Ethereum has always attracted bold predictions, but the current tug-of-war between a “Ethereum to $300” crash narrative and a “Ethereum to $9K” rally thesis feels especially intense. On one side, skeptics argue that macro stress, regulatory uncertainty, fading speculation, and cyclical bear-market mechanics could drag Ethereum down to levels that sound unthinkable in today’s market. On the other side, believers point to growing adoption, expanding infrastructure, improved scalability, and the long-term value of Ethereum as the settlement layer for smart contracts, DeFi, and tokenized assets.

What makes this debate so compelling is that both camps can cite real evidence. Ethereum is not just a coin that goes up or down on hype; it’s a living network where activity, fees, upgrades, staking participation, and capital flows constantly reshape the supply-and-demand picture. Meanwhile, the broader crypto market remains highly sensitive to liquidity cycles, risk appetite, and investor psychology. That mix creates a perfect environment for extreme predictions—some thoughtful, some sensational.

This article breaks down the logic behind the Ethereum $300 crash argument and the Ethereum $9K rally case, without pretending anyone can predict price with certainty. You’ll learn what assumptions each scenario requires, which indicators matter most, and how to think about Ethereum price targets with a clearer framework. By the end, you should be able to judge which voices are grounded, which are selling narratives, and what “being right” even means in a market as reflexive as Ethereum.

What Would Make Ethereum “Right” or “Wrong”?

To figure out who’s actually right, we first need to define what “right” means in a market like Ethereum. Many Ethereum calls are technically “correct” for a moment—especially during high volatility—then wrong a month later. A crash can happen in the middle of a longer-term uptrend, and a rally can happen during a multi-year sideways cycle.

Ethereum price prediction debates usually hinge on three categories: network fundamentals, market structure, and macro conditions. On-chain data can show whether Ethereum usage is expanding, whether long-term holders are accumulating, and how staking is affecting liquid supply. Market structure can reveal whether leverage is overcrowded, whether volatility is compressing, and whether large liquidity pools exist above or below current prices. Macro conditions determine whether capital is flowing toward risk assets or away from them.

When someone says “Ethereum will crash to $300,” they’re usually assuming a deep, systemic deleveraging event plus a broad risk-off cycle. When someone says “Ethereum will hit $9K,” they’re assuming a sustained expansion of liquidity, strong narrative momentum, and continued network relevance that attracts both users and investors. Ethereum can still be fundamentally strong and yet experience a sharp drawdown. It can also be fundamentally messy and still rally hard if liquidity returns. That’s why Ethereum is the ultimate battleground for narratives.

Why the Ethereum $300 Crash Thesis Exists

The Ethereum $300 crash argument sounds dramatic, but it usually comes from a familiar place: historical drawdowns and liquidity crises. Ethereum has experienced brutal bear markets before, and in crypto, price declines of 70%–90% are not theoretical—they are part of the cycle. The crash thesis often claims that Ethereum is not immune to a severe recession, a credit crunch, or a widespread liquidation cascade across risk assets.

The Bear Case Starts With Macro Liquidity

Ethereum tends to perform best when liquidity is expanding and investors are hungry for growth assets. When liquidity tightens—through higher interest rates, reduced money supply growth, or general financial stress—Ethereum can suffer. In a severe macro downturn, investors sell what they can, not what they want, and highly liquid assets like Ethereum often become funding sources for losses elsewhere. This is why the Ethereum crash thesis often tracks global liquidity indicators and broader risk sentiment.

If the world enters a major risk-off phase, Ethereum could face reduced speculative demand, smaller inflows into DeFi, and weaker appetite for volatile altcoins. In that environment, even strong tech narratives can lose their power temporarily. A crash call to $300 implies an extreme version of that: a prolonged liquidity drought plus mass liquidation.

The “Leverage Flush” Scenario in Crypto Markets

Crypto markets frequently amplify moves due to leverage. Ethereum’s derivatives ecosystem—perpetuals, options, and margin products—can create crowded positioning. When too many traders lean in the same direction, a relatively small price move can trigger liquidations that push Ethereum sharply lower, creating a cascading effect. This dynamic is not unique to Ethereum, but Ethereum’s size makes it a major center of leveraged activity.

