As the global economy rapidly shifts toward digitalization, Pakistan eyes Bitcoin and blockchain for financial infrastructure as part of a broader effort to modernize its economic systems. For a country with a large unbanked population, rising fintech adoption, and growing interest in digital assets, this strategic focus marks a potentially transformative moment. Governments worldwide are exploring how Bitcoin, blockchain technology, and decentralized financial models can improve efficiency, transparency, and inclusion, and Pakistan is increasingly part of that conversation.

Pakistan’s financial sector has long faced challenges such as limited access to banking services, high transaction costs, slow cross-border payments, and trust deficits within institutional frameworks. By exploring blockchain-based financial infrastructure, policymakers aim to address these systemic issues while aligning with global financial innovation trends. The growing discourse around digital currencies, crypto regulation, and distributed ledger systems suggests that Pakistan is no longer observing from the sidelines.

This article explores why Pakistan eyes Bitcoin and blockchain for financial infrastructure, what this shift could mean for the economy, how regulatory bodies are responding, and what opportunities and challenges lie ahead. By examining policy signals, technological readiness, and socioeconomic factors, we gain insight into how blockchain and Bitcoin could shape Pakistan’s financial future.

Why Pakistan Is Looking Toward Bitcoin and Blockchain

Economic Pressures and the Need for Financial Innovation

Pakistan’s economy has faced recurring balance-of-payments crises, inflationary pressures, and currency volatility. In such an environment, policymakers are increasingly open to alternative financial tools. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, the motivation is not to replace traditional systems overnight, but to supplement them with more resilient and transparent mechanisms.

Bitcoin has gained attention as a decentralized digital asset that operates independently of central banks, while blockchain technology offers immutable record-keeping and real-time verification. For a developing economy, these features are attractive because they can reduce reliance on intermediaries, lower costs, and increase trust in financial transactions. The growing popularity of crypto assets among Pakistani youth and freelancers further underscores the demand for digital financial solutions.

