Bitcoin stumbles, the entire crypto market seems to hold its breath. A red BTC candle can trigger a wave of fear, forced liquidations, and a sudden shift in trader psychology. Yet historically, periods where BTC falls have also created some of the best windows to identify top altcoin picks—especially when capital rotates into coins with strong narratives, resilient communities, or clear catalysts. In other words, BTC weakness doesn’t always mean the end of opportunity; sometimes it’s the beginning of a new phase where selective altcoins outperform.

This is also the moment when XRP builds quietly in the background. While many traders chase short-term moves, XRP often draws attention through its persistent liquidity, exchange availability, and the broader conversation around payments and cross-border settlement. Whether you’re bullish or skeptical, the reality is that when the market looks for large-cap “safer” alternatives during turbulence, XRP tends to re-enter the spotlight.

Then there’s the other side of the market: the high-risk, high-reward crowd that starts apeing early into emerging projects. This behavior isn’t random. In uncertain conditions, traders often seek asymmetric bets—tokens that can deliver outsized returns if momentum shifts, liquidity returns, or a new narrative catches fire. The key is learning how to approach this phase intelligently, with disciplined selection rather than blind hype.

Understanding the setup: What happens when BTC falls

When BTC falls, liquidity doesn’t disappear—it relocates. Some traders move into stablecoins, some rotate into defensive large-cap altcoins, and others aggressively hunt volatility. This rotation pattern shapes which top altcoin picks are most likely to hold up or bounce first.

One major driver is market structure. Bitcoin often acts as the “risk barometer” of crypto. When BTC drops rapidly, it can drag down altcoins due to correlated selling. But once the initial shock passes, altcoins with strong on-chain activity, sticky communities, and clear catalysts tend to rebound faster. That’s why the best top altcoin picks during BTC weakness are usually not random microcaps—they’re coins with a reason to be owned beyond “it might pump.”

Another factor is narrative. Crypto is not purely fundamentals; it’s a story-driven market. When BTC falls, traders look for the next storyline that feels independent of Bitcoin’s immediate price action. This is where themes like payments tokens, DeFi blue chips, Layer-2 scaling, and AI crypto can take turns absorbing attention. Understanding which narrative is rising helps you focus on top altcoin picks that match the moment.

Why XRP builds during market turbulence

Even among traders who don’t hold it long-term, XRP has a unique market presence. It often functions like a “liquidity monument” in crypto: widely listed, heavily traded, and familiar to both new and veteran participants. When BTC falls and traders feel uncertain, they often gravitate toward assets with deep liquidity and recognizable branding. That’s one reason XRP builds can coincide with broader market stress.

XRP’s liquidity advantage and trader psychology

Liquidity matters most when volatility spikes. Deep liquidity can reduce slippage and make it easier for large traders to enter and exit positions. During selloffs, coins with thinner order books can drop harder because there aren’t enough bids. XRP, as a long-standing large-cap token, often retains comparatively healthy trading depth. This can support the idea that XRP builds in sideways phases while riskier assets bleed out.

Trader psychology also plays a role. When the market is shaky, people want a “known quantity.” XRP’s long presence creates familiarity, and familiarity often becomes a form of comfort trade. That doesn’t guarantee upside, but it helps explain why XRP can stay relevant when BTC falls.

What to watch if XRP builds continues

If you’re evaluating top altcoin picks that include XRP, it’s helpful to track momentum signals rather than just price. Watch how XRP behaves on down days: does it fall less than peers? Does volume remain elevated? Does it recover quickly after market-wide dips? These are subtle signs that XRP builds is not just a narrative but a tradable structure.

It’s also smart to compare XRP against BTC and ETH pairs, not just USD. Relative strength is often the earliest sign that a large-cap altcoin is positioning for rotation flows. If XRP strengthens relative to BTC while BTC falls, it can hint that capital is quietly rotating.

Top altcoin picks when BTC falls: A practical selection framework

Rather than naming dozens of tokens, a better approach is to understand why certain coins become top altcoin picks during BTC weakness. A framework keeps you from chasing every pump and helps you make consistent decisions.

