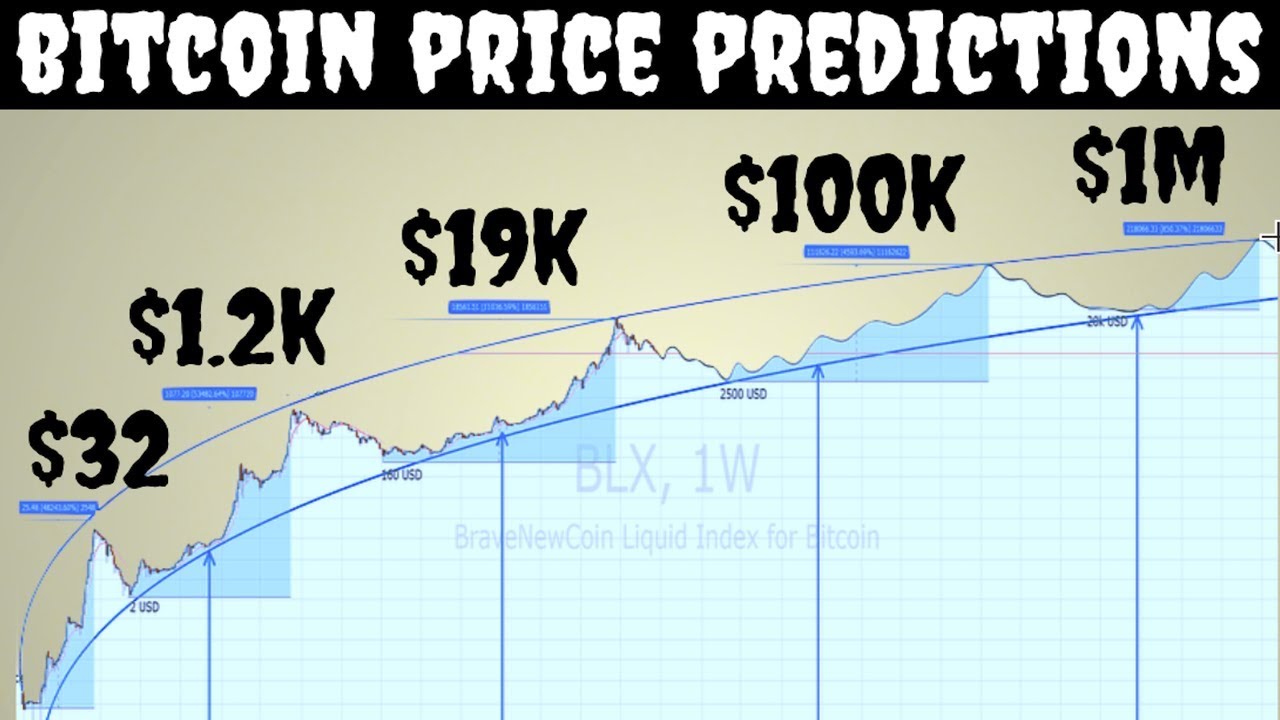

Bitcoin has a habit of turning every twist in price action into a sweeping story about destiny. When the market surges, it’s “inevitable adoption.” When it corrects, it’s “the end of crypto.” And whenever Bitcoin behaves even slightly differently than traders expect, a familiar headline returns: the Bitcoin four-year cycle is dead.

That idea—often packaged as the “death of the pattern”—sounds persuasive in a world where Bitcoin now trades alongside macro narratives, institutional flows, and exchange-traded products. Compared with earlier eras of thin liquidity and retail-dominated mania, today’s Bitcoin market looks more mature, more integrated, and more complex. So it’s understandable that some people question whether the Bitcoin four-year cycle still holds.

Onchain analyst Willy Woo has consistently pushed back on these cycle obituaries. His stance isn’t that Bitcoin repeats the same movie scene-for-scene. It’s that the structural forces that created the Bitcoin four-year cycle—especially the Bitcoin halving and the demand-and-liquidity engine around it—haven’t vanished. Instead, the market is evolving, and the cycle is “growing up.” The rhythm may be less dramatic, the timing may shift, and the drivers may be more intertwined with macro conditions, but the underlying cadence remains visible when you zoom out and follow the data.

