Bitcoin price lags behind stock. When a major political standoff finally ends, markets usually breathe a sigh of relief. That is exactly what happened after the longest-ever US government shutdown came to a close. Stock indices like the S&P 500 and Dow Jones surged as investors celebrated the return of federal spending and reduced uncertainty. Yet, in the same window, the Bitcoin price lagged behind the stock rally, confusing many traders who expected the flagship cryptocurrency to move in tandem with risk assets.

Bitcoin is often marketed as “digital gold”, a hedge against political turmoil and failing monetary policy. So, why did the Bitcoin price underperform just when uncertainty appeared to be easing and risk appetite was returning? The divergence highlighted deeper issues in crypto market sentiment, liquidity, and investor behavior. Bitcoin price lags behind stock.

In this article, we will explore why the Bitcoin price lags behind stock rally as the longest-ever US shutdown ends, how traditional markets and digital assets respond differently to macro events, and what this means for both short-term traders and long-term believers in blockchain technology. By the end, you will have a clearer understanding of how Bitcoin, equities, and the broader financial markets interact when politics takes center stage.

The longest-ever US shutdown and how markets reacted

The longest US government shutdown in history created weeks of uncertainty. Hundreds of thousands of federal workers went unpaid, key agencies operated with limited staff, and investors feared a drag on economic growth if the stalemate continued. During the height of the shutdown, both stock markets and cryptocurrencies saw periods of volatility, as traders tried to price in the economic damage and policy risks.

When the shutdown finally ended, the reaction in equities was swift. Major indices climbed as investors rotated back into risk-on assets, encouraged by the prospect of normalized government operations. Corporate earnings, economic data, and central bank policy once again took center stage instead of political brinkmanship. The stock rally reflected renewed confidence in the near-term growth outlook.

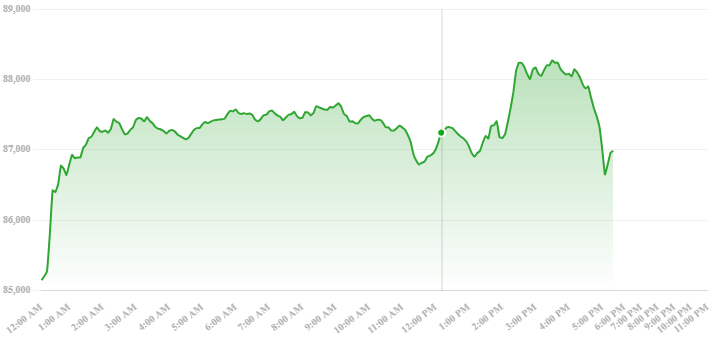

However, the Bitcoin price, along with parts of the broader crypto market, did not mirror this enthusiasm. Instead of roaring higher, Bitcoin moved far more cautiously, even appearing stagnant compared to the sharp climb in stocks. This raised an important question: if Bitcoin is a speculative asset with high volatility, why did it fail to ride the wave of rising risk appetite? Bitcoin price lags behind stock.

To answer that, we need to understand how Bitcoin fits into the macro picture and how its investor base differs from those in traditional equity markets.

Why Bitcoin price lagged behind the stock market rally

The fact that the Bitcoin price lags behind stock rally as longest-ever US shutdown ends is not a random coincidence. It reflects a combination of sentiment, market structure, and the evolving role of cryptocurrencies in global finance. Several forces were at play simultaneously.

Flight to safety dynamics and shifting risk appetite

During periods of intense uncertainty, some investors reduce exposure to risky assets and move into safer havens. For many, that still means cash, Treasuries, and defensive stocks, rather than Bitcoin. Although Bitcoin is sometimes compared to gold and treated as a hedge against monetary debasement, it is still widely perceived as a high-risk, speculative asset.

When the shutdown ended and stocks rallied, much of the inflow of capital was driven by traditional institutional players who were already active in equities. These investors view Bitcoin differently from blue-chip stocks. While they may consider adding crypto exposure in the future, their primary risk-on vehicle remains the stock market. As a result, the rally in equities did not automatically translate into a surge in Bitcoin price.

In other words, the flight to safety and subsequent risk-on rotation occurred mostly within traditional asset classes. Bitcoin was not yet fully integrated into that rotation, leaving it trailing behind the stock market’s rebound.

Liquidity and institutional participation in crypto

Stocks in major indices benefit from deep liquidity, established market infrastructure, and participation from a wide range of institutional players, from pension funds to hedge funds. The crypto market, though much larger than in its early days, still operates with comparatively lower liquidity and a more fragmented exchange ecosystem. Bitcoin price lags behind stock.