The Ethereum $300 crash thesis often assumes a large leverage flush combined with panic selling and a multi-month bear trend. In that scenario, support levels can break faster than expected, and “impossible” prices become possible. It’s not the everyday volatility that drives a $300 call; it’s the idea of a systemic unwind.

Network Fee Compression and “Fundamentals Don’t Matter” Phases

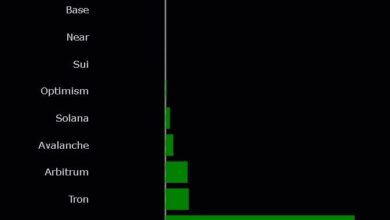

Ethereum’s long-term value proposition is tied to usage. If transaction fees collapse for an extended period, bearish voices argue that Ethereum’s economic activity is weaker than expected. They may claim that lower fees reduce ETH value capture, that competition from alternative chains erodes market share, or that users migrate to cheaper networks.

However, fee compression can be complicated. Lower fees can also increase accessibility and encourage more activity, especially on L2 ecosystems. But in “fundamentals don’t matter” phases—common during panic—traders may ignore nuanced interpretations. The crash thesis leans on the idea that sentiment overwhelms fundamentals and drags Ethereum toward historically depressed valuations.

Why the Ethereum $9K Rally Thesis Exists

Now let’s flip the lens. The Ethereum $9K rally thesis isn’t just wishful thinking; it’s often built on Ethereum’s expanding role as a global settlement layer and the continued growth of applications built on top of it. Ethereum has a unique advantage: it’s not merely a store of value story; it’s also a programmable platform for finance, identity, and digital ownership.

Ethereum as the Base Layer for Tokenized Finance

A major bullish argument is that Ethereum is becoming the foundation for tokenized real-world assets, stablecoins, and institutional-grade settlement. If tokenization grows, Ethereum could benefit from increased transaction volume, stronger demand for blockspace, and a broader investor base that values Ethereum as infrastructure rather than speculation. In this view, Ethereum doesn’t need meme energy to rally; it needs adoption that compounds.

The Ethereum $9K rally narrative often connects to institutional adoption, tokenization, and an expanding stablecoin economy. If more capital uses Ethereum rails, ETH demand can rise through staking, collateral needs in DeFi, and long-term holding as a strategic asset.

The Supply Story: Staking, Lockups, and Reduced Liquid ETH

Ethereum’s shift to Proof-of-Stake changed the supply dynamics. Staking can reduce liquid circulating ETH, especially if more holders commit ETH to validate the network rather than keep it available for trading. Bullish analysts often describe Ethereum as benefiting from a structural reduction in liquid supply, particularly during strong demand phases.

In a sustained uptrend, the combination of rising demand and constrained liquid supply can create sharper moves upward. The Ethereum $9K rally thesis assumes that staking participation remains high, that holders are reluctant to sell, and that new demand arrives through long-term capital rather than fleeting speculation.

Layer-2 Growth Can Strengthen the Ethereum Ecosystem

A common misunderstanding is that L2 networks “steal” value from Ethereum. In reality, many L2s settle back to Ethereum and rely on it for security. If the broader L2 ecosystem grows, Ethereum can become the backbone of a multi-chain environment where Ethereum is the settlement hub.

The bullish view argues that L2 scaling helps Ethereum capture more users without sacrificing security. More users can mean more total economic activity tied to Ethereum’s security layer, which can reinforce confidence in Ethereum as the dominant smart contract platform. In a strong cycle, narratives around scalability, rollups, and Ethereum ecosystem expansion can attract capital and push ETH into higher valuation regimes—potentially toward Ethereum price targets like $9K.

Market Structure: Where Crash Calls and Moon Calls Both Go Wrong

One reason Ethereum predictions become so polarized is that people confuse a plausible pathway with a guaranteed outcome. Market structure is where both sides often misjudge reality.