In this article, we’ll explore why Willy Woo defends the Bitcoin four-year cycle, what the “death of the pattern” narrative gets wrong, and how you can think about cycles without falling into rigid predictions. Along the way, we’ll weave in bold LSI keywords and related phrases—like on-chain data, market structure, long-term holders, capital inflows, and liquidity cycles—to paint a clearer picture of what’s actually happening beneath the price chart.

Understanding the Bitcoin Four-Year Cycle and Why It Exists

The Bitcoin four-year cycle emerged from something rare in financial markets: a transparent, scheduled supply change. Bitcoin’s monetary policy is encoded, and its issuance rate decreases over time. Roughly every four years, the Bitcoin halving reduces the block subsidy miners receive for securing the network. That means fewer new bitcoins are created each day after each halving event.

This matters because supply and demand sit at the center of price formation. If demand stays the same while new supply falls, the market can tighten. If demand rises while new supply falls, the tightening can become dramatic. Historically, this recurring reduction in new supply has coincided with multi-year cycles in price behavior, investor sentiment, and liquidity.

But it’s important to be precise: the Bitcoin four-year cycle is not a magic timer that forces price to pump. It’s a structural rhythm that influences incentives and flows. Bitcoin still needs demand to rise. It still needs capital to enter. And it still responds to broader economic conditions.

Willy Woo’s framework helps here because he looks beyond “halving date equals bull run” simplifications. He treats the Bitcoin four-year cycle as an interplay of issuance, investor behavior, and liquidity—not as a single event that flips a switch.

Who Is Willy Woo and Why His Onchain Perspective Matters

Willy Woo is best known for analyzing Bitcoin through on-chain data—metrics derived from the blockchain that can reveal patterns about coin movement, holder behavior, and broader network dynamics. Instead of focusing only on candlesticks and chart patterns, Woo often emphasizes the internal mechanics of the Bitcoin economy.

That approach matters because Bitcoin offers a level of transparency that traditional markets can’t match. While identities are not directly written on-chain, transaction flows, coin age, dormancy, and movement between wallet clusters can still help analysts infer broader behavior. This is why on-chain analytics has become a cornerstone of modern Bitcoin research.

Woo’s defenders value his ability to translate complex signals into market narratives that are not purely emotion-driven. When he defends the Bitcoin four-year cycle, he’s not merely arguing from tradition. He’s arguing from a model of market structure—one that connects investor cohorts, capital rotation, and supply dynamics to the cycle’s familiar phases.

Why “Death of the Pattern” Narratives Keep Spreading

The “death of the pattern” story tends to appear in predictable moments: whenever Bitcoin doesn’t follow a neat historical timeline. If a post-halving year looks slower than expected, people declare the cycle broken. If price peaks earlier than expected, people declare the cycle “pulled forward” and therefore invalid. If price consolidates longer than traders can tolerate, people declare the market has “changed forever.”

A deeper reason is psychological. The Bitcoin four-year cycle became popular because it offered a sense of certainty in a volatile market. Many participants wanted a roadmap: buy here, sell there, repeat. When reality fails to match that roadmap, the mind searches for a new story to restore certainty—often by replacing “the cycle is predictable” with “the cycle is dead.”

Willy Woo’s rebuttal is essentially a call for nuance. He argues that cycles can persist even if they don’t conform to a simplified script. Bitcoin can still move through multi-year phases shaped by issuance and demand, even if new market participants and macro forces alter the surface-level choreography.

Willy Woo’s Core View: The Cycle Still Exists, It’s Just Maturing

At the heart of Woo’s defense is a maturity thesis. As Bitcoin becomes larger and more liquid, its behavior can change without losing its underlying rhythm. In earlier cycles, thin liquidity and retail mania produced explosive moves. As the market deepens, the amplitude can compress. Peaks may become less blow-off and more grind. Drawdowns may become less catastrophic—though still painful. And timelines can stretch or shift depending on liquidity and risk appetite.

