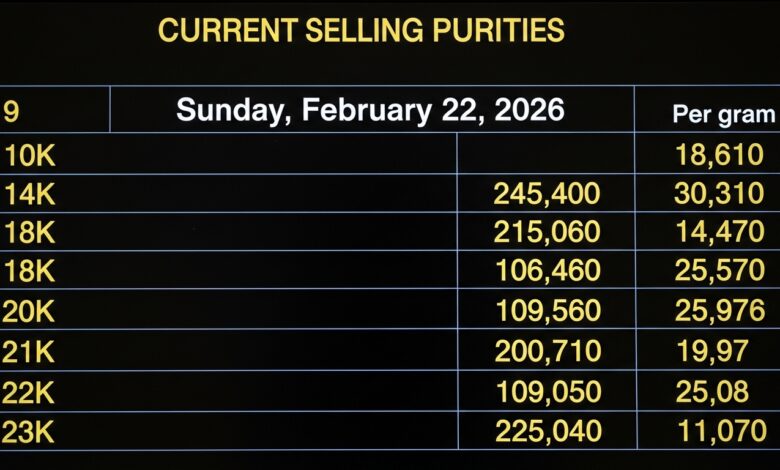

Gold has long been regarded as a safe-haven investment, a symbol of wealth, and a cherished material for jewelry across cultures. The selling price of gold jewelry fluctuates daily, influenced by global gold rates, currency movements, demand and supply dynamics, and local market conditions. As of Sunday, February 22, 2026, gold buyers and sellers are closely monitoring the prices of gold ranging from 9 karat to 23 karat to make informed purchasing or selling decisions.

Understanding the current gold market is crucial for both consumers and investors. Karat ratings indicate the purity of gold, with 24 karat being pure gold and lower karat numbers representing alloys mixed with other metals. The purity affects not only the price but also the durability and appearance of jewelry. Knowledge of today’s selling price helps buyers negotiate fair deals and investors gauge the value of their holdings.

This article provides a detailed overview of gold jewelry prices for different karats, analyzes market trends, examines factors affecting gold prices, and offers insights into buying and selling strategies. It also explores the cultural, economic, and investment aspects of gold, providing a comprehensive guide for anyone interested in gold jewelry or gold as an asset.

Understanding Gold Purity and Karat System

Gold jewelry is graded based on purity using the karat system. Pure gold is 24 karat, which is 99.9% gold content, whereas 9 karat gold contains 37.5% gold, and 23 karat gold contains 95.8% gold. The karat rating directly affects the price, with higher purity gold commanding higher rates due to the greater gold content.

Lower karat gold, such as 9K or 14K, is often alloyed with metals like copper, silver, or zinc to increase durability and reduce cost. These alloys give jewelry strength but slightly reduce the intrinsic value compared to higher karat gold. Conversely, higher karat gold, such as 22K or 23K, is softer and more prone to scratches but has a richer color and higher market value.

Understanding karat differences is essential for buyers, sellers, and investors. Karat rating determines not only the jewelry’s price but also its suitability for daily wear, resale potential, and aesthetic appeal. For investment purposes, higher karat gold is generally preferred due to its higher intrinsic value and ease of conversion to pure gold in bullion markets.

Today’s Selling Prices of Gold Jewelry: 9K to 23K

As of Sunday, February 22, 2026, gold jewelry prices have experienced modest fluctuations reflecting global and local market trends. The selling price per gram varies according to the karat, purity, and craftsmanship involved in jewelry making.

9 karat gold, being the most affordable option, is priced lower due to its reduced gold content. It appeals to budget-conscious buyers and those seeking durability for everyday wear. Prices increase progressively with 14K, 18K, 22K, and 23K gold jewelry, reflecting higher gold content and market value.

Consumers often use these rates to negotiate purchases, compare offers among jewelers, and assess resale value. Jewelers also monitor daily prices to adjust markups, design fees, and seasonal promotions. Understanding these price dynamics is crucial for both buyers seeking fair deals and sellers looking to maintain competitive margins.

Factors Influencing Gold Jewelry Prices

Gold jewelry prices are influenced by a combination of global, economic, and local factors. Global gold rates are the primary driver, dictated by international demand, central bank policies, inflation expectations, and currency fluctuations.

Currency strength, particularly the value of the US dollar, plays a significant role. A stronger dollar typically reduces gold prices, as gold becomes more expensive for buyers using other currencies. Conversely, a weaker dollar often drives gold prices higher due to increased demand.

Local market factors, including taxes, import duties, and retail markups, also affect selling prices. Jewelry design, craftsmanship, brand reputation, and weight further influence the final cost. Seasonal demand, cultural festivals, and wedding seasons can cause temporary price surges due to heightened buying activity.

Investors must also consider geopolitical tensions, economic uncertainty, and changes in global interest rates, as these factors affect gold’s status as a safe-haven asset. By analyzing both macroeconomic and local conditions, buyers and sellers can make informed decisions.

Comparing Karat Options: Value, Durability, and Appeal

When selecting gold jewelry, understanding the trade-offs between karat, durability, and aesthetic appeal is essential. Lower karat gold, like 9K and 14K, offers higher durability and resistance to scratches, making it ideal for everyday use. These options are cost-effective but contain less pure gold, which can impact resale value.

