Ethereum price prediction has sharpened as ETH defends the $3,100 zone. In crypto markets, round numbers attract attention, but true importance comes from what a level represents: investor conviction, liquidity, and the point where buyers repeatedly step in. When Ethereum holds $3,100, it signals that market participants see value at that range, and it sets the stage for a broader debate—can this base support a move toward $4,000 in 2026?

A credible Ethereum price prediction isn’t just about hope or hype. It’s a mix of market structure, on-chain signals, macro conditions, and the evolving utility of Ethereum itself. ETH is not merely another speculative token; it powers a massive ecosystem of decentralized finance, tokenized assets, stablecoin rails, and smart contract activity. That underlying demand can translate into price, especially when paired with a favorable liquidity cycle and improving risk appetite.

Still, it’s important to keep expectations grounded. Crypto assets remain volatile, and even the best Ethereum price prediction should be treated as a framework, not a guarantee. The market can swing on regulation, security incidents, broader economic shocks, and shifting narratives. The goal of this analysis is to explain why holding $3,100 can matter, what “data-backed” really means in the context of a $4,000 2026 thesis, and what conditions must align for that scenario to play out.

Throughout this article, we’ll use the core keyword naturally—Ethereum price prediction—while also incorporating LSI keywords and related phrases like ETH price forecast, on-chain data, network activity, institutional demand, staking yield, spot ETF narrative, and crypto market cycle to provide a comprehensive, search-friendly, and reader-friendly view.

Ethereum Holds $3,100: What This Support Level Signals

A strong Ethereum price prediction often begins with a simple question: where is the market drawing a line in the sand? In this thesis, that line is $3,100. Support levels are not magical; they’re behavioral. They represent areas where demand has historically met supply—where traders, long-term holders, and institutions see attractive risk-to-reward.

When ETH holds $3,100, it can indicate that sellers are getting absorbed. That absorption matters because it reduces downside momentum and can encourage sidelined capital to return. In many crypto cycles, sustained support at a widely watched level becomes a springboard for a breakout, especially if volume and liquidity expand.

There’s also a psychological component. The market often “remembers” prior zones of heavy trading. If $3,100 has acted as a pivot, it tends to attract bids again. For an Ethereum price prediction aimed at 2026, this matters because long-duration moves frequently start with stability. An asset that can’t hold a base struggles to generate confidence. One that can hold a base can attract longer-term positioning.

Liquidity and Market Structure Around $3,100

Liquidity is the oxygen of price moves. A reliable Ethereum price prediction must account for how easily capital can enter and exit without massive slippage. When price consolidates near $3,100, it often builds liquidity “pockets” above and below—areas where stop orders and limit orders cluster. If Ethereum continues to defend this level, it can gradually shift liquidity upward, making it easier to attempt a run toward higher resistance levels.

Market structure also includes how derivatives traders behave. Funding rates, open interest, and liquidation levels can amplify moves in either direction. A stable base can reduce forced selling and lower the odds of cascading liquidations. That doesn’t guarantee upside, but it strengthens the foundation for a bullish Ethereum price prediction.

The “Data” Behind the $4,000 2026 Thesis

A $4,000 Ethereum price prediction for 2026 becomes more credible when multiple independent signals point in the same direction. Data, in this context, typically refers to on-chain behavior, network economics, supply dynamics, and demand catalysts. No single metric is decisive, but a cluster of supportive signals can justify a bullish thesis.

Ethereum’s investment case has evolved. It’s no longer only a “growth asset” narrative. It also has structural features—like staking and changing supply dynamics—that can influence long-term value. The strongest Ethereum price prediction models incorporate both adoption and scarcity, alongside macro conditions.

On-Chain Data and Network Activity Trends

A practical Ethereum price prediction looks at whether the network is being used. On-chain data can reflect user demand, including transaction count, active addresses (with caveats), and the economic activity moving through Ethereum. While these metrics can be noisy, persistent growth in network usage tends to support long-term valuation.

Ethereum’s relevance is also visible in how much value it settles. Stablecoins, tokenized assets, and DeFi transactions create baseline utility. Even when speculative activity cools, the network can still process economically meaningful transactions. That underlying usage can help justify the idea that a 2026 ETH price forecast includes higher price ceilings—especially if broader adoption continues.

