LS support for major crypto bill marks one of the most significant turning points the digital asset industry has faced in years. For an ecosystem that has long operated in regulatory uncertainty, this development signals a potential shift away from enforcement-driven oversight toward a clearer, rules-based framework. As lawmakers begin to align around comprehensive crypto legislation, industry participants, investors, and developers are closely watching what this support could mean for the future of blockchain innovation.

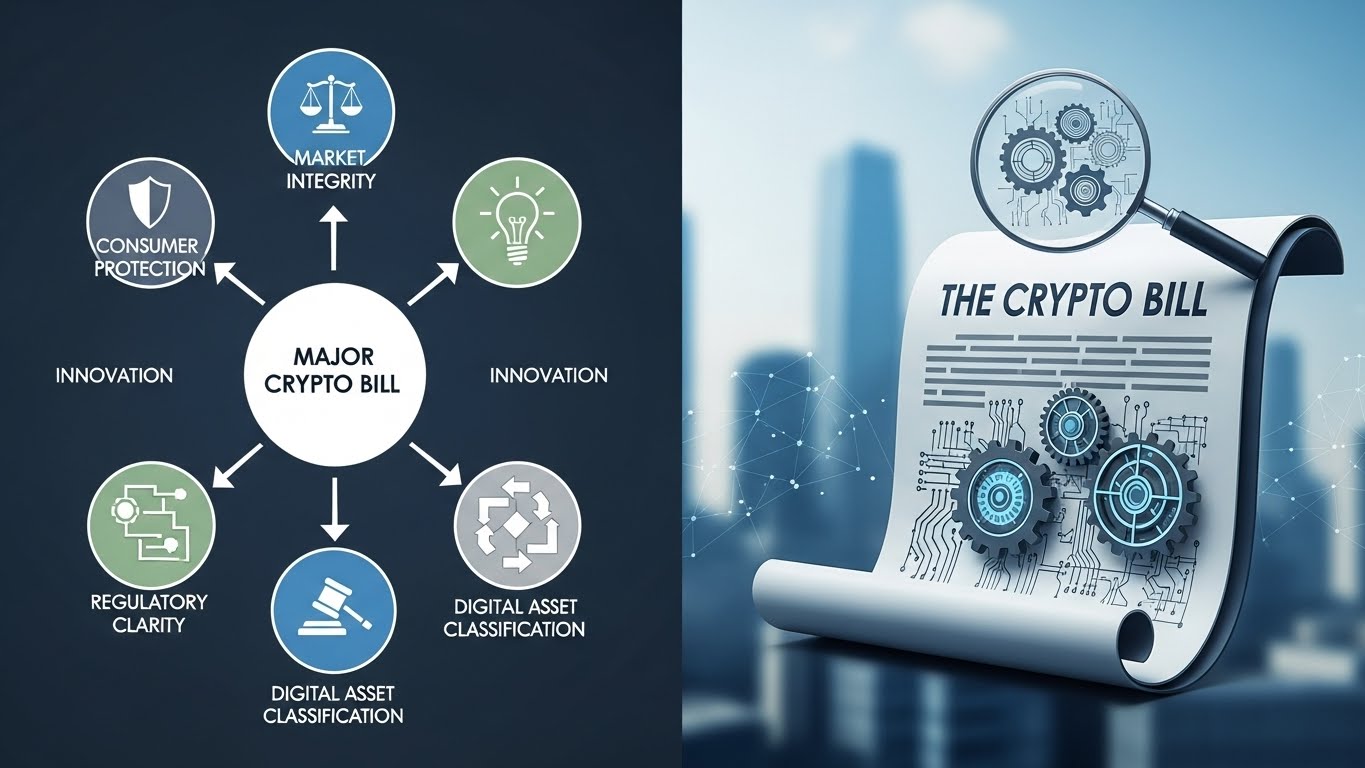

At its core, LS support for major crypto bill reflects rising political recognition that cryptocurrencies and blockchain-based financial systems are no longer niche technologies. They are deeply embedded in global markets, payment systems, and investment portfolios. Without clear regulation, innovation risks moving offshore, consumers face inconsistent protections, and institutions remain hesitant to participate at scale. This bill aims to address those issues by defining how digital assets should be regulated, who oversees them, and how crypto businesses can operate legally within the United States.