Woo’s argument doesn’t require claiming Bitcoin will repeat exact percentage gains or identical timing windows. It requires a more realistic idea: the Bitcoin four-year cycle is a regime framework. It describes how Bitcoin tends to transition between phases based on supply issuance, investor psychology, and capital flows.

A Cycle Framework, Not a Calendar Prediction

One of the biggest mistakes people make with the Bitcoin four-year cycle is treating it like a calendar. They expect a single peak month, a single crash season, and a repeatable schedule. In reality, cycles behave like overlapping waves. The halving is one wave. Macro liquidity is another. Market sentiment is another. Institutional flows add another layer.

In a mature market, these waves can align or misalign. When they align, Bitcoin can look like it’s following a textbook cycle. When they misalign, Bitcoin can still be in a cycle—just one that expresses differently in timing and shape.

The Role of the Bitcoin Halving in Modern Market Structure

The Bitcoin halving still matters because it directly affects the production of new supply. Even in an era of large funds and sophisticated products, Bitcoin remains an asset with an unusually predictable issuance schedule.

But halving impact doesn’t appear instantly. The market absorbs the halving through miner behavior, supply pressure changes, and shifting expectations. Historically, the most dramatic cycle phases have often occurred after the halving, but not necessarily right away. Markets can front-run narratives, then consolidate, then break out later as liquidity and demand intensify.

Willy Woo’s onchain style encourages investors to look for confirmation in behavior rather than guessing based on the calendar. In other words, you watch whether the post-halving supply environment is tightening and whether demand is accelerating, instead of assuming the halving alone guarantees a rally.

Miner Economics and Supply Pressure Still Matter

Miners are not just network participants—they are structural sellers. They must fund operations, upgrade hardware, and manage energy costs. After a halving, miner revenue in BTC terms is cut, forcing the least efficient operations to adjust. This can influence short-term supply flows and can create periods of volatility while the mining sector rebalances.

In more mature markets, miners can hedge more effectively, and liquidity can absorb their selling more smoothly. But the fundamental dynamic remains: the halving shifts the economics of production, and those shifts ripple through the market.

