Bitcoin is once again approaching a critical moment in its market cycle as short-term holders edge closer to profitability. After weeks of consolidation and price fluctuations, recent on-chain signals suggest that Bitcoin short-term holders are nearing a “profit flip” — a psychological and structural threshold that often determines whether the market stabilizes or enters another phase of volatility.

Short-term holders play a unique role in Bitcoin’s price action. Unlike long-term holders, who typically weather market swings with conviction, short-term holders are far more sensitive to price changes. They tend to buy closer to the current market price and react quickly when Bitcoin moves against them. As a result, their collective behavior often amplifies volatility during uncertain periods.

At the moment, Bitcoin short-term holders are approaching break-even levels after spending a significant period under pressure. This development is drawing increased attention from traders, analysts, and investors alike because profit flips for short-term holders have historically coincided with meaningful market transitions. As this key level comes into focus, understanding what it represents — and why it matters — becomes essential for interpreting Bitcoin’s next move.

Understanding Bitcoin Short-Term Holders and Their Market Impact

Bitcoin short-term holders are typically defined as investors who have held their coins for less than approximately five months. This group includes recent buyers, swing traders, and speculative participants who are more likely to respond emotionally to price movements.

Because their entry prices are usually close to current market levels, short-term holders experience profit or loss much more quickly than long-term holders. When Bitcoin declines, short-term holders often find themselves underwater, leading to increased selling pressure as fear and uncertainty take hold. Conversely, when price recovers, these same holders may rush to exit at break-even or modest profit levels.

This behavior makes Bitcoin short-term holders a crucial cohort to monitor. Their collective reactions can influence whether rallies stall, accelerations occur, or corrections deepen. When short-term holders are heavily in loss, markets often struggle to sustain upward momentum. When they approach profitability, sentiment can shift rapidly.

What Does a “Profit Flip” Mean in Bitcoin Markets?

A profit flip occurs when the average cost basis of Bitcoin short-term holders is reclaimed by the market price. In simple terms, it means that most recent buyers move from unrealized losses to unrealized gains.

This transition has significant psychological implications. While short-term holders are in loss, any price rally tends to be met with selling as participants attempt to recover capital. Once profitability is restored, selling pressure can ease as panic subsides. However, profit flips can also introduce new selling behavior, as holders choose to lock in gains after enduring drawdowns.

The profit flip is not a single moment but a zone where market psychology shifts. Sustained movement above short-term holder break-even levels is typically more meaningful than a brief price spike. This is why analysts refer to it as a “key level” rather than a precise price target.

Why This Key Level Matters More Than Typical Support or Resistance

Traditional technical analysis often focuses on horizontal support and resistance levels derived from price charts. While useful, these levels do not always account for investor psychology. The short-term holder cost basis, on the other hand, represents where real market participants are emotionally invested.

When Bitcoin trades below the short-term holder cost basis, fear dominates. Above it, relief sets in. This emotional transition can dramatically alter market behavior, influencing liquidity, volatility, and trend direction.

This is why the short-term holder break-even zone frequently acts as both resistance during recoveries and support during healthy uptrends. It is a behavioral threshold rather than a purely technical one.

The Role of STH-SOPR in Identifying Profit Flips

One of the most widely used on-chain indicators for tracking short-term holder behavior is the Short-Term Holder Spent Output Profit Ratio, commonly known as STH-SOPR.

STH-SOPR measures whether Bitcoin short-term holders are selling their coins at a profit or a loss. When the metric is below 1, it indicates that coins are being sold for less than their acquisition price, signaling loss realization. When it moves above 1, it suggests that selling is occurring at a profit.

The 1.0 level is particularly important because it marks the transition between these two regimes. When Bitcoin approaches this threshold, markets often become highly reactive. A sustained move above 1 can indicate that selling pressure is no longer driven by fear, while repeated rejection below it may signal ongoing stress among recent buyers.

Short-Term Holder Realized Price and Market Stability

The short-term holder realized price represents the average price at which short-term holders acquired their Bitcoin. It functions as a dynamic reference point for market stress and relief.