Supply Dynamics: Burn, Issuance, and the Float

Ethereum’s supply behavior is a key ingredient in any Ethereum price prediction. The relationship between new issuance and token burn influences how scarce ETH is over time. When network activity is robust, fees can contribute to burn, potentially reducing net supply growth. While conditions vary, the long-term story many investors watch is whether ETH’s circulating supply remains relatively constrained compared to demand.

A tighter liquid float can matter even more when combined with staking. Tokens locked in staking aren’t immediately available on the open market, which can reduce sell pressure and deepen the impact of new demand. That doesn’t mean staked ETH can’t be sold—holders can exit positions—but it can still change market dynamics.

Staking Yield and Investor Appetite for “Productive” ETH

One reason the 2026 Ethereum price prediction remains compelling to many is the idea of ETH as a productive asset. Staking yield offers a native return mechanism that can attract investors who want exposure with an embedded yield component. In traditional markets, yield is a powerful magnet, especially when investors compare the opportunity cost of holding non-yielding assets.

If staking participation remains strong and the network continues to mature, the “productive ETH” narrative can support demand. It’s not just speculation on price; it’s also participation in network security and rewards. For a $4,000 ETH price forecast, this matters because steady demand can stabilize price during pullbacks and support longer-term accumulation.

Macro and Cycle Context: Why 2026 Could Be Different

No Ethereum price prediction exists in isolation. Crypto markets are strongly influenced by global liquidity, interest rates, risk sentiment, and broader technological investment cycles. By 2026, a range of macro scenarios could shape ETH’s trajectory.

If global liquidity conditions become more favorable—whether through easing financial conditions, rising risk appetite, or improving growth expectations—crypto often benefits. In those environments, capital tends to flow into higher-beta assets. Ethereum, with its deep liquidity and central role in the ecosystem, is often a primary beneficiary.

At the same time, macro risk can derail even the best Ethereum price prediction. Persistent inflation shocks, geopolitical surprises, or regulatory crackdowns can reduce risk appetite fast. That’s why a 2026 thesis should be framed in scenarios rather than absolutes.

Inflation, Rates, and Risk Appetite

When real yields are high and policy remains tight, speculative assets can struggle. When conditions loosen, the market often seeks growth again. Ethereum’s positioning as both a technology bet and a network utility asset can make it attractive during periods when investors rotate back into growth.

A realistic Ethereum price prediction acknowledges that rate expectations can change quickly. But if the 2026 environment is meaningfully more supportive for risk assets than a restrictive period, ETH’s upside potential increases.

Institutional Demand and the “Ethereum as Infrastructure” Narrative

Institutional demand can amplify an Ethereum price prediction because it can introduce larger, steadier flows than retail speculation. Institutions often look for clarity: robust custody, regulated access points, transparent market structure, and an investment thesis they can explain.

Ethereum increasingly fits an “infrastructure” narrative. It’s a settlement layer for digital finance experiments and, potentially, more mainstream tokenization. If institutions continue to treat ETH as a core allocation within the digital asset space, a $4,000 2026 target becomes easier to argue as a plausible outcome rather than a moonshot.