Volatility Cuts Both Ways

Ethereum is volatile by nature. In bull markets, Ethereum can move so quickly that conservative targets look silly. In bear markets, Ethereum can drop so far that “strong support” seems meaningless. The same volatility that makes Ethereum a candidate for huge upside also makes it vulnerable to huge drawdowns.

The mistake crash callers often make is assuming the worst-case scenario must happen. The mistake moon callers often make is assuming the best-case scenario is inevitable. The truth is that Ethereum can grind, range, chop, and fake out both extremes. If you want to evaluate Ethereum calls responsibly, you have to accept that timing and path matter as much as destination.

Liquidity Zones and the Psychology of Round Numbers

Prices like $300 and $9K are psychologically powerful. They stick in people’s minds and attract attention. But Ethereum doesn’t “care” about round numbers—markets care about liquidity. The real question is where forced sellers cluster, where long-term buyers step in, and where leveraged positions get stressed.

Ethereum can revisit old price zones, especially in major downturns, but it usually takes a catalyst strong enough to push the crowd into panic. Similarly, Ethereum can surge into new all-time highs when liquidity returns and narratives align, but it typically requires sustained demand rather than a single hype spike. The more extreme the target, the more extreme the conditions need to be.

Key Indicators That Decide Which Ethereum Scenario Is More Likely

Rather than picking a camp, it’s smarter to watch indicators that hint whether Ethereum is leaning toward a crash regime or a rally regime.

On-Chain Demand and Network Activity

If Ethereum network usage is rising—more users, more transactions, and stronger economic activity—Ethereum tends to build a healthier foundation. On-chain data doesn’t guarantee price appreciation, but it can reveal whether Ethereum is gaining real traction or just riding speculative waves.

In a crash scenario, you’d expect prolonged weakness in activity, reduced capital deployment in DeFi, and a general decline in ecosystem engagement. In a rally scenario, you’d expect steady growth in usage, stronger capital flows into Ethereum-based applications, and increased confidence that Ethereum remains the default platform for smart contracts.

Staking Trends and Liquid Supply Pressure

Staking participation influences how much Ethereum is readily available on exchanges. If more Ethereum is staked, liquid supply can tighten. If staking participation falls—especially during fear—more Ethereum can become available for selling.

A meaningful drop in staking confidence can support bearish narratives. Strong or growing staking participation can support bullish narratives, particularly if combined with rising demand. This is one reason Ethereum analysts watch staking ratios closely when forming an Ethereum price prediction.

Macro Conditions and Risk Appetite

Ethereum does not trade in a vacuum. If global markets are risk-on and liquidity is expanding, Ethereum often benefits. If markets are risk-off, Ethereum often suffers. This is why macro signals can overwhelm crypto-specific developments in the short term.

The Ethereum $300 crash thesis needs a severe risk-off environment plus crypto-specific stress. The Ethereum $9K rally thesis needs a risk-on environment where capital is willing to rotate into high-beta assets like Ethereum. Watching macro liquidity is not “tradfi cope”—it’s recognizing what moves the marginal buyer.

Competition and Narrative: Can Ethereum Keep Its Edge?

Ethereum’s leadership has been challenged many times. Faster chains, cheaper chains, and newer ecosystems constantly try to pull users away. Yet Ethereum remains the dominant platform for many high-value activities and the main hub for developer mindshare in much of the industry.

The Bullish View: Ethereum’s Network Effects Are Durable

Ethereum’s strongest advantage is its network effect. Developers, tools, liquidity, standards, and community create a reinforcing loop. New projects often choose Ethereum because that’s where users and capital already are. This matters because the value of a platform grows as more participants build on it, and Ethereum is still the center of many critical crypto primitives.

If Ethereum maintains this lead, then the Ethereum $9K rally becomes more plausible over time, especially in a strong cycle where capital prefers established infrastructure over experimental alternatives.

