The crypto market is witnessing a renewed wave of optimism as Ethereum experiences a significant influx of institutional capital. With $57.6 million flowing into Ethereum ETFs, market sentiment has shifted, sparking debates about whether Ethereum is on the brink of a major breakout or simply experiencing a temporary inflow-driven rally. As Bitcoin continues to dominate headlines, Ethereum is quietly building momentum that could shape its medium- and long-term price path.

This in-depth analysis explores the Ethereum price prediction landscape following these ETF inflows, examining the technical, fundamental, and macroeconomic factors influencing ETH’s next big move. From institutional demand to upgrades in the Ethereum ecosystem, from market psychology to whale accumulation, this article aims to provide a comprehensive understanding of what might be coming next for the world’s second-largest cryptocurrency. The goal is to deliver a detailed, human-written, SEO-optimized resource designed to inform, engage, and equip investors with strategic insights into Ethereum’s evolving market behavior.

Institutional Inflows Are Rewriting Ethereum’s Market Story

For months, the crypto market has been waiting for a clear indicator of rising institutional confidence in Ethereum. The recent $57.6M ETF inflows mark one of the strongest signs that institutional investors are once again turning their attention toward ETH.

Why ETF Inflows Matter for Ethereum’s Future Price

ETF inflows represent more than just capital; they symbolize confidence, accumulated conviction, and long-term positioning. When institutional investors allocate millions into Ethereum ETFs, they are making a strategic bet on ETH’s medium- to long-term performance. These investors are less likely to engage in impulsive selling, creating a more stable and supportive foundation for price appreciation.

ETF inflows also stimulate higher liquidity and decreased volatility. This environment becomes highly favorable for traders who rely on consistent market behavior, ultimately leading to improved price stability and a more predictable trading range. These improvements make Ethereum an even more attractive option for both retail and institutional investors.

What This Institutional Vote of Confidence Suggests

The scale of the inflow indicates that institutions expect an upward trajectory in Ethereum’s valuation. With regulatory clarity improving and digital asset adoption on the rise, the presence of ETF inflows hints at deeper structural shifts in market expectations. Analysts interpret these inflows as signs that Ethereum may soon experience a stronger upside trend, particularly if macroeconomic conditions remain supportive.

Ethereum Price Prediction: Is a Breakout Coming?

The central question on investors’ minds is whether this surge in inflows will translate into a major Ethereum price breakout. Historically, large institutional inflows into ETH have preceded major rallies, making this moment especially critical for price forecasting.

Ethereum’s Technical Setup Is Strengthening

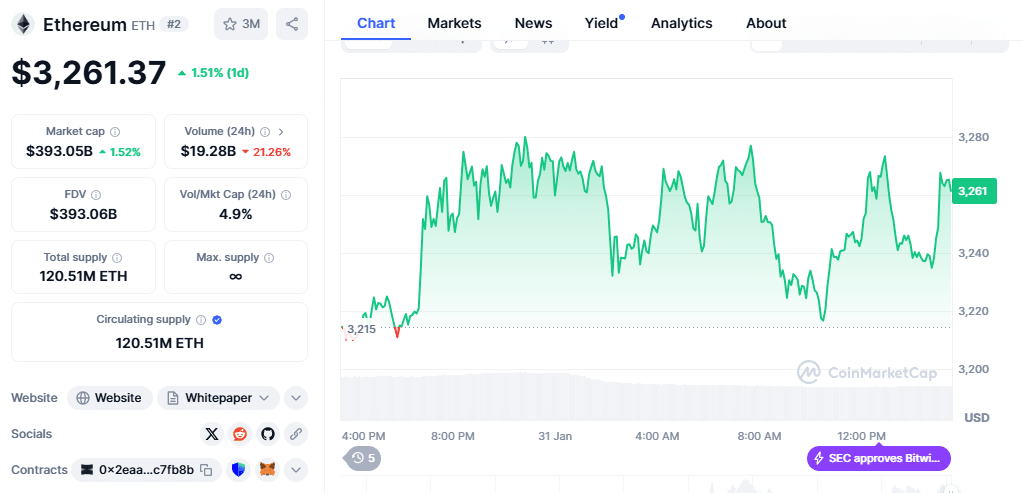

Ethereum’s technical chart suggests tightening consolidation above crucial support levels. The price has been forming higher lows, indicating that dips are being aggressively bought. This accumulation pattern reflects bullish pressure building beneath the surface.