When Bitcoin trades below this level, short-term holders are collectively in unrealized loss. This often leads to fragile market conditions, where rallies are short-lived and volatility remains elevated. When price reclaims this level, market structure tends to improve as forced selling diminishes.

However, reclaiming the short-term holder realized price does not guarantee sustained upside. Instead, it opens the door for stabilization, allowing the market to determine whether demand is strong enough to absorb profit-taking.

How Market Behavior Changes After a Profit Flip

Once Bitcoin short-term holders move into profit, the market typically enters a transitional phase. Panic-driven selling tends to decline, but new challenges emerge.

Some holders will take profits quickly, especially if confidence remains fragile. Others may hold longer, expecting higher prices. This creates a tug-of-war that often results in consolidation rather than immediate continuation.

If the market can absorb this selling and maintain price above the short-term holder cost basis, confidence gradually builds. Over time, this can lead to improved liquidity, reduced volatility, and a healthier trend structure.

If price fails to hold above the key level, short-term holders may re-enter loss territory, reigniting fear and increasing downside risk.

Capitulation, Recovery, and the Reset Effect

Periods when Bitcoin short-term holders are deeply underwater often coincide with capitulation events. During these phases, weaker hands exit the market, transferring coins to more patient participants.

While capitulation is painful, it can serve as a reset mechanism. Once selling pressure is exhausted, even modest demand can push price higher. The challenge lies in determining whether a recovery is sustainable or merely a relief rally.

The profit flip helps clarify this distinction. A market that cannot reclaim short-term holder profitability is often vulnerable to further declines. A market that does reclaim it gains breathing room to establish a base.

Psychological Shifts at Break-Even Levels

Break-even levels are powerful psychological anchors. For Bitcoin short-term holders, reaching break-even after weeks or months of losses can feel like an opportunity for escape.

This is why markets often stall around these zones. Some participants sell immediately to avoid future pain, while others hold in anticipation of a stronger move. The resulting indecision can compress volatility before the next expansion.

Understanding this psychological dynamic helps explain why price action around profit flips can be choppy and emotionally charged.

