The Core Principles of Rich Dad Poor Dad

In Rich Dad Poor Dad, Robert Kiyosaki promotes financial education, asset investing, and changing one’s perspective from working for money to making money work for one. The book’s main lessons are understanding money and taking charge of one’s finances. Instead of relying on job income, Kiyosaki advises investing in assets that increase over time to achieve financial freedom.

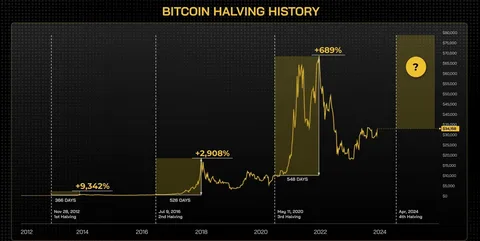

Many believe Bitcoin could yield high returns in the future. Kiyosaki advocates investing in “the new rich,” which includes real estate, stocks, and now cryptocurrencies. Some say Bitcoin’s unpredictable but high-potential growth aligns with Kiyosaki’s concept of investing in assets with significant returns.

Why Bitcoin?

Bitcoin, the first decentralized cryptocurrency, was launched in 2009 as a peer-to-peer digital currency free from government control. Over the years, Bitcoin has grown in popularity, becoming a store of value for many investors. The concept of saving in Bitcoin aligns well with Kiyosaki’s idea of taking control of one’s finances and finding alternative ways to build wealth. As a digital asset, Bitcoin offers several advantages over traditional fiat currencies. Its decentralized nature means it is not subject to inflationary pressures or government intervention, making it an attractive option for individuals looking to protect their savings from devaluation.

Additionally, Bitcoin’s limited supply of 21 million coins ensures scarcity, a key factor that could drive up its value over time. As more people worldwide look to hedge against inflation and economic instability, Bitcoin has emerged as a valuable asset to hold and save.

Saving in Bitcoin: A Long-Term Strategy

Kiyosaki highlights that conserving money in low-interest bank accounts is ineffective for wealth creation. He recommends saving in appreciating assets . Saving in Bitcoin helps fight inflation. Bitcoin’s capped quantity and deflationary characteristics make it a good long-term investment. Kiyosaki has repeatedly compared Bitcoin to gold, a haven asset, as an inflation hedge. Bitcoin may become increasingly more important in the global financial scene if institutional and retail investors accept it. Bitcoin may be great for Kiyosaki followers who invest in appreciating assets.

Read More: $300 SOL is recovered by a sharp sell-off Is it feasible?

Conclusion

Using Bitcoin to develop money fits Rich Dad Poor Dad’s philosophy. By managing their finances and investing in assets that they can appreciate, people can develop wealth outside of typical saving methods. While Bitcoin has hazards, it represents an intriguing new frontier in personal finance that might deliver huge rewards for those who embrace it.

Financial education is the takeaway from Rich Dad Poor Dad and Bitcoin adoption. Knowing the basics of Bitcoin and other assets helps people make smart financial decisions. Although Bitcoin may never become a widespread savings technique, its potential to produce wealth is apparent.

[sp_easyaccordion id=”2511″]