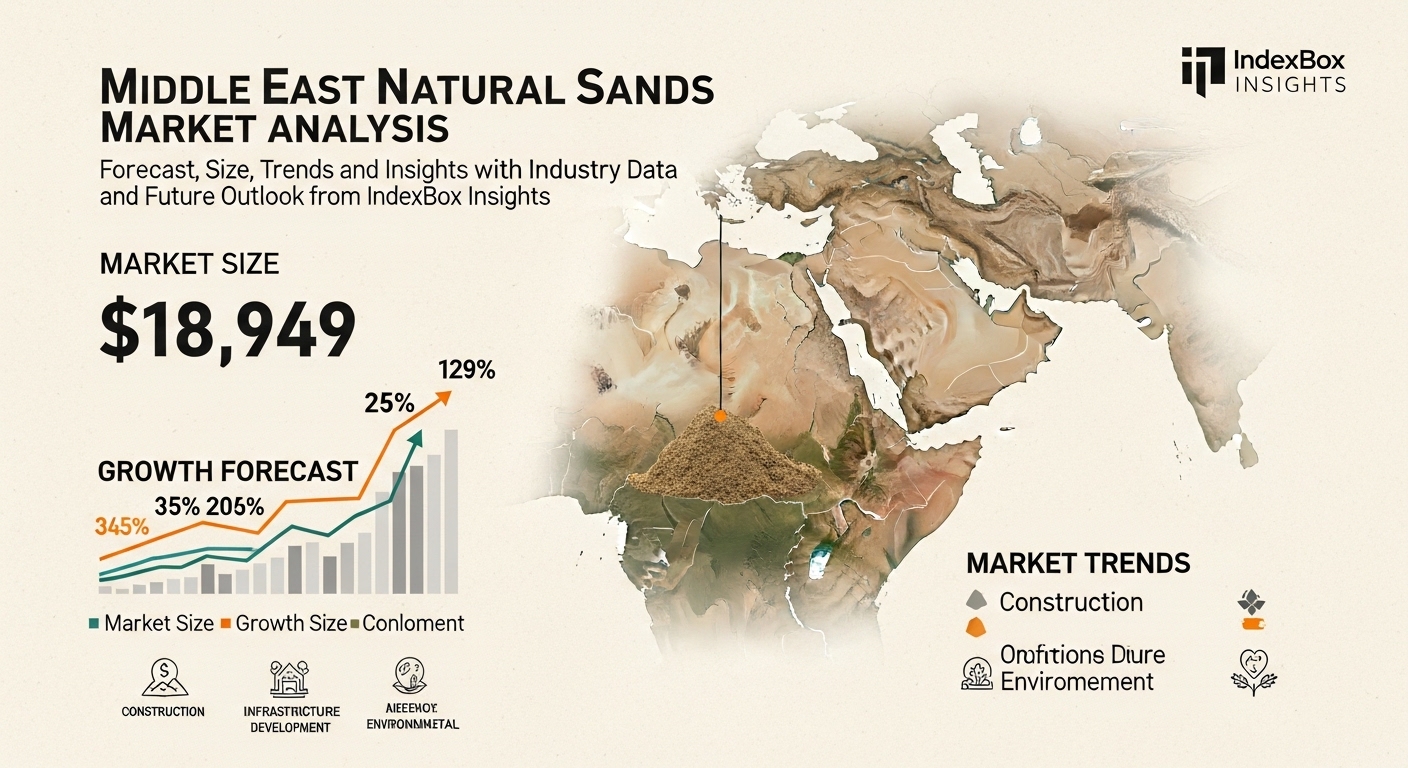

The Middle East natural sands market is a critical component of the region’s construction, infrastructure, and industrial sectors. Natural sand, a fundamental raw material for concrete, asphalt, glass production, and land reclamation projects, has seen dynamic shifts in demand, supply, and pricing over recent years. The region’s rapid urbanization, coupled with large-scale infrastructure projects spanning multiple countries, has positioned natural sands as a strategic commodity in Middle Eastern economies. According to comprehensive market research and the latest reporting from IndexBox, stakeholders are closely monitoring trends, forecasts, and emerging insights to make informed decisions. Understanding the current landscape and future outlook requires a detailed exploration of market size, demand drivers, regional nuances, and key industry trends.