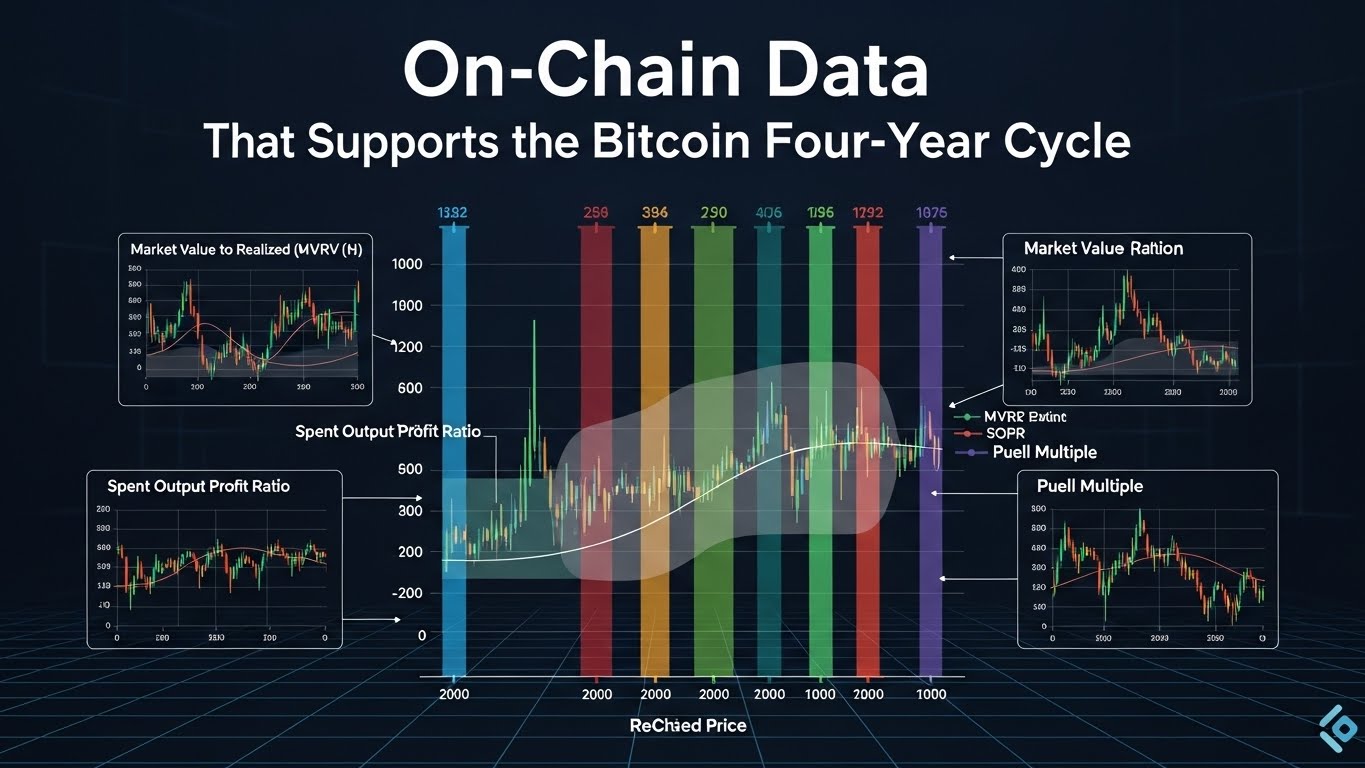

On-Chain Data That Supports the Bitcoin Four-Year Cycle

One reason Willy Woo remains influential is that on-chain data can provide a grounded way to evaluate cycle claims. Instead of arguing purely from narratives, you can watch what participants are doing. While every analyst emphasizes different metrics, several categories often appear in cycle analysis:

Long-Term Holders and Supply “Stickiness”

A recurring hallmark of the Bitcoin four-year cycle is the behavior of long-term holders. During accumulation phases, coins tend to become more “sticky,” meaning they move less frequently. Long-term holders are less likely to sell into weakness. This creates a tighter supply environment over time.

During late-cycle exuberance, the pattern often shifts. Coins that have been dormant for long periods begin to move. That can signal profit-taking, distribution, or the return of speculative behavior. These shifts don’t predict exact tops, but they help identify whether the market is transitioning from accumulation to distribution.

Woo’s defense of the cycle aligns with this logic: if long-term holder behavior continues to cycle between accumulation and distribution regimes, then the Bitcoin four-year cycle is still visible at the structural level.

Capital Inflows and Demand Regimes

Price doesn’t rise sustainably without net demand. In many cycles, the most explosive moves occur when a broad wave of new capital enters the market—often after sentiment flips from skepticism to optimism.

Woo frequently frames cycle maturity in terms of capital inflows. If inflows are not yet at a peak-like level, it can imply the market has not reached a classic late-cycle regime. If inflows are accelerating alongside strong holder conviction, it can imply the cycle is progressing rather than ending.

This “flow-based” view is a powerful antidote to the “death of the pattern” narrative because it focuses on what matters: whether the market is attracting sustained demand under tightening issuance conditions.

Exchange Dynamics and Liquidity Paths

Another useful lens is how coins move relative to exchanges and liquidity venues. Coins flowing toward places where selling is easier can sometimes suggest rising sell pressure. Coins leaving can suggest long-term storage and conviction. These signals are not perfect, but they provide texture.

In a world of custodians, funds, and institutional rails, the exchange story is more complex than it once was. Still, liquidity pathways matter, and cycle phases often show up as shifts in how and why coins move.

ETFs and Institutions: Do They Kill the Four-Year Cycle?