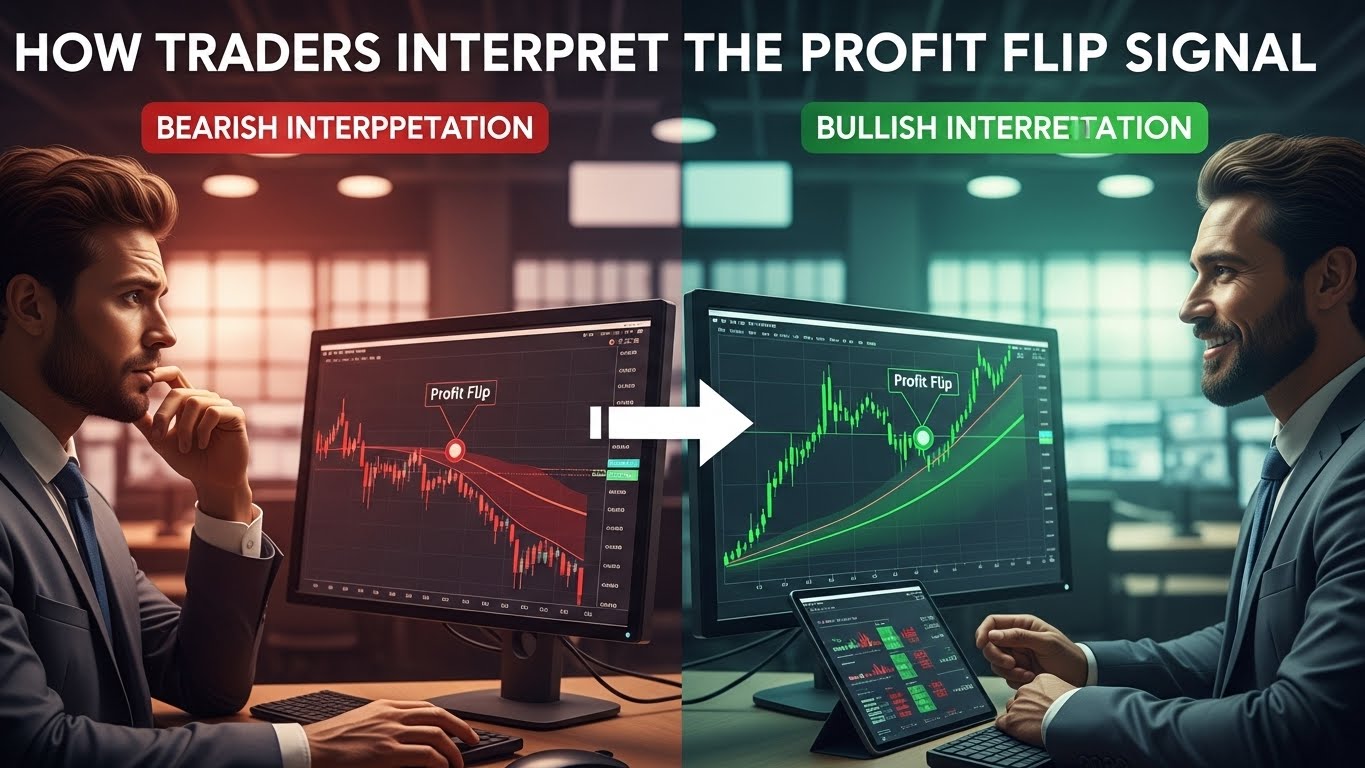

How Traders Interpret the Profit Flip Signal

From a trading perspective, the profit flip is best viewed as a contextual signal rather than a standalone trigger. It provides insight into market conditions, not guarantees.

When Bitcoin short-term holders are near profitability, traders often expect increased volatility. Breakouts can accelerate quickly, but false moves are also common. Risk management becomes especially important during these phases.

Longer-term investors may view the profit flip as confirmation that downside risk is diminishing, while short-term traders may see it as an opportunity to capitalize on volatility.

Broader Market Implications of Short-Term Holder Profitability

The behavior of Bitcoin short-term holders often influences broader market sentiment. When recent buyers regain confidence, participation tends to increase. Liquidity improves, derivatives activity rises, and altcoins may experience renewed interest.

Conversely, if short-term holders remain under pressure, risk appetite across the market typically declines. Capital rotates defensively, and speculative activity contracts.

This makes the profit flip a useful lens for understanding not just Bitcoin, but the overall health of the crypto market.

Conclusion

Bitcoin short-term holders nearing a profit flip represents a pivotal moment for the market. As price approaches key break-even levels, investor psychology, selling behavior, and market structure are all poised for change.

This key level is not about predicting exact prices. It is about understanding behavior. When short-term holders move from loss to profit, fear-driven selling often gives way to more rational decision-making. Whether that results in consolidation, continuation, or renewed volatility depends on how the market responds.

As Bitcoin navigates this sensitive zone, observing how price behaves relative to short-term holder cost bases can provide valuable insight into what comes next.

FAQs

Q: What are Bitcoin short-term holders?

Bitcoin short-term holders are investors who have held their coins for a relatively short period, usually less than five months. They tend to react quickly to price changes and often drive short-term volatility.

Q: What does a profit flip indicate in Bitcoin?

A profit flip indicates that short-term holders have moved from unrealized losses to unrealized gains, signaling a shift in market psychology and selling behavior.

Q: Why is the short-term holder cost basis important?

It represents the average entry price of recent buyers. Price action around this level often determines whether rallies succeed or fail.

Q: Does a profit flip guarantee a bullish trend?

No. While it can reduce downside pressure, profit flips often lead to consolidation and profit-taking before a clear trend emerges.

Q: How can investors use this information?

Understanding short-term holder behavior helps investors interpret volatility, manage risk, and assess whether market moves are driven by fear, relief, or genuine demand.

Also More: Bitcoin Rebound Retail Shifts After October Crash