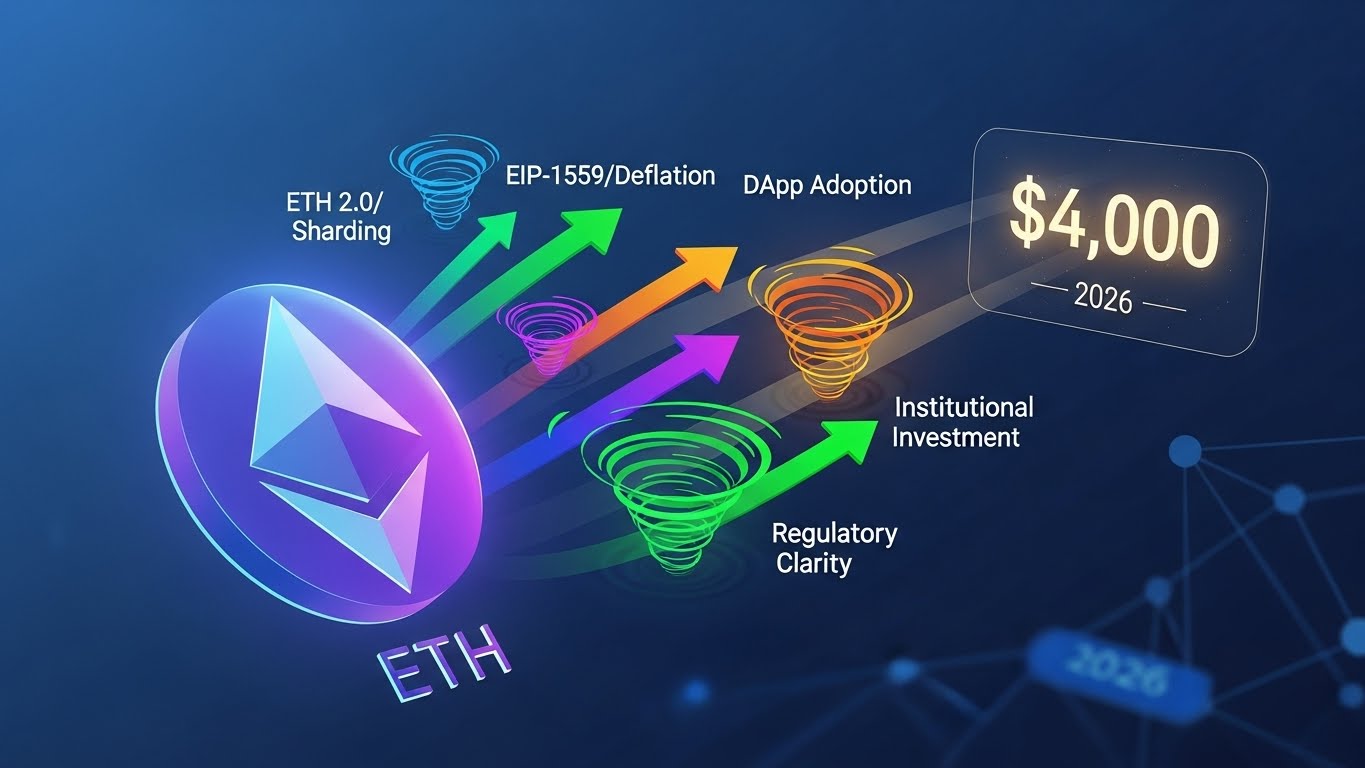

Catalysts That Could Push Ethereum Toward $4,000 in 2026

A $4,000 Ethereum price prediction is not only about charts and supply. It’s about catalysts—events or developments that shift demand, expectations, or market confidence. Ethereum has several potential catalysts that could matter into 2026, especially if they reinforce each other.

Scaling Progress and Lower Friction for Users

Ethereum’s long-term competitiveness depends on user experience. Lower costs and smoother onboarding can expand adoption, driving more activity and value settlement. Scaling improvements—especially those that reduce transaction friction—can help Ethereum retain and grow its user base.

For an Ethereum price prediction, this matters because adoption is not abstract. If more users and applications rely on Ethereum rails, demand for ETH (as a core asset used in fees, collateral, and staking) can rise.

DeFi Revival and Real-World Asset Tokenization

DeFi cycles come and go, but the concept of programmable finance remains powerful. A new wave of DeFi innovation—more sustainable yields, better risk controls, and real adoption—could support a stronger ETH price forecast.

Additionally, tokenization of real-world assets is a narrative that could mature by 2026. If tokenized treasuries, funds, credit products, or settlement systems become more common, Ethereum’s role as a trusted base layer could strengthen.

Regulation Clarity as a Demand Multiplier

Regulation is often viewed as a threat, but clarity can also unlock demand. A more defined regulatory environment can encourage institutions and conservative investors to participate. If 2026 brings clearer rules for custody, trading, staking, and market access, it could reduce uncertainty premiums and support a more bullish Ethereum price prediction.

Technical Outlook: What Needs to Happen After $3,100

Even though this is a long-term Ethereum price prediction, technical structure still matters. A market that holds support but fails to reclaim key resistance levels can remain range-bound. A $4,000 target becomes more likely if ETH can establish higher highs and higher lows over time, turning resistance into support.

Key Resistance Zones and Momentum Triggers

For ETH to validate a $4,000 2026 thesis, the market typically needs to reclaim major resistance zones above the current base. Breakouts that hold—meaning price consolidates above prior resistance—often signal stronger demand. That kind of structure can attract trend-followers and longer-term allocations.

Momentum is also psychological. A decisive shift in narrative often follows price confirmation. In crypto, sentiment can change quickly once the market believes a higher regime is underway. A disciplined Ethereum price prediction watches for confirmation rather than forcing certainty.

Volatility as a Feature, Not a Bug

Ethereum’s volatility can be uncomfortable, but it’s also part of why upside targets are possible. A $4,000 ETH price forecast assumes that drawdowns and sharp corrections will likely occur along the way. Long-term uptrends often include violent pullbacks that shake out weak hands before the trend continues.