The global drive toward improved infrastructure, along with ambitious national development strategies in countries such as Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait, continues to stimulate demand for high-quality natural sand aggregates. However, the market also faces challenges such as environmental regulations, depletion of traditional sand sources, and the need for sustainable alternatives. This article presents a nuanced and deeply researched analysis of the natural sands market in the Middle East, detailing its growth trajectory, underlying factors, and anticipated contours up to the forecast period.

Overview of the Middle East Natural Sands Market

The Middle East’s natural sands market is underpinned by robust construction activity and large-scale infrastructure investments. Natural sand is indispensable in the formulation of concrete and asphalt mixes, which are foundational materials for residential developments, commercial complexes, transport infrastructure, and energy facilities. Over the past decade, the market has expanded significantly as nations in the region diversify their economic bases and prioritize urban growth.

Economic diversification plans, such as Saudi Arabia’s Vision 2030 and the UAE’s Centennial 2071 strategy, have led to increased investment in megaprojects, including new cities, airports, seaports, and renewable energy installations. These projects, by their scale and complexity, drive demand for natural sands across multiple applications. While the market size fluctuates due to macroeconomic factors and project timelines, the underlying demand trend remains firmly upward.

Natural sand is distinct from manufactured sand (crushed rock) in terms of particle shape, texture, and mineral composition. In many Middle Eastern markets, naturally occurring sand deposits are preferred due to their workability in construction and compatibility with local engineering specifications. However, as high-quality sources become scarcer in certain areas, suppliers and developers are increasingly exploring alternatives or augmenting natural sand with substitutes where feasible.

Regional Dynamics and Country-Level Insights

The Middle East encompasses diverse economies with varying levels of infrastructure activity and resource endowments. Key markets for natural sands include the Gulf Cooperation Council (GCC) countries, as well as emerging markets in North Africa and the Arabian Peninsula. Each country’s market exhibits unique characteristics based on regulatory environments, resource availability, and the pace of construction.

In Saudi Arabia, the sheer scale of national development projects translates into significant consumption of natural sands. The Kingdom’s infrastructure rollouts and housing developments require vast quantities of raw materials, prompting local suppliers to ramp up extraction and distribution capacities. Nearby the UAE, which boasts some of the tallest and most ambitious architectural feats, the demand for natural sands remains high, particularly in the emirates with ongoing hospitality and tourism infrastructure expansion.

Qatar’s preparations for global events and investment in transport networks have also driven sand demand, while Kuwait’s oil sector modernization contributes to steady consumption. In contrast, smaller markets such as Oman and Bahrain present more modest but consistent demand profiles, often tied to local development plans and state-funded infrastructure initiatives.

Key Market Trends Shaping Growth

Several core trends are shaping the trajectory of the Middle East natural sands market. Urbanization is a perennial force, driving the need for housing, commercial spaces, and public infrastructure. Population growth in major cities stimulates construction activity, which in turn fuels sustained demand for aggregates such as natural sand. The trend toward sustainable and resilient infrastructure also informs material choice, with developers exploring optimal combinations of natural and manufactured aggregates.

Another evolving trend is environmental regulation. Countries in the Middle East are increasingly mindful of ecological impacts associated with extensive sand mining. Regulations aimed at preserving natural landscapes, mitigating erosion, and reducing carbon footprints influence how sand extraction licenses are issued and enforced. As a result, industry players are adapting by investing in compliance, rehabilitation of mining sites, and exploring more sustainable sourcing practices.

Technological adoption in the sand supply chain further drives efficiency and transparency. Geospatial mapping technologies, automated extraction equipment, and digital logistics platforms contribute to optimizing resource utilization and reducing delays. These advancements support the overall efficiency of the supply chain, ensuring that natural sand products reach construction sites on time and at competitive prices.