The Bearish View: Fragmentation and User Experience Risks

Bearish arguments focus on fragmentation, complexity, and competition. If users find Ethereum confusing or expensive, they may move to simpler alternatives. If the ecosystem becomes too fragmented across many L2s, critics argue it could weaken the “single liquidity hub” narrative.

In reality, Ethereum’s roadmap is designed to scale without sacrificing decentralization, but execution and user experience still matter. If Ethereum fails to keep onboarding smooth and costs manageable, bearish sentiment can grow—even if the core technology remains strong.

So, Who’s Actually Right About Ethereum: $300 or $9K?

Here’s the honest answer: neither target is “right” without context, timeframe, and assumptions. A better way to judge is to ask which scenario requires fewer extreme conditions.

Ethereum to $300 would likely require a major systemic event: deep macro recession, severe liquidity contraction, widespread crypto deleveraging, and sustained loss of confidence. It’s not impossible, but it’s a high bar. Ethereum has survived brutal cycles, yet reaching $300 from typical mid-cycle levels would imply a market-wide breakdown and a long-lasting risk-off regime.

Ethereum to $9K, on the other hand, requires a strong risk-on cycle, expanding liquidity, and continued Ethereum relevance. That is also a high bar, but it aligns with how crypto bull markets have historically behaved when conditions are favorable. Ethereum doesn’t need a perfect world to rally; it needs a world where capital is willing to chase growth and where Ethereum remains a central beneficiary of adoption.

If you’re choosing which side is “more right,” the Ethereum $9K rally thesis often fits a long-term adoption arc, while the Ethereum $300 crash thesis fits a severe tail-risk scenario. In practical terms, the rally case is usually more probable over a multi-year horizon if crypto adoption continues, while the crash case is a reminder that risk management matters because Ethereum can still experience violent drawdowns.

Conclusion

The “Ethereum $300 crash vs $9K rally” debate is exciting, but the most useful takeaway is not picking a side—it’s learning the framework behind each claim. Ethereum can rally hard when liquidity expands and adoption narratives strengthen. Ethereum can also crash sharply if leverage unwinds and macro conditions deteriorate. Both extremes are possible in a volatile asset class, but they are not equally likely at all times.

Instead of anchoring to a sensational number, track the drivers: network activity, staking trends, capital flows, and macro risk appetite. When those indicators align positively, the Ethereum $9K rally narrative becomes more credible. When they deteriorate sharply, crash risk rises and even “impossible” levels become discussable. In the end, the best Ethereum price prediction is not a single number—it’s a disciplined way of updating your view as conditions change.

FAQs

Q: What would need to happen for Ethereum to crash to $300?

Ethereum would likely need a severe macro downturn, a major liquidity crunch, and a broad crypto deleveraging event that triggers prolonged forced selling. It would also require widespread loss of confidence across risk assets, not just a temporary dip in sentiment.

Q: Is Ethereum hitting $9K realistic, or just hype?

Ethereum hitting $9K is realistic under strong bull-market conditions, especially if liquidity expands and Ethereum remains a dominant platform for smart contracts, DeFi, and tokenized assets. It’s not guaranteed, but it’s within the range of outcomes crypto markets have produced during major cycles.

Q: How does staking affect the Ethereum price prediction?

Staking can reduce liquid supply by locking up Ethereum, which can amplify upside during demand surges. If staking participation declines sharply, more Ethereum may become available for selling, which can increase downside pressure during risk-off phases.

Q: Do Layer-2 networks help or hurt Ethereum’s long-term value?

Many L2s ultimately strengthen Ethereum by scaling user activity while settling back to Ethereum for security. If the ecosystem grows and remains cohesive, L2 adoption can reinforce Ethereum’s role as the settlement layer, supporting long-term demand.

Q: What indicators should I watch to judge Ethereum’s next major move?

Watch a mix of on-chain data, network activity, staking participation, exchange balances, and macro liquidity conditions. Ethereum often moves hardest when fundamentals and market structure align with broader risk sentiment in the crypto market.

Also More: Ethereum Signal $1.06B Whale Move in Days