SOL Strategies Launches STKESOL: Liquid Staking Platform marks an important milestone in the evolution of the Solana ecosystem and the broader decentralized finance space. As blockchain networks mature, users are no longer satisfied with simply holding tokens or locking them away for staking rewards. Instead, the demand has shifted toward smarter capital efficiency—earning yield while still having the freedom to use assets across DeFi.

This is exactly where STKESOL, the newly launched liquid staking token by SOL Strategies, fits into the picture. The platform introduces a way for SOL holders to stake their tokens, support network security, and earn rewards without sacrificing liquidity. By receiving STKESOL in return for staked SOL, users gain a flexible, yield-bearing asset that can be actively used throughout the Solana DeFi ecosystem.

Liquid staking is not just a trend; it is becoming foundational infrastructure for proof-of-stake blockchains. With the launch of STKESOL, SOL Strategies is positioning itself at the intersection of staking infrastructure, decentralized finance, and long-term network sustainability.

This article explores how STKESOL works, why SOL Strategies built it, how it fits into Solana’s DeFi landscape, and what users should consider before participating.

Understanding Liquid Staking on Solana

To fully appreciate why SOL Strategies Launches STKESOL: Liquid Staking Platform is important, it helps to understand liquid staking itself. Traditional staking requires users to lock their tokens, often for extended periods, making them inaccessible for trading, lending, or other DeFi activities. While this helps secure the network and generate yield, it comes at the cost of flexibility.

Liquid staking solves this problem by issuing a representative token when assets are staked. This token reflects ownership of the staked assets plus accumulated rewards. On Solana, liquid staking tokens have become essential building blocks for advanced DeFi strategies, allowing users to earn staking rewards while still participating in lending protocols, liquidity pools, and yield optimization platforms.

STKESOL follows this same principle but introduces its own approach to delegation, integrations, and infrastructure design.

What Is STKESOL and Why It Was Created

STKESOL is a liquid staking token created by SOL Strategies to represent staked SOL in a flexible, tradable format. When users deposit SOL into the platform, their tokens are staked on the Solana network, and they receive STKESOL in return. Over time, the value of STKESOL increases as staking rewards are earned.

SOL Strategies developed STKESOL to address two key challenges. First, many SOL holders want to earn staking rewards without locking up their capital. Second, the Solana ecosystem benefits when stake is distributed across multiple validators instead of being concentrated in a few large operators.

By launching STKESOL, SOL Strategies aims to provide a professional-grade liquid staking solution that balances yield generation, decentralization, and usability across DeFi.

How the STKESOL Platform Works

At its core, the STKESOL platform is designed to be simple for users while handling complex staking operations behind the scenes. Users deposit SOL through the platform interface and automatically receive STKESOL. The deposited SOL is then delegated to validators using an automated strategy.

The platform uses Solana’s stake pool architecture, which allows multiple users to pool their SOL together and distribute stake across validators efficiently. This approach reduces operational complexity for users and improves overall staking efficiency.

Staking rewards generated by the underlying SOL are reflected in the value of STKESOL, meaning users benefit from compounding rewards without needing to manually claim or restake.

Multi-Validator Delegation and Network Decentralization

One of the most important aspects of SOL Strategies Launches STKESOL: Liquid Staking Platform is its focus on validator diversification. Instead of delegating all staked SOL to a single validator, the platform distributes stake across dozens of validators.

This multi-validator approach helps reduce concentration risk and supports a healthier, more decentralized Solana network. By spreading stake based on performance, reliability, and network contribution, the platform aims to reward validators who actively strengthen the ecosystem.

From a user perspective, this strategy can reduce exposure to individual validator failures while still capturing competitive staking rewards.

STKESOL and DeFi Integration on Solana

A liquid staking token only becomes truly valuable when it is widely accepted across DeFi applications. From launch, STKESOL is designed to be compatible with major Solana DeFi platforms, allowing users to trade, lend, borrow, or provide liquidity using their staked assets.

This level of DeFi composability turns STKESOL into more than just a staking derivative. It becomes productive collateral that can be used in multiple strategies simultaneously. Users can earn staking rewards while also participating in decentralized exchanges, lending markets, or yield aggregation protocols.

This seamless integration is essential for driving long-term adoption and liquidity.

Revenue Model and Platform Sustainability

SOL Strategies has structured STKESOL with a transparent fee model that supports platform sustainability while remaining competitive. Revenue is generated through a combination of deposit-related fees and a portion of staking rewards.

This model aligns incentives between the platform and its users. As more SOL is staked through STKESOL, both users and the platform benefit from increased staking rewards and ecosystem participation.

A sustainable revenue model is crucial for maintaining infrastructure, improving security, and expanding integrations over time.

