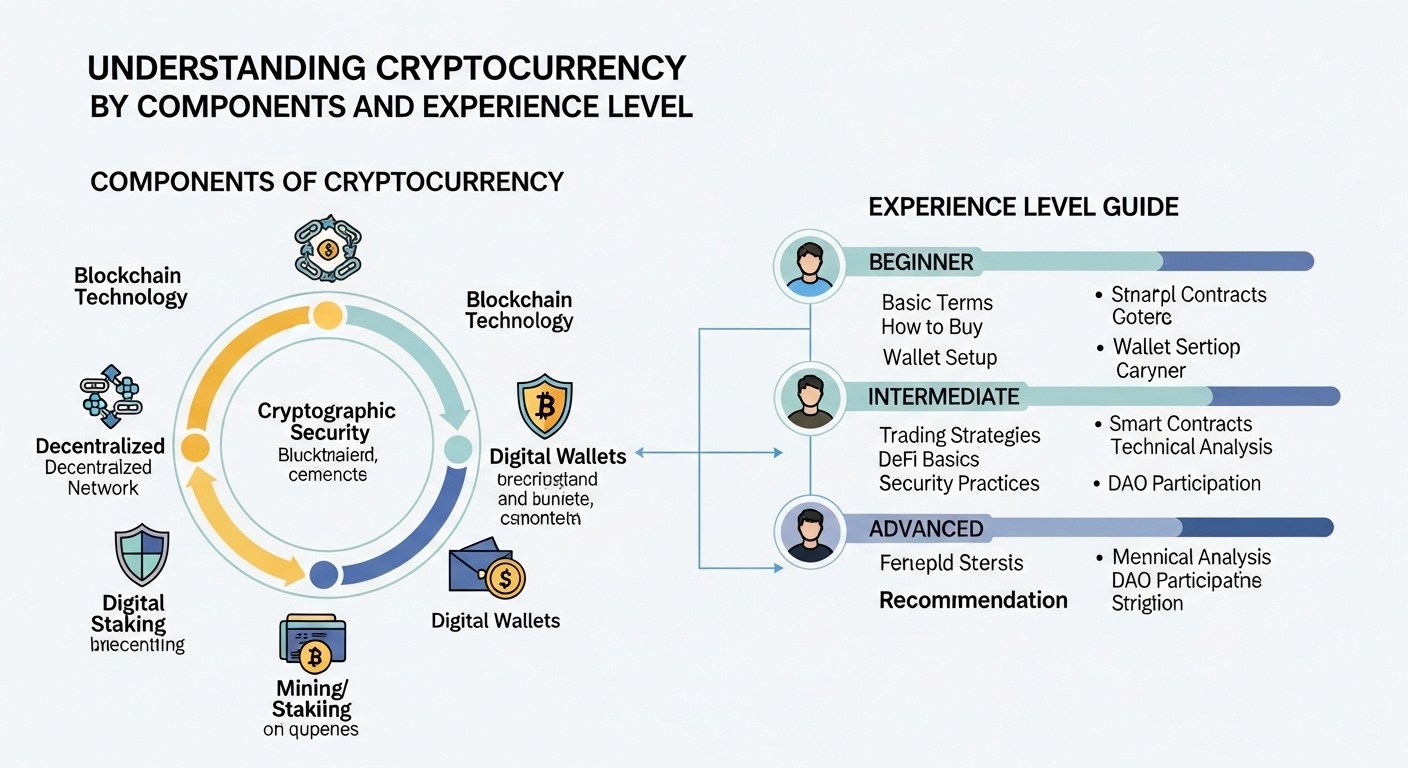

Cryptocurrency has moved from a niche tech experiment into a global financial and technology movement. Yet for many people, it still feels confusing because it blends money, software, security, and psychology into one fast-changing world. You hear about Bitcoin and Ethereum, but then you bump into terms like wallets, private keys, seed phrases, exchanges, blockchain nodes, DeFi protocols, gas fees, and smart contracts. That’s where the idea of “Cryptocurrency, Type of Component, Type of Experience Level” becomes useful. It’s a simple way to organize crypto learning: first understand the component you’re dealing with, then match it to your experience level so you don’t get overwhelmed or, worse, make costly mistakes.

Think of cryptocurrency as a system made up of parts. Each part has a purpose: storing assets, sending transactions, verifying blocks, trading tokens, or running decentralized applications. If you’re new, you don’t need to master every component at once. If you’re intermediate, you’ll want to move beyond buying and holding to understanding networks, fees, and risk. And if you’re advanced, you may explore building with smart contracts, running infrastructure, managing liquidity, and securing complex portfolios.