This article explores the deeper implications of LS support for major crypto bill, breaking down what the legislation seeks to accomplish, why it matters now, and how it could reshape the crypto industry for years to come.

Why LS support for major crypto bill is a big deal

LS support for major crypto bill matters because it represents a rare moment of alignment between policymakers and a rapidly evolving industry. For more than a decade, crypto regulation has largely been reactive. Regulators relied on existing securities and commodities laws that were never designed for decentralized networks or programmable money. This approach created confusion, uneven enforcement, and fear among legitimate builders.

The bill receiving LS support aims to establish a coherent market structure for digital assets. That means creating consistent definitions for tokens, outlining compliance obligations, and clarifying the roles of regulatory agencies. For crypto companies, this could mean fewer legal surprises and more confidence to invest in long-term growth.

From a global perspective, LS support for major crypto bill also sends a message that the U.S. intends to remain competitive in blockchain innovation. Jurisdictions with clearer frameworks have already attracted talent and capital. Without meaningful reform, the U.S. risks losing its leadership role in financial technology.

Understanding the major crypto bill at a high level

The major crypto bill backed by LS support focuses on market structure, not just a single crypto segment. Instead of regulating stablecoins, exchanges, or DeFi in isolation, it attempts to define the entire digital asset ecosystem under one coherent framework.

The legislation seeks to answer foundational questions such as how digital assets should be classified, when a token becomes decentralized, and what obligations apply to trading platforms. It also addresses disclosure standards, custody requirements, and market integrity safeguards.

Unlike previous piecemeal approaches, this bill is designed to provide long-term clarity rather than temporary guidance. That broader scope is exactly why LS support for major crypto bill is attracting so much attention across the industry.

Regulatory clarity: the core promise of the bill

Defining digital assets more clearly

One of the most important outcomes of LS support for major crypto bill is the push to clearly define what constitutes a digital asset. Today, many tokens exist in a gray area, leaving projects unsure whether they fall under securities laws or commodities regulation.

By establishing clearer definitions, the bill could reduce uncertainty for token issuers and investors alike. Projects would know what disclosures are required, and users would better understand the risks associated with different digital assets.

Clarifying regulatory jurisdiction

Another central issue the bill addresses is regulatory overlap. Multiple agencies currently claim authority over different aspects of crypto markets, leading to conflicting guidance and enforcement actions. LS support for major crypto bill could clarify which regulator oversees which part of the market, reducing confusion and duplication.

For exchanges and custodians, this clarity would make compliance more predictable and less costly over time.

How LS support for major crypto bill affects crypto exchanges

Crypto exchanges sit at the center of the digital asset economy, and they stand to be significantly impacted by market-structure legislation.

With clearer rules, exchanges may gain more certainty around asset listings. Instead of constantly assessing enforcement risk, platforms could follow standardized criteria when deciding which tokens to support. This could lead to more consistent markets and greater institutional participation.

However, LS support for major crypto bill also implies higher compliance standards. Exchanges may need to invest more in surveillance, reporting, and governance systems. While this could increase costs, it may also strengthen trust in crypto markets and reduce manipulation.

Stablecoins and payment innovation under the new framework

Stablecoins are a critical focus of crypto regulation because they bridge digital assets and traditional finance. LS support for major crypto bill could significantly reshape how stablecoins operate in the U.S.

The bill aims to ensure that stablecoins are properly backed, transparent, and resilient during periods of market stress. This could increase consumer confidence and encourage wider adoption for payments and remittances.

At the same time, certain incentive structures associated with stablecoins may face tighter scrutiny. While this could limit aggressive reward programs, it may also lead to a more sustainable and trustworthy stablecoin ecosystem.

What LS support for major crypto bill means for DeFi

Balancing innovation and accountability

Decentralized finance presents one of the toughest challenges for lawmakers. DeFi protocols often operate without a central authority, making traditional regulatory models difficult to apply.