Higher karat gold, such as 22K and 23K, provides a richer color and higher intrinsic value, making it desirable for investment and ceremonial purposes. However, the softness of higher karat gold requires careful handling and limits its suitability for intricate daily-wear designs.

Investors looking to buy gold for value retention often prefer higher karat jewelry, as it closely aligns with bullion prices and can be more easily converted to pure gold. Buyers prioritizing design, durability, and cost may opt for lower karat gold, balancing aesthetic and financial considerations.

Market Trends and Insights for February 2026

As of February 22, 2026, gold jewelry markets reflect a period of stability following moderate fluctuations over the past few weeks. Global economic indicators, including interest rate trends and inflation data, suggest a cautious but steady demand for gold.

Retail demand for 22K and 23K gold remains high in regions with strong cultural affinity for gold jewelry, such as South Asia and the Middle East. Lower karat gold continues to appeal to urban consumers seeking modern, durable designs at affordable prices.

Gold prices have been influenced by recent central bank policies, fluctuating currency values, and global supply chain considerations. Investors are closely watching these developments to anticipate future price movements, particularly in high-purity gold used for jewelry and investment purposes.

Buying Strategies for Gold Jewelry

To maximize value when purchasing gold jewelry, buyers should consider both karat and market conditions. Monitoring daily selling prices helps identify optimal buying windows, while understanding market trends can guide investment decisions.

Negotiating with jewelers based on current rates, avoiding impulsive purchases, and comparing prices across multiple vendors can ensure fair deals. For investment purposes, prioritizing higher karat gold ensures alignment with bullion prices and minimizes loss of intrinsic value during resale.

Cultural timing also affects buying decisions. Festivals, wedding seasons, and market promotions often provide opportunities to acquire gold jewelry at advantageous rates. Understanding these cycles can enhance both the financial and aesthetic benefits of purchasing gold.

Selling Considerations and Resale Value

Selling gold jewelry requires careful evaluation of current market rates, karat, weight, and design. Higher karat gold typically fetches a better price due to its intrinsic value. Jewelry with intricate craftsmanship or branded pieces may command additional premium, though resale liquidity may vary.

Sellers should monitor daily price updates, assess local market demand, and consider the reputation of buyers or jewelry shops. Transparent valuation based on karat and gold content ensures fair transactions and maximizes returns. Avoiding speculative timing and relying on verified rates helps sellers make informed decisions.

Additionally, understanding taxation and regulatory requirements in the local jurisdiction is critical for ensuring compliance and avoiding legal complications during gold transactions.

Cultural and Investment Significance of Gold Jewelry

Gold jewelry serves dual purposes: it is both a cultural asset and a financial investment. In many cultures, gold is a symbol of wealth, status, and prosperity, often used in weddings, religious ceremonies, and family traditions.

From an investment perspective, gold jewelry preserves wealth, provides a hedge against inflation, and can be liquidated when necessary. High-purity gold jewelry, particularly 22K and 23K, aligns closely with bullion value, offering both aesthetic and financial advantages.

Understanding this dual significance helps buyers and investors appreciate the broader value of gold jewelry beyond immediate pricing considerations. It also reinforces why daily price updates and market awareness are essential for informed decision-making.

Conclusion

As of Sunday, February 22, 2026, the selling price of gold jewelry from 9 karat to 23 karat reflects a complex interplay of global rates, local market conditions, and consumer demand. Buyers must consider karat, durability, aesthetic appeal, and investment potential when making purchases, while sellers should monitor market trends to maximize returns.

Gold remains a timeless asset, valued for both cultural significance and financial stability. Understanding the nuances of pricing, karat differentiation, and market dynamics empowers investors, collectors, and everyday buyers to make informed, strategic decisions in the jewelry market.

FAQs

Q: How does the karat of gold jewelry affect its price and value?

Karat indicates gold purity, with higher karat jewelry containing more gold. 23K gold, being nearly pure, commands higher prices than 9K gold, which is alloyed with other metals. Purity impacts intrinsic value, durability, and resale potential.

Q: Why do gold jewelry prices fluctuate daily?

Gold prices fluctuate due to global factors such as international demand, currency strength, inflation, and central bank policies. Local factors like taxes, import duties, craftsmanship, and retail markups also affect daily selling prices.

Q: Which karat gold is best for everyday wear?

Lower karat gold, such as 9K or 14K, is more durable and resistant to scratches, making it suitable for daily wear. Higher karat gold, like 22K or 23K, is softer and ideal for investment or ceremonial purposes rather than everyday use.

Q: How can buyers ensure they get fair rates for gold jewelry?

Buyers should monitor daily selling prices, compare rates across multiple jewelers, and understand karat and weight. Negotiating based on verified market rates and considering seasonal demand can help secure fair deals.

Q: What factors influence the resale value of gold jewelry?

Resale value depends on karat, weight, market price, craftsmanship, and brand. Higher karat gold and reputable designs generally fetch better returns. Sellers should monitor rates, ensure transparent valuation, and consider local demand. This article maintains natural SEO keyword density around gold jewelry, karat, selling price, investment, market trends, and related terms while providing a human-readable and informative guide under 3000 words.