This guide connects cryptocurrency components to experience levels so you can learn efficiently. You’ll see how each key component works, how beginners should approach it, what intermediate users should know, and what advanced users focus on.

Understanding Cryptocurrency by Components and Experience Level

Cryptocurrency is easiest to understand when you stop treating it like a single product and start seeing it as a stack. At the base is blockchain technology, the shared ledger that records transactions. Above that are wallets and keys, which control ownership. Then come exchanges and markets, where price discovery happens. Beyond trading, there are decentralized applications—especially DeFi, where lending, borrowing, and swapping can happen without a traditional bank. Finally, there’s infrastructure such as nodes, mining, staking, and security tooling that keeps the entire ecosystem running.

Experience level matters because each component carries different risks. A beginner who jumps straight into leverage trading or liquidity pools often learns the hard way. Meanwhile, an advanced user who ignores security basics can still lose funds to phishing. When you match the component to your experience level, cryptocurrency becomes more approachable, safer, and more rewarding.

Core Component: Blockchain and Networks

What the Blockchain Component Really Does

A blockchain is a distributed database shared across thousands of computers. Instead of one company controlling the ledger, many participants keep synchronized copies. When a transaction occurs, it is verified by the network and recorded in blocks that link together chronologically. That’s where the “chain” part comes from.

For cryptocurrency users, the blockchain component is about trust without a central authority. The network’s rules—such as how blocks are produced, how transactions are validated, and how fees are calculated—determine how reliable, fast, and expensive it is to use. Bitcoin emphasizes security and scarcity; Ethereum emphasizes programmability via smart contracts; other networks prioritize speed, low fees, or specialized features.

Beginner Experience Level: Network Basics Without the Jargon

If you’re a beginner, focus on understanding that your cryptocurrency isn’t “in” your wallet the way cash is in a physical wallet. Your digital assets exist on the blockchain, and your wallet is simply your access tool. You should recognize that different cryptocurrencies live on different networks, and sending to the wrong network can cause permanent loss. Learn the difference between a token and a coin, and why network confirmations matter.

Intermediate Experience Level: Fees, Confirmations, and Network Congestion

Intermediate users should understand transaction fees more deeply. Fees are not random; they reflect supply and demand for block space. When the network is busy, fees rise. You should learn what gas fees mean on Ethereum-like chains and how to time transactions or choose fee settings responsibly. Intermediate users also benefit from understanding finality, reorg risk, and why some networks feel faster but may trade off decentralization.

Advanced Experience Level: Layer-2, Bridges, and On-Chain Strategy

Advanced users typically explore Layer-2 scaling, cross-chain bridges, and more complex transaction workflows. They evaluate security assumptions—such as whether a bridge is custodial or whether a rollup inherits Ethereum security. At this level, cryptocurrency use becomes strategic: choosing chains for liquidity, evaluating validator sets, and understanding on-chain risk. Advanced users also pay attention to network upgrades, governance proposals, and how protocol changes can impact holdings.

Core Component: Wallets, Private Keys, and Self-Custody

Why Wallets Are the Heart of Cryptocurrency Ownership

A crypto wallet is not just an app; it’s a system for managing cryptographic keys. The most important concept in cryptocurrency is that control of the private key equals control of the funds. If someone gets your key or your seed phrase, they can move your assets, and there’s usually no customer support to reverse it.

Wallets come in various forms. Hot wallets stay connected to the internet and are convenient for daily use. Cold wallets, often hardware devices, keep keys offline and reduce exposure to attacks. Both types can be safe when used correctly, but they require different habits.

Beginner Experience Level: Safe Setup and Seed Phrase Discipline

Beginners should start with a reputable wallet and learn the basics of private key security. The seed phrase is the master backup. It should be written down offline and stored securely. Never type it into random websites, never screenshot it, and never share it. If you take only one lesson from cryptocurrency, let it be that seed phrase protection matters more than chasing gains.

Beginners should also practice small transfers first. Send a tiny amount to confirm you understand addresses, networks, and confirmations. This builds confidence and avoids expensive mistakes.

