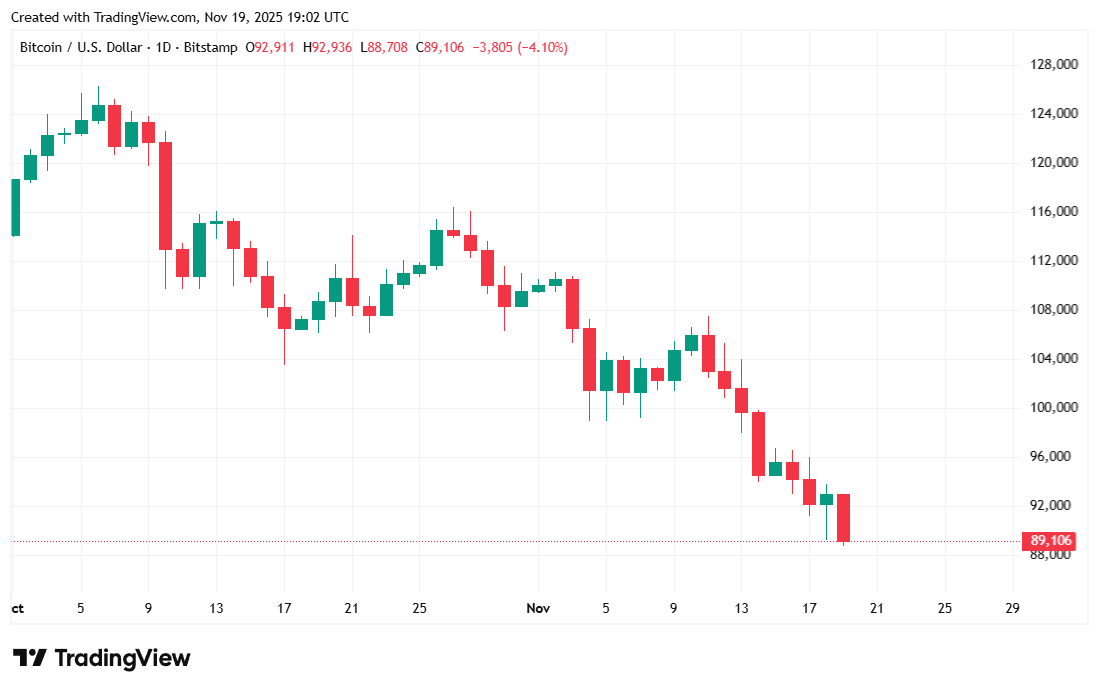

The cryptocurrency market has entered a tense and uncertain phase as Bitcoin drops below $90K, rattling investor confidence and triggering intense debate about the near-term direction of digital assets. After months of bullish momentum fueled by institutional inflows, ETF demand, and post-halving optimism, Bitcoin’s sudden retreat below this crucial psychological level has raised important questions. Is this merely a temporary pullback, or does it signal a deeper shift in market sentiment driven by macroeconomic pressures?

At the heart of this decline lies a noticeable fading risk appetite among global investors. With several key macro events on the horizon—including central bank policy decisions, inflation data releases, and geopolitical developments—markets across equities, commodities, and cryptocurrencies are showing signs of caution. Bitcoin, often viewed as both a risk asset and a hedge against monetary instability, finds itself caught between these competing narratives.

This article provides a comprehensive and SEO-optimized analysis of why Bitcoin drops below $90K, what the decline means for traders and long-term investors, and how upcoming macroeconomic events could shape Bitcoin’s next major move. By examining technical indicators, on-chain data, institutional behavior, and global economic conditions, we aim to deliver a clear and balanced perspective on the current state of the Bitcoin market.

Bitcoin Drops Below $90K: Understanding the Market Reaction

The Psychological Importance of the $90K Level

When Bitcoin drops below $90K, the impact goes beyond simple price action. Psychological price levels have always played a crucial role in financial markets, and Bitcoin is no exception. The $90,000 mark represented a zone of confidence for both retail and institutional investors, acting as a perceived floor during recent consolidation phases.

Once this level was breached, short-term traders began reassessing their positions. Stop-loss orders were triggered, leverage was reduced, and market participants shifted toward a more defensive stance. This reaction amplified selling pressure, contributing to Bitcoin’s downward momentum.