When the shutdown ended, institutional investors could allocate billions of dollars into stocks rapidly and efficiently. By contrast, their exposure to Bitcoin often remained limited, constrained by internal risk policies, regulatory uncertainty, and custody concerns. This uneven participation meant that the stock rally was broad and forceful, while the Bitcoin price only saw incremental moves.

Additionally, market-making in crypto can be more sensitive to order flow imbalances. Without a surge of new demand from large players, Bitcoin’s price did not have the same immediate catalyst as equities did. This helps explain why Bitcoin price lagged behind stock rally as longest-ever US shutdown ends, even though both markets were responding to the same macro event.

Regulatory uncertainty and sentiment around digital assets

While the shutdown itself was a political and fiscal issue, it intersected with another ongoing theme for crypto: regulatory clarity. The Bitcoin market is heavily influenced by expectations around regulation, especially in the United States, where agencies like the SEC and CFTC play key roles in defining the landscape for Bitcoin ETFs, custody solutions, and institutional frameworks. Bitcoin price lags behind stock.

Even as the government reopened, there remained unresolved questions around crypto regulation, enforcement actions, and how digital assets should be classified. This lingering uncertainty dampened enthusiasm among cautious investors who might otherwise have increased their Bitcoin holdings alongside their equity exposure.

The net effect was a split narrative: equities responded positively to short-term political resolution, while Bitcoin remained tethered to longer-term concerns about its regulatory future and the sustainability of its previous price cycles.

Comparing Bitcoin and stocks as investment assets

To fully understand why the Bitcoin price behaved differently from the stock market, it is crucial to compare the characteristics of these two asset classes.

Volatility, correlation, and diversification

Stocks, especially those in major indices, represent ownership in companies generating revenue, profits, and cash flows. Their prices are influenced by earnings, interest rates, economic data, and corporate fundamentals. In contrast, Bitcoin is a digital asset with no cash flows in the traditional sense. Its value is driven by supply and demand, adoption, network effects, and investor perception.

Historically, the Bitcoin price has exhibited significantly higher volatility than leading equity indices. This volatility offers opportunities for traders but can deter conservative investors. During the shutdown and its aftermath, some portfolio managers preferred to increase exposure to stocks, where they felt they had more predictable models and historical context, rather than add to a highly volatile asset that operates 24/7 across global exchanges.

Correlation is another key factor. While Bitcoin sometimes moves in tandem with risk assets, its correlation with the stock market is not stable. There are periods when Bitcoin decouples and trades based on crypto-specific news, such as exchange hacks, regulatory announcements, or network upgrades. This instability in correlation made some investors wary of treating Bitcoin as just another component of the risk-on rally triggered by the end of the shutdown.

At the same time, the potential for diversification remains one of Bitcoin’s selling points. For long-term portfolios, a modest allocation to Bitcoin may improve overall risk-adjusted returns if the asset continues to mature and adoption grows. However, this strategic perspective moves more slowly than the immediate reaction of stocks to a sudden political resolution.

Store-of-value versus growth narratives

Stocks are often seen as growth assets, tied to corporate innovation, productivity, and economic expansion. Bitcoin, on the other hand, is frequently framed as a store-of-value asset, akin to digital gold. It is designed with a fixed supply, halving events, and a deflationary issuance schedule that appeals to those concerned about inflation and currency debasement.

During the shutdown, the store-of-value narrative was not fully activated in the same way that a major monetary or inflation shock might trigger it. Instead, the primary issue was political gridlock and short-term government dysfunction, not systemic collapse. Once the shutdown ended, growth expectations for the economy improved, naturally boosting stocks more than store-of-value assets like Bitcoin.

This difference in narrative meant that the Bitcoin price lags behind stock rally as longest-ever US shutdown ends because the event favored growth-linked assets more than hedge-oriented ones. Investors betting on an extended crisis, where Bitcoin might shine as an alternative asset, did not see that thesis play out in the same way.

What the divergence means for crypto investors

For crypto investors, the divergence between Bitcoin and stocks during this period is rich with lessons. It underscores the importance of understanding how broader macro conditions affect different parts of a portfolio.

Implications for short-term traders

Short-term traders who expected Bitcoin to mimic the stock rally may have been caught off guard. The episode revealed that macro catalysts do not always translate uniformly across asset classes. Traders relying solely on headline events without considering underlying market structure and investor behavior risk mispricing opportunities.

For those active in the market, this period emphasized the need to track crypto-specific drivers alongside macro news. Exchange inflows, derivatives funding rates, on-chain data, and regulatory developments can be just as important as political events in shaping the Bitcoin price path.

Traders might also use such divergences as signals. When stocks rally and Bitcoin lags, it can indicate either a potential catch-up rally in crypto if sentiment improves, or a warning that capital is favoring traditional assets over digital ones for the time being. Interpreting that signal correctly requires careful analysis rather than assumptions.