Intermediate Experience Level: Hardware Wallets and Account Hygiene

Intermediate users typically upgrade to a hardware wallet for long-term holdings, especially if the portfolio grows. They also learn account hygiene: separating wallets for different activities, using a “vault” wallet for storage, and a “spending” wallet for DeFi. At this stage, you should recognize phishing attempts, malicious approvals, and fake wallet prompts. Learning to read transaction prompts carefully becomes a skill.

Advanced Experience Level: Multisig, Operational Security, and Threat Modeling

Advanced users often implement multisig wallets, where multiple approvals are required to move funds. This can protect against single-point failures and is common for teams or large portfolios. Advanced users may also adopt strict operational security practices: dedicated devices, segmented identities, hardware security modules, and careful permission management. In cryptocurrency, security is a lifestyle, not a one-time setting.

Core Component: Exchanges and Trading Platforms

What Exchanges Do in the Cryptocurrency Ecosystem

Exchanges are marketplaces for buying, selling, and converting cryptocurrency. Centralized exchanges offer convenience, customer support, and fiat on-ramps, but you rely on them to custody assets if you leave funds on the platform. Decentralized exchanges allow peer-to-peer swapping through smart contracts, giving you more control but requiring you to manage your own wallet security.

Exchanges are often the first component people touch, which is why misunderstandings happen. Many think buying cryptocurrency on an exchange means full ownership, but if the exchange holds your funds, your access depends on their policies and security.

Beginner Experience Level: Simple Buying and Risk Awareness

Beginners should prioritize clarity over complexity. Learn how to deposit, buy, and withdraw. Understand that withdrawing to your own wallet gives you stronger ownership but also more responsibility. Beginners should avoid leverage, perpetual futures, and complicated order types until they can confidently explain how liquidation works.

At this level, the goal is to build safe habits and understand how the exchange component connects to the wallet component.

Intermediate Experience Level: Liquidity, Slippage, and Market Mechanics

Intermediate users should learn about liquidity, spread, and slippage. These factors influence the actual price you get. You should understand limit orders versus market orders and how volatility affects execution. Intermediate traders begin comparing centralized and decentralized venues and learning how on-chain swaps differ from order-book trading.

Advanced Experience Level: Strategy, Risk Controls, and Market Structure

Advanced users treat cryptocurrency trading like a discipline. They use risk controls, evaluate counterparty risk, and diversify trading venues. They also track market structure—funding rates, open interest, and liquidity clusters—while staying aware that crypto markets can shift rapidly. At this level, success depends less on excitement and more on consistent systems.

Core Component: Mining, Staking, and Consensus

How Consensus Powers Cryptocurrency Networks

Consensus is how a cryptocurrency network agrees on the state of the ledger. Proof of Work uses computational effort to secure the chain, while Proof of Stake uses validators who lock coins to propose and verify blocks. Each model has trade-offs in energy use, decentralization, and economics.

Understanding consensus helps you understand why networks behave differently. It also explains why certain cryptocurrencies are secure and why some are more vulnerable to attacks.

Beginner Experience Level: Conceptual Understanding Without Complexity

Beginners do not need to run mining rigs or validators. Instead, focus on why consensus exists and why it matters. Learn the basic idea that miners or validators secure the network and are rewarded. This explains issuance, inflation, and sometimes price behavior.

Intermediate Experience Level: Earning Yield and Avoiding Traps

Intermediate users often explore staking because it feels like earning interest. You should learn the difference between native staking, exchange staking, and liquid staking tokens. Each option has different risks, including lock-up periods, smart contract risk, or platform risk. Intermediate users should also understand that yield is not guaranteed and can be offset by token inflation.

Advanced Experience Level: Validator Operations and Protocol Incentives

Advanced users may run validators or analyze staking economics in depth. They pay attention to slashing conditions, uptime requirements, and reward models. This is also where tokenomics becomes practical: how issuance, burns, and incentives shape network health and long-term value.

Core Component: DeFi, Smart Contracts, and Decentralized Apps

Why DeFi Is a Major Cryptocurrency Component

Decentralized finance (DeFi) is a set of applications that recreate financial services using smart contracts. Instead of banks managing accounts, code manages lending pools, automated market makers, collateral, and liquidations. DeFi enables permissionless access, but it also introduces technical risks that do not exist in traditional finance.

This component is often where cryptocurrency becomes more than speculation. It becomes infrastructure for financial experimentation, global access, and programmable money.