Short-Term Sentiment Versus Long-Term Structure

Despite the immediate bearish reaction, it is important to distinguish between short-term sentiment and long-term market structure. While Bitcoin drops below $90K has sparked concern, the broader uptrend that began earlier in the cycle has not been definitively broken.

Long-term holders continue to show resilience, with on-chain data suggesting that many investors are using the dip as an opportunity to accumulate. This divergence between short-term fear and long-term conviction highlights the complexity of Bitcoin’s current market dynamics.

Fading Risk Appetite and Its Impact on Bitcoin

Why Global Risk Appetite Is Declining

The phrase fading risk appetite has become increasingly common across financial media, and for good reason. Investors are growing cautious as uncertainty rises around interest rates, inflation trajectories, and economic growth. Traditional markets have responded with increased volatility, and cryptocurrencies are feeling the ripple effects.

Bitcoin, often correlated with risk-on assets during periods of economic optimism, tends to suffer when investors retreat to safer instruments. As global capital shifts toward bonds, cash, and defensive equities, speculative assets like Bitcoin face selling pressure.

Bitcoin’s Dual Role as Risk Asset and Hedge

One of the most debated topics in crypto analysis is Bitcoin’s identity. Is it a digital gold hedge, or a high-beta risk asset? When Bitcoin drops below $90K, this debate intensifies. In the current environment, Bitcoin is behaving more like a risk asset, moving in response to broader market sentiment rather than acting as a safe haven.

However, this does not invalidate Bitcoin’s long-term hedge narrative. Instead, it reflects the market’s short-term focus on liquidity and macroeconomic stability. Over longer timeframes, Bitcoin’s fixed supply and decentralized nature continue to attract investors seeking protection against monetary debasement.

Key Macro Events Driving Bitcoin’s Price Action

Central Bank Decisions and Interest Rate Outlook

One of the primary reasons Bitcoin drops below $90K is anticipation surrounding upcoming central bank meetings. Investors are closely watching signals from major central banks regarding interest rates and monetary policy. Even subtle changes in language can have outsized effects on risk assets.

Higher interest rates tend to reduce liquidity and increase the opportunity cost of holding non-yielding assets like Bitcoin. As a result, any indication of prolonged tight monetary policy can weigh heavily on crypto markets.

Inflation Data and Economic Indicators

Inflation remains a central concern for global markets. Upcoming inflation reports are among the most important key macro events influencing Bitcoin’s near-term trajectory. If inflation proves more persistent than expected, markets may price in further rate hikes, exacerbating risk-off sentiment.

Conversely, signs of easing inflation could restore confidence and reignite interest in Bitcoin. This delicate balance underscores why macro data releases have become critical catalysts for Bitcoin price movements.

Geopolitical Tensions and Global Uncertainty

Beyond economic data, geopolitical developments also contribute to market unease. Trade disputes, regional conflicts, and political instability can all impact investor behavior. When uncertainty rises, liquidity often dries up, making markets more susceptible to sharp moves.

In such an environment, it is not surprising to see Bitcoin drops below $90K as traders reduce exposure and wait for clearer signals.

Technical Analysis: What the Charts Reveal

Key Support and Resistance Zones

From a technical standpoint, the area just below $90,000 now becomes a critical zone to watch. Former support often turns into resistance, and Bitcoin must reclaim this level to restore bullish momentum. Failure to do so could open the door to deeper corrections.

However, strong support levels remain intact at lower price ranges, where historical buying interest has been significant. These zones could serve as a foundation for stabilization if selling pressure subsides.

Momentum Indicators and Market Structure

Momentum indicators such as moving averages and oscillators suggest that Bitcoin is currently in a cooling-off phase rather than a full trend reversal. While Bitcoin drops below $90K has weakened short-term momentum, longer-term indicators still point to structural strength.

This technical setup implies that the market may be undergoing a healthy reset, allowing overheated conditions to normalize before the next directional move.

Institutional Behavior as Bitcoin Drops Below $90K

ETF Flows and Institutional Positioning

Institutional activity plays a crucial role in shaping Bitcoin’s price. As Bitcoin drops below $90K, ETF flow data has become a focal point for analysts. While inflows have slowed, there is little evidence of mass institutional exit.