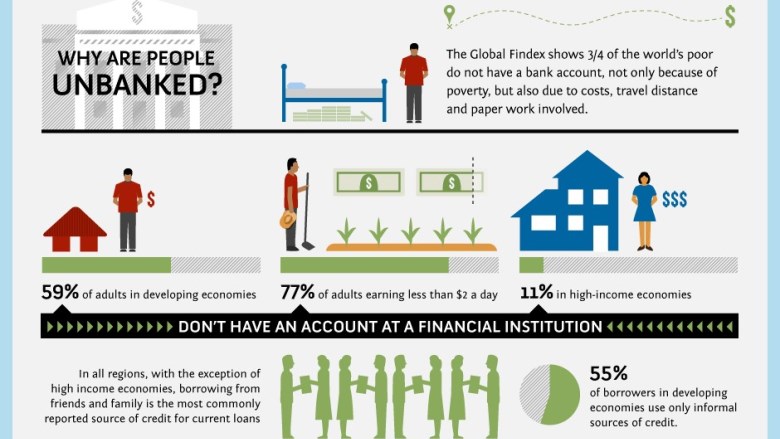

Financial Inclusion and the Unbanked Population

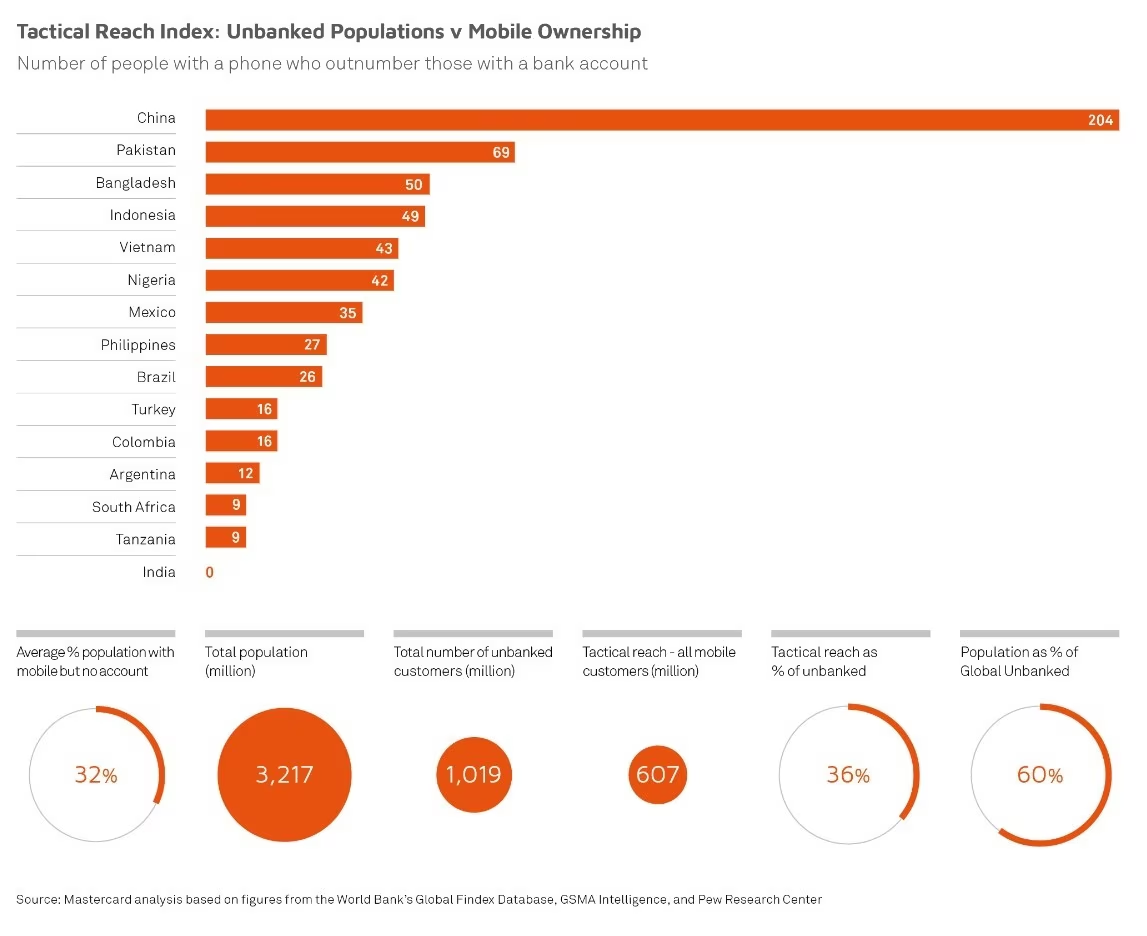

One of the strongest reasons Pakistan eyes Bitcoin and blockchain for financial infrastructure is the issue of financial inclusion. Millions of Pakistanis remain outside the formal banking system, particularly in rural areas. Traditional banking requires documentation, physical branches, and minimum balances that many citizens cannot easily access.

Blockchain-based financial services, including digital wallets, crypto payments, and decentralized finance (DeFi) platforms, can operate with minimal infrastructure. With smartphone penetration rising steadily, blockchain solutions could allow individuals to store value, send money, and access financial services without a conventional bank account. This aligns with national goals of expanding financial access and empowering underserved communities.

The Role of Bitcoin in Pakistan’s Financial Landscape

Bitcoin as a Store of Value and Payment Alternative

As Pakistan eyes Bitcoin and blockchain for financial infrastructure, Bitcoin’s role is often debated. While it is known for price volatility, Bitcoin is increasingly viewed as a store of value in economies experiencing currency depreciation. For some Pakistanis, Bitcoin represents a hedge against inflation and a way to preserve purchasing power.

In addition, Bitcoin can function as a cross-border payment tool, especially for freelancers and overseas Pakistanis sending remittances home. Traditional remittance channels can be slow and expensive, whereas Bitcoin transactions can be faster and more cost-effective. This potential has caught the attention of policymakers seeking to optimize foreign exchange inflows.

Regulatory Perception of Bitcoin in Pakistan

Historically, Pakistan’s stance on Bitcoin has been cautious, with concerns about money laundering, fraud, and capital flight. However, as Pakistan eyes Bitcoin and blockchain for financial infrastructure, the tone of regulatory discussions is gradually evolving. Authorities are increasingly focused on creating frameworks that balance innovation with risk management.

Rather than outright bans, there is growing recognition that regulated Bitcoin adoption could bring transparency to an otherwise informal crypto market. Clear guidelines could help monitor transactions, protect consumers, and integrate Bitcoin activity into the formal economy, thereby increasing tax compliance and oversight.

Blockchain Technology as the Backbone of Modern Finance

Transparency and Trust Through Distributed Ledgers

While Bitcoin often dominates headlines, blockchain technology itself may have an even broader impact. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, blockchain’s ability to create transparent, tamper-proof records is particularly appealing for public and private sector applications.

In financial systems where trust deficits exist, distributed ledger technology can ensure that transactions are verifiable and immutable. This can reduce corruption, improve auditability, and enhance confidence in financial institutions. From banking settlements to government disbursements, blockchain can introduce a new level of accountability.

Streamlining Banking and Payments Systems

Pakistan’s banking sector could benefit significantly from blockchain integration. Interbank settlements, trade finance, and identity verification are often slow and paper-intensive. Blockchain-based systems can automate these processes through smart contracts, reducing delays and operational costs.

As Pakistan eyes Bitcoin and blockchain for financial infrastructure, local banks and fintech companies are exploring pilot projects that leverage blockchain for faster payments and real-time reconciliation. These innovations could improve customer experience while strengthening the overall efficiency of the financial ecosystem.

Government and Regulatory Initiatives Supporting Blockchain

Policy Signals and Institutional Interest

Recent discussions among policymakers suggest that Pakistan is actively studying global best practices in digital finance. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, institutions such as the State Bank of Pakistan and other regulatory bodies are reportedly assessing how blockchain can be used within controlled environments.

