lowering technical and operational barriers, the integration allows more users to explore real world asset yield without extensive preparation. This democratizes access and shifts the focus toward evaluating risk and return rather than navigating complexity.

Better Liquidity and Market Efficiency

DEX-based access encourages more active participation. As more users trade and hold RWA-linked assets, liquidity improves. Better liquidity leads to tighter spreads, more reliable pricing, and greater confidence among participants.

Stronger Composability Within DeFi

One of DeFi’s greatest strengths is composability. Assets that integrate smoothly can be used across multiple protocols and strategies. As real world asset yield becomes more accessible, it opens the door for new use cases such as diversified yield strategies, onchain portfolio management, and hybrid DeFi products.

Understanding the Risks Clearly

While simplified access is a major improvement, it does not eliminate risk. DeFi users should approach real world asset yield with the same caution they apply to any financial product.

Smart contract risk remains a factor, as onchain infrastructure must be secure and well-audited. At the same time, offchain risks such as credit quality, servicing reliability, and legal enforcement must be considered.

The advantage of transparent integration is that users can better assess these risks. Onchain data provides visibility into token supply and flows, while offchain reporting offers insight into asset performance. Together, they create a more informed decision-making environment.

How This Integration Could Shape the Future of DeFi

The broader impact of the Gate DEX and Plume integration extends beyond individual users. It represents a shift toward a more balanced DeFi ecosystem, where yield is not solely dependent on speculation.

As real world asset yield becomes easier to access, DeFi may attract more long-term capital seeking consistent returns. This could reduce reliance on inflationary incentives and encourage more sustainable growth.

Over time, RWAs could become a core component of DeFi portfolios, alongside stablecoins and crypto-native assets. This evolution would strengthen DeFi’s position as a viable alternative financial system rather than just a high-risk trading environment.

Conclusion

The integration between Gate DEX and Plume marks an important step in the evolution of decentralized finance. By simplifying access to real world asset yield, it removes one of the biggest obstacles to RWA adoption and aligns these assets more closely with DeFi’s core principles.

For users, this means easier entry, better liquidity, and more options for building resilient portfolios. For the ecosystem, it means a move toward more sustainable, cash-flow-driven yield models.

As DeFi continues to mature, integrations like this will likely play a crucial role in bridging the gap between onchain innovation and real-world economic value.

FAQs

Q: What is real world asset yield in DeFi?

Real world asset yield refers to returns generated from offchain assets, such as credit or interest-bearing instruments, that are made accessible onchain for DeFi users.

Q: How does the Gate DEX and Plume integration help users?

It simplifies access by allowing users to engage with real world asset yield through familiar decentralized exchange workflows.

Q: Is real world asset yield safer than traditional DeFi yield?

Not necessarily. It carries different risks, including credit and operational risk, but may offer more stable cash flows.

Q: Can beginners access real world asset yield through this integration?

Yes. The goal of the integration is to reduce complexity and make RWAs more approachable for a wider range of DeFi users.

Q: Will real world asset yield become a core part of DeFi?

As access improves and liquidity grows, real world asset yield is likely to play an increasingly important role in diversified DeFi portfolios.

See More: PoP Planet Joins Blockchain Giants to Advance Web3 and DeFi