LS support for major crypto bill suggests lawmakers are attempting to strike a balance. The goal is not to ban decentralized systems, but to identify points of accountability where user protection is necessary. This could include front-end interfaces, governance mechanisms, or entities exercising control over protocols.

Implications for developers

For developers, the biggest concern is liability. Clear rules could protect open-source contributors who do not control how their code is used, while still addressing bad actors who exploit decentralization to evade responsibility.

If crafted carefully, the bill could reduce fear among developers and encourage more innovation within compliant frameworks.

Tokenization and traditional finance integration

Tokenization of real-world assets is one of the fastest-growing areas in crypto. From equities to bonds and funds, on-chain representations of traditional assets promise greater efficiency and accessibility.

LS support for major crypto bill could either unlock or restrict this potential. Clear guidelines for tokenized securities would allow traditional financial institutions to experiment with blockchain technology without legal ambiguity.

If the framework is too restrictive, however, tokenization efforts may move to other jurisdictions. This makes tokenization one of the most closely watched aspects of the bill.

Investor protection and market integrity

A major selling point of LS support for major crypto bill is improved investor protection. Clear disclosure standards, custody rules, and anti-manipulation safeguards could reduce fraud and improve market transparency.

For retail investors, this could mean fewer sudden collapses caused by hidden risks. For institutional investors, it could provide the confidence needed to allocate more capital to digital assets.

Better market integrity does not eliminate risk, but it does create a more level playing field where informed decisions are possible.

Economic and innovation implications

Beyond compliance, LS support for major crypto bill has broader economic implications. Clear regulation can attract investment, create jobs, and support innovation in blockchain-based services.

Startups benefit from knowing the rules before launching products. Venture capital becomes easier to secure when legal risks are defined. Universities and research institutions gain clearer pathways to collaborate with industry.

In the long term, this framework could help integrate crypto into the mainstream economy rather than treating it as a fringe sector.

Challenges and criticisms surrounding the bill

Despite LS support for major crypto bill, the legislation faces criticism from various sides. Some argue it does not go far enough in protecting consumers, while others fear it could stifle innovation.

Industry groups worry about overregulation, particularly in areas like DeFi and stablecoins. Privacy advocates are concerned about increased surveillance. Policymakers must navigate these competing interests to produce a workable final version.

The ongoing debate highlights how complex crypto regulation has become, and why consensus takes time.

How crypto businesses should prepare

Crypto businesses should view LS support for major crypto bill as a signal to prepare for a more formal regulatory environment. This means investing in compliance, governance, and risk management now rather than later.

Projects that prioritize transparency, user protection, and responsible innovation will likely adapt more easily. Those relying on regulatory ambiguity may face tougher adjustments.

Preparation does not mean abandoning decentralization. It means designing systems that can coexist with clear legal expectations.

Conclusion

LS support for major crypto bill represents a defining moment in the evolution of digital assets. It signals a shift toward regulatory maturity and acknowledges that crypto is here to stay. While the final outcome remains uncertain, the direction is clear: the industry is moving toward clearer rules and higher standards.

If implemented thoughtfully, this legislation could strengthen trust, encourage innovation, and position the U.S. as a leader in the next phase of blockchain development. The road ahead will not be easy, but LS support for major crypto bill brings the industry closer to long-term legitimacy and sustainable growth.

FAQs

Q: What does LS support for major crypto bill mean?

It refers to backing from influential lawmakers for comprehensive crypto legislation that aims to define market structure and regulatory oversight.

Q: Will this bill ban cryptocurrencies?

No, the goal is regulation and clarity, not prohibition. The bill seeks to create rules that allow crypto to operate responsibly.

Q: How could the bill affect crypto investors?

Investors may benefit from stronger protections, clearer disclosures, and more transparent markets.

Q: What impact will it have on DeFi?

The bill may introduce accountability measures while attempting to preserve innovation in decentralized systems.

Q: Is this good or bad for the crypto industry?

Overall, LS support for major crypto bill is seen as positive because clarity enables growth, investment, and long-term stability.