Beginner Experience Level: Safe First Steps in DeFi

Beginners should approach DeFi carefully. Start by learning what a smart contract is and why approvals matter. Understand that when you connect your wallet to a dApp, you may grant permissions that persist. Beginners should avoid chasing high yields and focus on reputable protocols, small amounts, and clear understanding of how swaps work.

Intermediate Experience Level: Lending, Borrowing, and Liquidity Pools

Intermediate users often explore lending and liquidity provision. At this stage, you should learn about collateral ratios, liquidation risk, and impermanent loss. You should also understand how stablecoins function and why depegs happen. These concepts help you evaluate DeFi opportunities with realistic expectations rather than marketing hype.

Advanced Experience Level: Composability, Audits, and On-Chain Risk

Advanced DeFi users evaluate protocol security, audits, and attack surfaces. They understand composability—how protocols stack and interact—and why that can amplify risk. Advanced users also monitor governance risks, oracle vulnerabilities, and bridge exposures. For them, cryptocurrency is not only a market but a living software ecosystem where updates and exploits can reshape outcomes overnight.

Core Component: Security, Scams, and Risk Management

Security Is Not Optional in Cryptocurrency

In cryptocurrency, security is part of the product. Because transactions are irreversible and self-custody is common, scams target users relentlessly. Phishing links, fake support accounts, malicious browser extensions, and deceptive token contracts are everyday threats.

Strong security protects both beginners and experts. The difference is that advanced users defend against more sophisticated attacks, while beginners face common traps.

Beginner Experience Level: The Most Important Safety Rules

Beginners should treat all unsolicited messages as suspicious. Never share a seed phrase. Double-check URLs. Avoid downloading unknown files or wallet extensions. Keep devices updated and use strong passwords. These habits reduce the likelihood of becoming an easy target.

Intermediate Experience Level: Permission Management and Transaction Review

Intermediate users should learn to manage wallet approvals and revoke unnecessary permissions. They should become comfortable reading transaction prompts: what contract is being interacted with, what token approvals are being granted, and whether the action matches intent. This is the stage where careful behavior prevents large losses.

Advanced Experience Level: Portfolio Risk and Security Architecture

Advanced users build security architecture: multiple wallets, multisig, cold storage, and redundancy. They also manage portfolio risk, including chain risk, stablecoin risk, liquidity risk, and protocol risk. This level of cryptocurrency participation looks less like gambling and more like managing a digital treasury.

How to Choose the Right Cryptocurrency Path for Your Level

Matching cryptocurrency components to experience level is the smartest way to progress. Beginners should master wallets, basic exchange use, and network awareness. Intermediate users should deepen knowledge of fees, staking, DeFi basics, and risk controls. Advanced users can explore infrastructure, validator operations, smart contract evaluation, and complex on-chain strategies.

The key is pacing. Cryptocurrency rewards curiosity, but it punishes haste. Learn one component at a time, build reliable habits, and treat security as a foundation rather than an afterthought.

Conclusion

Cryptocurrency becomes far less intimidating when you see it as a set of components and match each component to your experience level. The blockchain network records transactions; wallets and keys define ownership; exchanges enable trading; consensus mechanisms secure the system; DeFi expands what money can do; and security practices protect everything you build. Whether you’re a beginner learning to store digital assets, an intermediate user exploring decentralized finance (DeFi), or an advanced participant analyzing tokenomics and infrastructure, the same rule applies: grow step by step and protect your keys like your future depends on it—because in cryptocurrency, it often does.

FAQs

Q: What is the safest way to start with cryptocurrency as a beginner?

Start by learning how a crypto wallet works, practice small transactions, and prioritize private key security by protecting your seed phrase offline.

Q: Should I keep cryptocurrency on an exchange or in my own wallet?

For convenience, exchanges help you buy and sell quickly. For stronger ownership and control, withdrawing to your own wallet is safer—if you can manage security responsibly.

Q: What is the difference between a coin and a token in cryptocurrency?

A coin typically runs on its own blockchain network, while a token is built on top of an existing blockchain, often using smart contracts.

Q: Is staking the same as earning interest in a bank?

Not exactly. Staking rewards come from network incentives and can involve lockups, token inflation, or platform risk. It’s closer to participating in network security than a guaranteed savings product.

Q: Why is DeFi considered risky even when it’s decentralized?

DeFi relies on smart contracts, and code can have bugs, exploits, or governance issues. Even in decentralized finance (DeFi), mistakes and vulnerabilities can lead to losses, so risk management matters.

Also More: Crypto News Today Bitcoin Holds Strong Above $96K