Demand Drivers: Construction, Infrastructure, and Economic Growth

The principal driver of the Middle East natural sands market is construction demand, which spans residential, commercial, and industrial sectors. Rapid urban expansion in cities such as Riyadh, Dubai, Doha, and Kuwait City necessitates extensive use of sand in concrete production, foundation works, roadbeds, and structural components. Governments in the region allocate significant resources to public works, including expressways, rail systems, ports, and energy hubs, which rely heavily on natural sand aggregates.

Infrastructure projects often form part of broader economic diversification plans. These initiatives aim to reduce dependence on oil and gas revenues by fostering sectors such as tourism, logistics, and high-tech industries. The construction of new airports, logistics hubs, and economic free zones stimulates demand for construction materials, including natural sands. Moreover, the region’s strategic location as a global trade corridor enhances the relevance of infrastructure development, which in turn maintains steady consumption patterns for natural sand products.

While economic growth underpins demand, cyclical factors such as fluctuations in oil prices and global financial conditions can influence investment in large-scale projects. Periods of economic uncertainty, project timelines may be extended or restructured, which can temporarily affect sand demand. Nonetheless, the long-term outlook remains positive due to sustained commitments to infrastructure and urban development.

Supply Side Considerations: Extraction, Logistics, and Sustainability

On the supply side, the availability and accessibility of natural sand deposits are crucial determinants of market viability. Countries with abundant high-quality sand reserves have an advantage in meeting local demand without heavy reliance on imports. Local extraction operations involve permitting, environmental assessments, and compliance with regulatory frameworks designed to minimize ecological disruption.

Logistics plays a critical role in the natural sands market, as transportation costs account for a significant portion of the final price. Heavy bulk materials such as sand are expensive to transport over long distances, leading many developers to source sand locally whenever possible. Proximity to construction sites, port facilities, and adequate trucking infrastructure influence supplier selection and overall cost structures.

Sustainability concerns are increasingly shaping how sand extraction is approached. Regulatory bodies are implementing guidelines for land rehabilitation, water management, and ecological impact mitigation. Suppliers who embrace sustainable practices may benefit from improved public perception and enhanced access to contracts involving government-backed projects that prioritize environmental compliance.

Pricing Dynamics and Market Forecasts

Pricing in the natural sands market is influenced by global gold rates, construction demand, availability of high-quality aggregates, and operational costs associated with extraction and transportation. Natural sand prices often rise in regions where traditional sources are depleted, prompting suppliers to seek new sites or rely on alternative materials.

Forecasting models suggest that the Middle East natural sands market will experience continued growth through the mid-2020s, although the pace may vary by country. Demand forecasts account for ongoing infrastructure projects, housing development plans, and the increasing sophistication of construction specifications. However, potential market headwinds, including economic slowdowns or regulatory tightening, could moderate the pace of expansion.

Analysts emphasize that capturing future market opportunities will depend on adaptive strategies by suppliers and policymakers. Investments in logistics efficiencies, environmentally responsible extraction methods, and diversification of material portfolios will support long-term resilience. In addition, technological innovations that facilitate real-time monitoring of supply chains and predictive demand forecasting are helping stakeholders optimize operations.

The Role of Imported and Alternative Sand Sources

While local extraction remains dominant, imported sand also plays a role in specific Middle Eastern markets. Countries without sufficient high-quality deposits may source sand from neighboring regions or international suppliers. Import dynamics are influenced by trade agreements, shipping costs, and comparative quality differences between domestic and foreign sand.

Alternative materials, such as manufactured sand and recycled aggregates, are gaining attention as sustainable substitutes in certain construction applications. While they may not always match the physical characteristics of natural sand, ongoing research and engineering advancements are enabling wider adoption in non-critical structural contexts. The balance between natural and alternative materials will shape future supply architectures and may relieve some pressure on traditional sand resources.