Many institutional investors operate with longer time horizons and are less likely to react impulsively to short-term volatility. Their continued presence provides a degree of underlying support to the market.

Long-Term Holders Versus Short-Term Traders

On-chain metrics reveal a growing divide between long-term holders and short-term traders. While traders have reduced exposure amid uncertainty, long-term holders appear largely unfazed by the dip.

This behavior suggests that the current decline may be more about sentiment than fundamentals. Historically, such phases have often preceded periods of renewed accumulation and recovery.

Broader Crypto Market Impact

Altcoins and Market Correlation

When Bitcoin drops below $90K, the effects are felt across the entire crypto ecosystem. Altcoins, which often exhibit higher volatility, tend to experience sharper declines during periods of Bitcoin weakness.

This correlation underscores Bitcoin’s role as the market’s primary liquidity driver. Until Bitcoin stabilizes, broader crypto market recovery remains challenging.

Liquidity Conditions and Market Depth

Reduced risk appetite also affects market liquidity. Lower trading volumes can exacerbate price swings, making markets more sensitive to large orders. This dynamic contributes to the heightened volatility observed as Bitcoin trades below key psychological levels.

As liquidity conditions improve, price discovery becomes more efficient, reducing the likelihood of extreme moves.

Medium- to Long-Term Outlook for Bitcoin

Is This a Temporary Pullback or Trend Shift?

A central question for investors is whether Bitcoin drops below $90K represents a temporary correction or the beginning of a prolonged downturn. Current evidence leans toward a corrective phase within a broader bullish cycle.

Macro uncertainty has temporarily overshadowed Bitcoin’s structural strengths, but these fundamentals remain intact. As clarity emerges around key macro events, confidence could gradually return.

The Role of Halving and Supply Dynamics

Bitcoin’s fixed supply and halving mechanism continue to support long-term bullish narratives. Reduced issuance over time creates scarcity, which has historically contributed to price appreciation during periods of renewed demand.

While macro factors dominate short-term price action, supply dynamics play a critical role in shaping Bitcoin’s long-term value proposition.

Investor Strategy Amid Fading Risk Appetite

Managing Volatility and Expectations

Periods when Bitcoin drops below $90K test investor discipline. Managing expectations and maintaining a long-term perspective are essential during such times. Emotional reactions to short-term price movements often lead to suboptimal decisions.

Understanding the broader context can help investors navigate volatility with greater confidence.

Positioning for the Next Market Phase

As markets await clarity from upcoming macro events, patience becomes a strategic advantage. Investors who focus on fundamentals rather than headlines are better positioned to benefit when sentiment shifts.

Bitcoin’s history suggests that periods of uncertainty often precede significant moves, making current conditions particularly important to monitor.

Conclusion

The moment when Bitcoin drops below $90K marks a critical juncture for the crypto market. Driven by fading risk appetite and anticipation of key macro events, the recent decline reflects caution rather than capitulation. While short-term volatility remains likely, the broader structural and fundamental outlook for Bitcoin remains resilient.

As investors digest upcoming economic data and policy decisions, Bitcoin’s next move will largely depend on how macro uncertainty resolves. Whether this dip becomes a springboard for renewed growth or a deeper consolidation phase, one thing is clear: Bitcoin continues to command global attention as a defining asset of the modern financial landscape.

FAQs

Q.Why did Bitcoin drop below $90K?

Bitcoin dropped below $90K due to fading risk appetite, macroeconomic uncertainty, and anticipation of key central bank and inflation-related events.

Q.Is Bitcoin dropping below $90K a bearish signal?

In the short term, it reflects caution and reduced risk-taking, but it does not necessarily indicate a long-term bearish trend.

Q.How do macro events affect Bitcoin price?

Macro events influence liquidity, interest rates, and investor sentiment, all of which directly impact Bitcoin’s price movements.

Q.Should long-term investors be concerned?

Long-term investors often view such pullbacks as part of normal market cycles, especially when fundamentals remain strong.

Q.What levels should traders watch next?

Traders are closely monitoring key support and resistance zones around the $90K level and below for signs of stabilization or further downside.