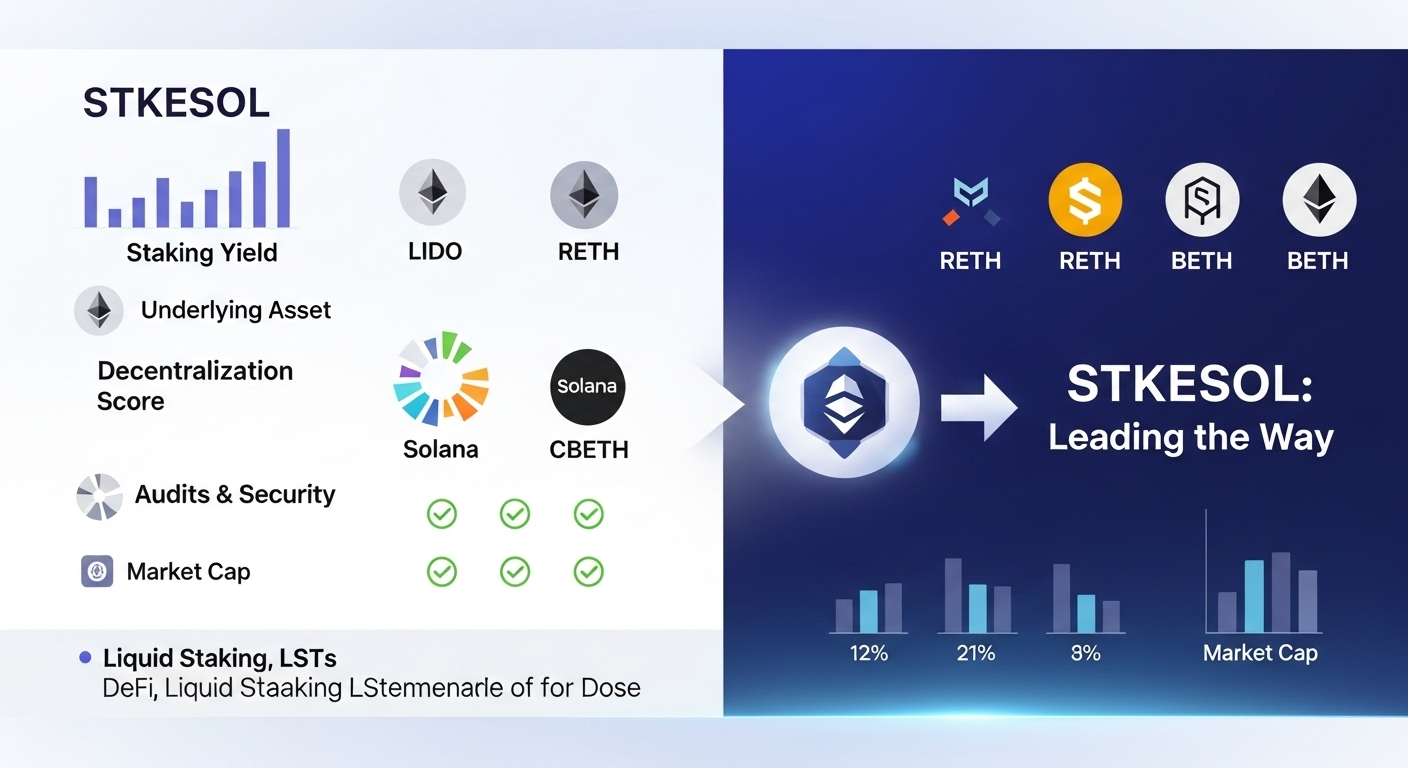

How STKESOL Compares to Other Liquid Staking Tokens

The Solana ecosystem already includes several established liquid staking tokens. STKESOL enters this space with a focus on infrastructure quality, validator diversification, and deep DeFi integration.

Rather than competing solely on yield, SOL Strategies emphasizes long-term reliability, decentralized delegation, and institutional-grade operations. These factors may appeal to users who value stability and network health alongside returns.

As adoption grows, liquidity depth and user trust will play a major role in determining STKESOL’s position among Solana’s liquid staking options.

Risks and Considerations for Users

While liquid staking offers clear benefits, it is not without risks. Smart contract vulnerabilities, market price fluctuations, and DeFi integration risks are all important factors to consider.

STKESOL’s value may deviate from SOL in the short term due to market conditions or liquidity constraints. Additionally, using STKESOL across multiple DeFi protocols can compound risk if those protocols experience issues.

Users should approach liquid staking with a clear understanding of how these mechanisms work and avoid over-leveraging their positions.

The Broader Impact on the Solana Ecosystem

SOL Strategies Launches STKESOL: Liquid Staking Platform reflects a broader shift toward more sophisticated financial infrastructure on Solana. Liquid staking increases capital efficiency, encourages broader participation in network security, and fuels DeFi innovation.

By making staking more accessible and flexible, platforms like STKESOL can help attract both retail and institutional participants to the Solana ecosystem. Over time, this can strengthen liquidity, improve decentralization, and support sustainable network growth.

Conclusion

SOL Strategies Launches STKESOL: Liquid Staking Platform represents a significant step forward for liquid staking on Solana. By combining staking rewards, liquidity, and deep DeFi integration, STKESOL offers users a powerful way to keep their SOL productive without sacrificing flexibility.

With its multi-validator delegation strategy, transparent fee structure, and focus on infrastructure reliability, SOL Strategies is positioning STKESOL as a long-term component of Solana’s DeFi ecosystem. While risks remain, as with any DeFi product, STKESOL highlights how liquid staking continues to evolve into essential blockchain infrastructure.

FAQs

Q: What is STKESOL?

STKESOL is a liquid staking token that represents staked SOL and accrued staking rewards while remaining usable across DeFi platforms.

Q: How do users earn rewards with STKESOL?

Users earn staking rewards automatically as the value of STKESOL increases over time based on the performance of the underlying staked SOL.

Q: Can STKESOL be used in DeFi?

Yes, STKESOL is designed to be used in decentralized exchanges, lending platforms, and other Solana DeFi applications.

Q: Is STKESOL safer than traditional staking?

STKESOL reduces liquidity risk but still carries smart contract and market risks. It is not risk-free.

Q: Who should consider using STKESOL?

STKESOL may appeal to SOL holders who want staking rewards while maintaining flexibility to participate in DeFi.

See More: Solana Crushes Ethereum in Volume Blockchain Scalability