Choose altcoins with clear catalysts and durable demand

When BTC falls, speculative demand dries up first. Coins that still have durable demand—whether from utility, ecosystem incentives, or strong community participation—tend to hold up better. Look for projects with upcoming upgrades, major ecosystem launches, or sustained usage. In SEO terms, these are the “high-intent” assets: tokens people want to buy for a reason, not just to flip.

Catalysts can include protocol upgrades, ecosystem expansions, new integrations, or a broader narrative wave. If you’re aiming for top altcoin picks, you want coins that can attract attention even when the market mood is cautious.

Prefer assets with strong relative strength and liquid markets

When BTC falls, correlations rise. That’s why relative strength becomes a powerful filter. Coins that refuse to make new lows while BTC drops often become first movers on the rebound. Liquidity also remains crucial—especially if you plan to scale in and out without getting wrecked by spreads.

If you’re watching XRP builds, you’re already thinking in this direction: liquidity and staying power. Apply the same logic to other large-cap or mid-cap candidates.

Avoid overhyped tokens with fragile liquidity

This is where many traders lose money while apeing early. A small-cap token can look “cheap” after a crash, but if there’s no organic demand, it can keep bleeding. Thin liquidity means the chart can trap you. For top altcoin picks, it’s usually better to start with assets that can survive volatility, then reserve smaller positions for higher-risk plays.

Large-cap resilience plays for when BTC falls

When BTC falls, large-cap altcoins often behave like the market’s “second line of defense.” They may drop, but they tend to recover faster because institutions, whales, and large traders can deploy size there.

Ethereum as the ecosystem gravity center

ETH remains central to DeFi, NFT infrastructure, and much of the on-chain economy. Even in bearish phases, Ethereum’s developer activity and network effects keep it relevant. That doesn’t mean ETH is immune when BTC falls, but it often becomes a core top altcoin pick for traders seeking long-term exposure while the market shakes out weaker tokens.

Ethereum also benefits from a broad set of LSI keywords in the market: smart contracts, staking, DeFi liquidity, and Layer-2 scaling. Those narratives can resurface quickly once selling pressure cools.

XRP as a liquidity-heavy large-cap rotation candidate

If XRP builds continues, it can act as a rotation magnet when traders shift away from purely speculative corners. XRP’s consistent exchange presence and longstanding role in market discussions can support flows during uncertain periods. For those constructing a large-cap basket of top altcoin picks, XRP is often included due to liquidity and historical trading behavior—especially during phases where BTC falls and the market seeks stability within crypto.

Solana and other high-throughput networks

High-throughput chains can capture attention when users demand cheaper fees and faster transactions. Solana, for example, has historically experienced sharp drawdowns and sharp recoveries. In periods where BTC falls, traders often watch whether SOL holds key levels, because it can be an early indicator of risk appetite returning to altcoins.

The point isn’t that one chain is “best,” but that network activity and ecosystem momentum can help determine top altcoin picks in a fast-moving environment.

DeFi leaders that can rebound strongly after BTC falls

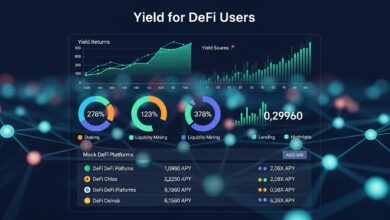

DeFi tokens often get punished during market drawdowns because leverage unwinds. But once the dust settles, DeFi can rebound with surprising force—especially if trading activity returns, yields become attractive, or stablecoin flows increase.

Why DeFi can outperform after capitulation

When BTC falls sharply, speculative positions are flushed. After that, survivors often look for yield, liquidity opportunities, and structured strategies. DeFi protocols that are deeply integrated into on-chain finance can benefit. This is why many traders keep DeFi blue chips on their list of top altcoin picks—not as blind buys, but as rebound candidates once conditions stabilize.

DeFi also has built-in narrative fuel: DEX volume, total value locked, and protocol revenue. When these metrics improve, attention follows.

The role of risk management in DeFi exposure

If you’re building a portfolio of top altcoin picks, DeFi allocation should match your risk tolerance. DeFi can rip upward, but it can also get hit harder when BTC falls again. The best approach is thoughtful sizing and focusing on projects with real usage rather than purely speculative tokenomics.

Layer-2 and scaling narratives as BTC falls

Layer-2 solutions often thrive when the market focuses on practicality and efficiency. Even if BTC falls, the longer-term story of scaling doesn’t disappear. In fact, users often become more fee-sensitive during downturns, making lower-cost transaction layers more appealing.