Key indicators including the RSI, MACD, and moving averages reveal that momentum is gradually shifting into bullish territory. If Ethereum manages to break through its current resistance zones with sustained volume, it could ignite a new leg upward.

More importantly, the presence of ETF inflows creates a supportive environment that reinforces upward momentum. With institutional capital purchasing ETH at consistent intervals, the market is forming a stronger price floor.

Short-Term Price Targets Based on Current Market Conditions

Given the existing momentum, short-term Ethereum price predictions suggest potential movement toward key psychological levels. Traders are monitoring breakthrough opportunities that could send ETH toward higher resistance points in the coming weeks.

Market structure indicates that Ethereum could make significant progress if bullish pressure continues. As long as institutional buying persists, ETH is positioned to benefit from increased liquidity, heightened demand, and reduced sell-side pressure.

How Ethereum ETF Inflows Alter Market Sentiment

Market sentiment plays a crucial role in determining short- and long-term price action. When confidence surges—especially from institutional participants—it creates a ripple effect across retail investors, whales, and trading algorithms.

Retail Investors Reacting to Institutional Signals

Retail investors have always paid close attention to institutional behavior. Large ETF inflows into Ethereum give the impression that the asset remains undervalued or poised for growth. This creates what many analysts refer to as a confidence cascade, inspiring additional buyers to enter the market.

As retail sentiment strengthens, more liquidity arrives. When sentiment combines with improved trader optimism, the cumulative effect supports stable upward momentum.

Ethereum’s Strength Reinforced by Broader Market Trends

Trends in Layer-1 networks and renewed interest in smart contract ecosystems are also driving positive sentiment for Ethereum. As the leading smart contract blockchain, Ethereum remains the backbone of DeFi, NFTs, and Web3 development. This foundational role strengthens the case for sustained bullish sentiment.

Institutional inflows simply amplify these underlying fundamentals, fueling expectations of stronger long-term performance.

The Role of Ethereum Upgrades in Price Movement

Beyond ETF inflows, Ethereum’s roadmap continues to generate enthusiasm among investors. Recent and upcoming upgrades play a vital role in shaping Ethereum’s price potential.

Network Upgrades Boosting Efficiency and Value

Ethereum’s transition to Proof of Stake and subsequent network enhancements have improved scalability, efficiency, and overall transaction economics. These improvements not only enhance Ethereum’s usability but also elevate its value proposition for developers and institutions.

Each upgrade strengthens Ethereum’s position in the broader blockchain landscape, solidifying its status as a dominant network for DeFi, Web3, gaming, and enterprise solutions.

How Upgrades Influence Long-Term Price Predictions

Network upgrades often correlate with phases of accumulation and bullish movement. Investors tend to anticipate future improvements, buying Ethereum ahead of major milestones. This combination of anticipation, utility growth, and institutional adoption forms the backbone of long-term Ethereum price predictions.

As the ecosystem expands, ETH’s fundamental strength becomes more evident, increasing the likelihood of substantial long-term appreciation.

On-Chain Data Supports the Bullish Narrative

On-chain analysis is one of the most powerful tools for assessing the health and direction of a cryptocurrency. Recent on-chain metrics show strong support for Ethereum’s bullish prospects after the ETF inflows.

Whale Accumulation Is Growing Rapidly

Whale wallets—typically defined as addresses holding large quantities of ETH—have been steadily accumulating Ethereum. This behavior is often a precursor to major price increases. Whale accumulation reflects confidence in the asset’s long-term potential and indicates strategic positioning ahead of a potential breakout.