Environmental and Regulatory Challenges

The environmental footprint of sand extraction has become a focal point for regulators and industry stakeholders. Unregulated mining can lead to habitat destruction, water table disruptions, and soil erosion. Governments in the Middle East are increasingly codifying environmental standards for extraction, rehabilitation, and monitoring of mining sites.

Regulatory compliance costs add complexity to operations but also encourage responsible practices that align with global sustainability goals. For example, mandatory land restoration programs and ecological impact assessments are becoming standard components of extraction licenses. These measures, while increasing operational overhead, promote long-term environmental stewardship and reduce conflict with local communities.

Addressing regulatory challenges effectively requires collaboration among policymakers, industry players, and environmental advocates. Through stakeholder engagement and transparent compliance frameworks, the market can balance economic growth with ecological preservation.

Strategic Insights for Market Participants

Participants in the natural sands market—whether suppliers, construction firms, or investors—must remain agile and informed to navigate evolving trends. Continuous monitoring of market demand, regulatory updates, and macroeconomic conditions allows stakeholders to anticipate shifts and adjust strategies accordingly. Investment in technology, supply chain resilience, and sustainable practices enhances competitive positioning.

Engaging in long-term contracts with infrastructure developers, forming alliances with logistics providers, and diversifying offerings with value-added materials such as graded sands or blends tailored to specific construction needs can create differentiation. Moreover, understanding regional nuances in demand enables companies to allocate resources efficiently and prioritize high-growth segments.

Conclusion

The Middle East natural sands market is a dynamic and essential component of regional economic development, driven by robust construction activity, infrastructure investment, and strategic national initiatives. While demand continues to grow, market participants must confront challenges related to sustainability, regulatory compliance, and fluctuating supply conditions. By adopting forward-looking strategies, leveraging technological innovations, and aligning with environmental standards, the industry can sustain growth and support the region’s ambitious development agendas.

Monitoring trends, understanding pricing dynamics, and anticipating future demand are critical for suppliers, investors, and policymakers alike. As the Middle East shapes its economic landscape through transformative projects and sustained construction activity, natural sands will remain a cornerstone material with significant market relevance.

FAQs

Q: What factors are driving the demand for natural sands in the Middle East?

Demand for natural sands in the Middle East is primarily driven by construction and infrastructure development. Large-scale national projects, urbanization trends, and housing expansion contribute to steady demand. Economic diversification plans also require new transport networks, commercial centers, and manufacturing facilities, all of which rely on quality sand aggregates for concrete and asphalt applications.

Q: How do environmental regulations impact the natural sands market?

Environmental regulations influence how sand extraction is permitted, monitored, and rehabilitated. Stricter standards require mining companies to undertake land restoration, water management, and ecological impact mitigation. These regulations increase operational costs but promote responsible practices and reduce ecological disruption. Compliance enhances sustainability and supports long-term resource availability.

Q: Why is pricing for natural sand variable across the Middle East?

Natural sand pricing varies due to differences in local availability, extraction costs, transportation logistics, and demand intensity. Areas with abundant sand sources typically have lower prices, while regions dependent on imports or longer transport distances see higher costs. Seasonal demand shifts and construction cycles also influence short-term pricing fluctuations.

Q: Can alternative materials replace natural sand in construction?

Yes, alternative materials such as manufactured sand and recycled aggregates are increasingly used in specific applications. While they may not match natural sand in all properties, ongoing engineering innovations allow these substitutes to be viable in certain structural components and non-critical construction tasks. Adoption rates vary based on project specifications and regulatory acceptance.

Q: What strategies can companies adopt to succeed in the natural sands market?

Companies can succeed by investing in supply chain efficiencies, adopting sustainable extraction practices, and understanding regional demand patterns. Forming strategic partnerships with construction firms and logistics providers helps ensure consistent supply. Embracing technology for demand forecasting and compliance monitoring further enhances competitiveness and resilience in a dynamic market.