Layer-2 adoption and the return of on-chain activity

If on-chain users keep transacting during a downturn, it signals resilience. Layer-2 ecosystems can capture that activity, and tokens associated with scaling can become top altcoin picks when capital starts rotating back into growth themes. The key is to look for evidence of actual usage rather than marketing noise.

Layer-2 narratives also connect with bold related phrases like faster settlements, lower fees, and scalable infrastructure, which can remain relevant regardless of BTC’s short-term direction.

How to hunt emerging altcoin opportunities without getting wrecked

The phrase apeing early usually implies rushing into a new token before the crowd arrives. Done recklessly, it’s a fast track to drawdowns. Done with a framework, it can be a calculated way to capture upside.

What “apeing early” really means in smart money terms

Smart “early” positioning isn’t random. It’s about identifying early liquidity, early community traction, and early narrative alignment. If BTC falls and the market is fearful, early opportunities often emerge because prices are discounted and attention is low. The key is to differentiate between a temporary discount and a project with no demand.

A disciplined approach to apeing early often includes evaluating whether a token has consistent volume, growing participation, and a clear roadmap. It’s less about “new” and more about “under-owned.”

Signs a token is worth early attention

A strong early candidate tends to show persistent social momentum, rising on-chain activity, and increasing exchange or DEX liquidity. When you see these factors while BTC falls, it can signal that the project is building despite the broader market. In many cases, that’s how tomorrow’s top altcoin picks are born.

Why timing matters more than hype

Many traders fail because they confuse excitement with timing. If you buy after a huge spike, you’re not apeing early—you’re apeing late. True early entries often feel boring, uncomfortable, or unnoticed. That’s why a plan matters: decide entry zones, define invalidation points, and avoid oversized bets.

How to combine top altcoin picks with a BTC-falls strategy

When BTC falls, the best strategy is rarely “all in” or “all out.” It’s about building exposure in layers while staying flexible.

A balanced approach often includes a core allocation to resilient large caps, a secondary allocation to narrative-driven rebound candidates, and a small “high-upside” sleeve for apeing early plays. If XRP builds is part of your thesis, it can sit in the large-cap sleeve while you explore other opportunities.

The common thread is selectivity. Top altcoin picks are not “everything that looks cheap.” They’re assets that can attract sustained demand, survive volatility, and benefit from narrative rotation once the market regains confidence.

Conclusion

When BTC falls, fear dominates headlines—but opportunity often quietly takes shape. The most effective way to identify top altcoin picks is to focus on liquidity, catalysts, and relative strength rather than hype. Large caps can provide stability, DeFi and scaling narratives can rebound sharply when conditions improve, and apeing early can be profitable if approached with discipline instead of impulse. Meanwhile, if XRP builds continues through uncertainty, it may signal rotation interest in liquid, familiar assets.

In a market as emotional as crypto, the edge isn’t predicting every move—it’s having a repeatable process. By combining resilience plays with carefully chosen growth narratives, you can stay positioned for recovery without taking unnecessary risk when volatility returns.

FAQs

Q: What are top altcoin picks when BTC falls?

Top altcoin picks when BTC falls are usually assets with strong liquidity, clear catalysts, and relative strength versus other coins. They tend to recover faster after market-wide selloffs.

Q: Why does XRP build during uncertain markets?

XRP builds often because it has deep liquidity, widespread exchange listings, and strong market familiarity. During turbulence, traders frequently prefer liquid assets they can enter and exit easily.

Q: Is apeing early always risky?

Apeing early is inherently risky because early-stage tokens can be volatile and illiquid. It becomes more manageable when you size positions small, choose projects with real traction, and set clear invalidation levels.

Q: Should I buy altcoins while BTC falls?

Buying while BTC falls can work, but it’s usually smarter to scale in gradually and prioritize top altcoin picks with resilient demand. Sudden BTC drops can keep dragging altcoins down before a rebound starts.

Q: How can I avoid over-optimization while targeting SEO keywords?

Use the main keyword naturally, include LSI keywords and bold related phrases sparingly, and focus on clear, helpful explanations. Strong readability and genuine utility typically rank better than repetitive keyword stuffing.