This does not necessarily imply immediate legalization of all crypto activities, but rather a phased approach. Regulatory sandboxes, pilot programs, and public-private partnerships are being considered to test blockchain applications in areas like payments, land records, and supply chain finance.

Learning from Global Blockchain Adoption

Countries around the world are experimenting with central bank digital currencies (CBDCs), blockchain-based identity systems, and crypto regulations. Pakistan’s interest in blockchain is informed by these global trends. By observing successes and failures elsewhere, policymakers hope to avoid common pitfalls while accelerating innovation.

As Pakistan eyes Bitcoin and blockchain for financial infrastructure, aligning with international standards on anti-money laundering (AML) and know-your-customer (KYC) requirements will be crucial. This alignment can help Pakistan integrate into the global digital economy while maintaining financial stability.

Opportunities for Economic Growth and Innovation

Boosting the Fintech and Startup Ecosystem

Pakistan’s startup ecosystem has grown rapidly in recent years, particularly in fintech. Blockchain adoption could further energize this sector by enabling new business models and attracting foreign investment. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, entrepreneurs are exploring applications in payments, lending, insurance, and asset tokenization.

Blockchain-based startups can create high-skilled jobs, encourage innovation, and position Pakistan as a regional technology hub. With the right regulatory support, the country could leverage its young, tech-savvy population to drive blockchain innovation at scale.

Enhancing Remittances and Trade Finance

Remittances are a critical source of foreign exchange for Pakistan. Blockchain and Bitcoin-based solutions can make remittance flows faster, cheaper, and more transparent. This efficiency could encourage more overseas Pakistanis to use formal channels, increasing recorded inflows.

Similarly, trade finance, which often involves complex documentation and delays, can be streamlined through blockchain. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, improving trade efficiency could enhance competitiveness in global markets and support export growth.

Challenges and Risks in Adopting Bitcoin and Blockchain

Volatility, Security, and Consumer Protection

Despite the potential benefits, challenges remain. Bitcoin’s price volatility poses risks for consumers and businesses, especially those unfamiliar with digital assets. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, ensuring adequate consumer education and risk awareness is essential.

Security concerns, including hacking and fraud, also need to be addressed. Robust cybersecurity measures and clear legal recourse mechanisms will be critical to building trust in blockchain-based financial systems.

Regulatory Balance and Institutional Readiness

Implementing blockchain solutions requires not only technology but also institutional capacity. Regulators, banks, and law enforcement agencies must develop the expertise to oversee and manage digital finance effectively. As Pakistan eyes Bitcoin and blockchain for financial infrastructure, striking the right balance between innovation and control will be a delicate task.

Overregulation could stifle innovation, while underregulation could expose the system to abuse. A flexible, adaptive regulatory framework will be key to navigating this evolving landscape.

The Future Outlook: A Gradual but Strategic Shift

The fact that Pakistan eyes Bitcoin and blockchain for financial infrastructure signals a recognition that digital transformation is no longer optional. While widespread adoption may take time, incremental steps can lay the foundation for a more inclusive and efficient financial system.

By prioritizing blockchain applications with clear public value, such as payments, remittances, and transparency initiatives, Pakistan can build confidence and experience. Over time, this could pave the way for broader acceptance of Bitcoin and other digital assets within a regulated framework.

Conclusion

As Pakistan eyes Bitcoin and blockchain for financial infrastructure, the country stands at a crossroads between traditional finance and digital innovation. Bitcoin offers new possibilities for value storage and cross-border payments, while blockchain technology promises transparency, efficiency, and inclusion. Together, they present an opportunity to address long-standing financial challenges and align Pakistan with global economic trends.

The journey will not be without obstacles, but with thoughtful regulation, public awareness, and strategic investment, blockchain and Bitcoin could become integral components of Pakistan’s financial future. The coming years will determine how effectively the country harnesses these technologies to drive sustainable growth and financial empowerment.

Frequently Asked Questions

Q.Why does Pakistan eye Bitcoin and blockchain for financial infrastructure?

Pakistan is exploring Bitcoin and blockchain to improve financial inclusion, reduce transaction costs, enhance transparency, and modernize its financial systems in line with global digital trends.

Q.Is Bitcoin legal in Pakistan?

Bitcoin operates in a regulatory gray area in Pakistan. While not officially recognized as legal tender, authorities are increasingly discussing frameworks to regulate and monitor its use rather than banning it outright.

Q.How can blockchain help Pakistan’s banking sector?

Blockchain can streamline payments, improve interbank settlements, enhance transparency, and reduce operational costs through automation and smart contracts.

Q.What are the risks of adopting Bitcoin and blockchain in Pakistan?

Key risks include price volatility, cybersecurity threats, regulatory uncertainty, and the need for consumer education to prevent fraud and misuse.

Q.Will blockchain improve financial inclusion in Pakistan?

Yes, blockchain-based solutions can provide access to financial services for unbanked populations by enabling digital wallets and low-cost transactions without traditional banking infrastructure.