For readers, the key is to understand that volatility does not invalidate the thesis by itself. What matters is whether the market continues to build higher bases and whether fundamental demand remains intact.

Risks That Could Break the $4,000 2026 Ethereum Price Prediction

A responsible Ethereum price prediction must address what could go wrong. Bullish theses fail when the assumptions behind them fail. Understanding risks helps readers evaluate probabilities rather than narratives.

One risk is macro: if global markets enter a deep risk-off period, crypto can fall hard. Another risk is regulatory: unfavorable rules could restrict access, reduce staking participation, or dampen institutional flows. There are also ecosystem risks, including smart contract failures in major applications, security incidents, or a loss of developer momentum.

Competition is a factor too. Ethereum remains the dominant smart contract platform by mindshare and value, but rival ecosystems continue to innovate. If another chain meaningfully captures adoption and liquidity, Ethereum’s growth rate could slow, weighing on any Ethereum price prediction that assumes strong, persistent leadership.

Finally, there’s the risk of expectations themselves. If the market becomes overly leveraged, even good news can trigger sell-offs. For a $4,000 2026 thesis to hold, the path matters: healthier rallies are usually built on spot demand and sustainable participation, not just leverage.

Scenario-Based Ethereum Price Prediction for 2026

Rather than pretending any single number is certain, a better Ethereum price prediction uses scenarios. The $4,000 thesis is best viewed as the center of a bullish-but-plausible scenario where key supports hold, adoption continues, and macro conditions don’t turn hostile.

In a base case, Ethereum remains a primary settlement layer, staking participation stays strong, and liquidity conditions gradually improve. In that environment, reclaiming higher ranges and eventually testing $4,000 in 2026 can be realistic.

In a more bullish case, catalysts stack: scaling makes UX meaningfully better, DeFi innovation returns with real demand, tokenization narratives accelerate, and regulatory clarity opens more institutional flow. In that scenario, $4,000 might not be the ceiling.

In a bearish case, macro tightens or a major regulatory shock hits. Ethereum could still remain fundamentally strong, but price targets would compress and timelines would extend. A prudent Ethereum price prediction always respects the possibility that markets move slower—or faster—than expected.

Conclusion

The $3,100 level matters because it represents a behavioral floor where buyers appear willing to defend Ethereum. If ETH continues to hold this base and market conditions improve, the $4,000 2026 thesis becomes increasingly plausible—especially when supported by on-chain data, supply dynamics, staking yield participation, and the broader narrative of Ethereum as critical infrastructure for digital finance.

A high-quality Ethereum price prediction is not a promise. It’s a map of conditions. The data-driven view suggests that Ethereum’s long-term setup can support higher prices, but the path will likely include volatility, setbacks, and shifts in sentiment. If the network continues to grow in utility while liquidity conditions remain supportive, $4,000 in 2026 is a reasonable target to keep on the radar—anchored by the idea that holding $3,100 is more than a number; it’s a signal of underlying demand.

FAQs

Q: Is $3,100 a strong support level for this Ethereum price prediction?

In this Ethereum price prediction framework, $3,100 acts as a meaningful support because it represents a zone where buyers repeatedly show interest. If price continues to defend it over time, it can strengthen confidence and improve the odds of a sustained uptrend.

Q: What data best supports a $4,000 ETH price forecast for 2026?

The most cited pillars in a $4,000 ETH price forecast include on-chain activity, supply constraints from burn and issuance dynamics, and ongoing demand tied to staking yield and Ethereum’s role in DeFi and settlement.

Q: Can staking influence the 2026 Ethereum price prediction?

Yes. Staking can influence the 2026 Ethereum price prediction by reducing liquid supply and making ETH more attractive as a “productive” asset. Strong staking participation can also reflect long-term conviction among holders.

Q: What are the biggest risks to a bullish Ethereum price prediction?

Major risks include macroeconomic downturns, adverse regulation, security incidents, and competitive pressure from other smart contract platforms. Any of these can weaken demand and disrupt a bullish Ethereum price prediction.

Q: Is a $4,000 Ethereum price prediction for 2026 guaranteed?

No. A $4,000 Ethereum price prediction for 2026 is a thesis, not a certainty. It becomes more likely if adoption grows, liquidity improves, and key technical levels hold, but markets can change quickly and unpredictably.