Perspective for long-term HODLers

Long-term Bitcoin holders, often referred to as HODLers, typically view short-term price movements through a broader lens. For them, the fact that the Bitcoin price lags behind stock rally as longest-ever US shutdown ends is less about timing entries and exits and more about understanding Bitcoin’s evolving role in the financial system.

From a long-term viewpoint, this divergence highlights that Bitcoin is still in its adoption phase. Institutions are gradually building frameworks around custody, compliance, and integration into traditional portfolios, but this process takes time. Each macro event, from shutdowns to interest rate shifts, is another test of how Bitcoin behaves relative to established assets.

Lessons from the shutdown for future macro shocks

The interaction between politics, markets, and digital assets during the longest US shutdown offers a template for interpreting future macro shocks.

Market cycles and reaction patterns

Markets tend to move in cycles, driven by sentiment, liquidity, and fundamentals. The shutdown, and its resolution, triggered a mini-cycle of fear followed by relief in stocks. Bitcoin’s more muted response shows that its market cycle was not perfectly aligned with that of traditional equities.

For investors, this means that interpreting Bitcoin’s price action requires context beyond headline news. It involves understanding where Bitcoin is in its own cycle—whether in accumulation, expansion, distribution, or decline—and how macro events interact with these phases. A political shock might trigger a sell-off in one phase and barely move the needle in another.

Portfolio strategy and risk management

The divergence between Bitcoin and stocks during this period reinforces the value of diversified portfolios. When different assets respond differently to the same event, diversification can smooth out volatility and create more robust long-term outcomes.

Investors can use episodes like the shutdown to reassess their allocations. If they found themselves disappointed by Bitcoin’s lack of reaction, they may need to revisit their expectations and time horizons. If, on the other hand, they appreciated that Bitcoin did not simply follow stock indices, they might see stronger value in its role as an uncorrelated or selectively correlated asset.

In both cases, the key lesson is that Bitcoin is not just another stock. It occupies a distinct place in the financial ecosystem, one that will continue to evolve as regulation, adoption, and market infrastructure develop.

Conclusion

The story of how the Bitcoin price lags behind stock rally as longest-ever US shutdown ends is more than a snapshot of a single event. It is a window into the complex relationship between crypto markets and traditional finance. While equities responded quickly and strongly to the end of political deadlock, Bitcoin’s more subdued reaction revealed ongoing questions about its role, adoption, and regulatory future.

Several factors contributed to this divergence: shifting risk appetite, differing investor bases, liquidity gaps, and the unique narratives attached to Bitcoin as both a speculative asset and a potential store of value. For traders, the episode was a reminder that macro news must be filtered through the lens of each asset’s structure and drivers. For long-term investors, it reinforced the importance of clear expectations and diversified strategies.

FAQs

Q. Why did Bitcoin lag behind stocks after the US shutdown ended?

Bitcoin lagged behind stocks because most of the relief rally capital flowed into traditional equity markets, where institutional participation and liquidity are deepest. While the end of the shutdown boosted confidence in economic growth and corporate earnings, Bitcoin remained more influenced by ongoing concerns about regulation, adoption, and market structure. As a result, the Bitcoin price did not surge in the same way major stock indices did.

Q. Does this mean Bitcoin is no longer a hedge against political risk?

Not necessarily. Bitcoin’s performance during the shutdown and its aftermath shows that it is still an evolving asset class. While some investors see it as a hedge against long-term monetary and systemic risks, short-term political events do not always translate into immediate Bitcoin rallies. The hedge narrative may play out more clearly during broader monetary crises or periods of high inflation rather than isolated political standoffs.

Q. Should investors worry if Bitcoin underperforms stocks during rallies?

Underperformance during a particular rally is not automatically a red flag. Assets with different risk profiles and narratives will respond differently to various catalysts.Consistent review of goals, time horizon, and risk tolerance is more important than any single episode.

Q. Can Bitcoin still benefit from future macro events?

Yes. Bitcoin’s reaction to macro events depends on the nature of the shock. Situations involving monetary policy shifts, inflation concerns, currency crises, or loss of confidence in traditional financial systems may favor Bitcoin more than a political standoff like a government shutdown.

Q. How should I position Bitcoin in my portfolio after such events?

Positioning Bitcoin in a portfolio should be guided by your overall strategy rather than a single event. Many investors treat Bitcoin as a small allocation within a diversified portfolio, balancing its high volatility with the potential for significant long-term upside and diversification benefits. After events like the shutdown, it can be useful to reassess whether your Bitcoin exposure aligns with your risk tolerance, investment goals, and belief in the long-term digital asset thesis, rather than reacting purely to short-term price movements.