When whales accumulate, it reduces the available circulating supply on exchanges, tightening supply and increasing potential upside volatility.

Exchange Outflows Highlight Bullish Intent

Data reveals that Ethereum is being withdrawn from exchanges at a significant rate. Exchange outflows typically signal that investors plan to hold their ETH for the long term, rather than selling it on the open market.

This reduction in sellable supply strengthens the likelihood of upward price pressure, especially when combined with rising institutional inflows and steady retail interest.

Macroeconomic Factors Supporting Ethereum’s Price Outlook

Crypto markets do not operate in isolation. Broader macroeconomic conditions significantly affect market behavior and price direction.

Interest Rates, Inflation, and Risk Assets

Cryptocurrencies, especially high-value networks like Ethereum, tend to benefit from supportive macroeconomic environments. Expectations of easing monetary policy may create a favorable backdrop for digital assets. Lower interest rates typically encourage risk-on sentiment, driving liquidity into crypto markets.

If inflation stabilizes and risk assets regain momentum, Ethereum stands to benefit dramatically from broader market conditions.

Institutional Adoption and Growing Regulatory Clarity

Regulatory clarity is gradually improving, especially regarding crypto ETFs. As more institutions gain comfort with digital assets, Ethereum’s adoption increases. This trend enhances ETH’s role as a long-term investment asset, strengthening confidence and supporting bullish price predictions.

Is Ethereum Positioned for a Long-Term Bull Market?

Given the combination of ETF inflows, strong on-chain metrics, ecosystem expansion, and improving institutional sentiment, Ethereum appears increasingly well-positioned for a sustained bull market.

Long-Term Outlook Remains Strong

Ethereum’s long-term fundamentals remain robust. As the leading smart contract platform, it continues to attract developers, institutions, and retail investors alike. This enduring demand forms the base of strong long-term price predictions.

Many analysts predict that Ethereum could experience substantial growth over the next market cycle, especially if institutional inflows continue to accelerate.

The Road Ahead: What Might Come Next?

The key drivers of future growth include:

- Continued institutional interest and ETF inflows

- Upcoming Ethereum network upgrades

- Expanding adoption in DeFi and Web3

- Improved regulatory environments

- Strong ecosystem development

If these factors remain favorable, Ethereum could be poised for significant appreciation in the months and years ahead.

Conclusion

Ethereum’s recent $57.6 million ETF inflows represent a powerful signal of rising institutional confidence. These inflows, combined with bullish on-chain metrics, strong network fundamentals, and supportive macroeconomic trends, suggest that Ethereum may be approaching a pivotal moment.

While short-term price fluctuations are inevitable, the broader outlook for Ethereum remains highly positive. Whether you are a seasoned investor or just entering the crypto market, this wave of institutional interest offers a compelling indication of Ethereum’s strengthening position in the global financial landscape.

As always, investors should conduct thorough research and consider multiple factors when evaluating Ethereum price predictions. Yet the evidence suggests that Ethereum is entering a promising phase, with substantial potential for growth.

FAQs

Q. Why did Ethereum see $57.6 million in ETF inflows recently?

ETF inflows surged due to rising institutional confidence, improved market conditions, and increasing interest in Ethereum as a long-term investment asset.

Q. How will ETF inflows impact Ethereum’s price?

Large inflows increase liquidity, reduce volatility, and signal confidence—factors that generally support upward price movement and long-term appreciation.

Q. Is Ethereum likely to break out soon?

Ethereum’s technical indicators and rising demand suggest a potential breakout, especially if institutional inflows continue and resistance levels are breached.

Q. What role do upcoming Ethereum upgrades play in price predictions?

Upgrades improve network efficiency and utility, strengthening long-term demand and positively influencing Ethereum price forecasts.

Q. Should investors expect more institutional adoption of Ethereum?

Yes. With regulatory clarity improving and ETF inflows rising, institutional adoption is expected to continue expanding, supporting Ethereum’s growth trajectory.