A major driver of “cycle death” claims is institutionalization. With spot products, custody solutions, and large allocators, some assume Bitcoin will behave like a mature commodity and lose its dramatic boom-and-bust rhythm.

But institutionalization can reshape cycles without eliminating them. Institutions can add demand that is less emotional and more strategic, potentially smoothing some volatility. At the same time, institutions can introduce new reflexive behaviors: momentum chasing, rebalancing flows, risk-parity adjustments, and macro-driven allocation shifts.

From Woo’s perspective, the Bitcoin four-year cycle doesn’t require retail mania to exist. It requires a structural supply rhythm plus shifting demand regimes. If institutions increase baseline demand while macro liquidity still ebbs and flows, Bitcoin can still experience multi-year cycles—just with new drivers and new textures.

Why Market Depth Can Change Amplitude, Not Rhythm

As Bitcoin’s market cap grows, the same supply shock can become proportionally smaller relative to total liquidity. That can reduce the magnitude of cycle moves. In other words, the cycle can become less explosive. But reduced explosiveness is not the same as disappearance.

Think of it like an athlete aging into a different style of play. The performance changes, but the identity remains. The Bitcoin four-year cycle can become more “macro-integrated,” more institutional, and more sophisticated—while still operating as a cycle.

Macro Liquidity: The Silent Partner of the Bitcoin Four-Year Cycle

Modern Bitcoin cycles are increasingly entangled with macro conditions. Interest rates, global risk appetite, and liquidity availability can accelerate or delay cycle phases.

This is where Woo’s thinking often resonates: the halving may set the structural stage, but liquidity provides the fuel. If liquidity conditions are tight, Bitcoin can still be in a cycle, but the expansion phase may be slower and more contested. If liquidity conditions loosen, the same supply environment can lead to faster repricing.

Why “Pattern Death” Claims Often Ignore Liquidity Regimes

When someone declares the Bitcoin four-year cycle dead, they often assume Bitcoin should behave the same regardless of the macro environment. But if the broader world shifts from easy money to tight money, it’s unrealistic to expect identical outcomes.

Cycles are not isolated. Bitcoin is increasingly a global asset. That means the Bitcoin four-year cycle may still be present, but the path through it may be more dependent on macro liquidity than in earlier eras.

Confusing “Different” With “Dead”

If there’s one phrase that explains the entire debate, it’s this: different is not dead. A mature cycle can have different timing. It can have multiple peaks. It can have longer consolidations. It can have drawdowns that feel “unfinished” and rallies that feel “underwhelming.” Yet the underlying cycle structure can remain.

Willy Woo’s defense of the Bitcoin four-year cycle is most convincing when you treat it as a set of regimes rather than a repeating template. In that view, the cycle is still present because Bitcoin still transitions through recognizable phases driven by supply issuance changes, evolving demand, and shifting liquidity.

Cycle as a Behavior Machine

At its core, the Bitcoin four-year cycle is a behavior machine. In quieter phases, investors accumulate cautiously, and conviction builds while attention fades. In expansion phases, narratives spread, inflows increase, and speculative behavior grows. In late-cycle phases, confidence becomes certainty, and risk-taking can become reckless. Eventually, the market overheats, demand cools, and a reset occurs.

Those emotional arcs are not unique to Bitcoin. But Bitcoin’s transparent issuance schedule and reflexive culture make them especially visible. Woo’s onchain approach is a way to observe those arcs through behavior rather than only through headlines.

How to Use the Bitcoin Four-Year Cycle Without Overfitting

If you want to use the Bitcoin four-year cycle intelligently, the goal is to avoid overfitting. Overfitting happens when you treat historical patterns as guarantees and force today’s market to match yesterday’s chart.

A healthier approach is to use the cycle as a context engine. You ask: Are we in an accumulation regime, an expansion regime, or a distribution regime? Are long-term holders accumulating or spending? Are inflows broadening? Is liquidity expanding or contracting?

When you think this way, the Bitcoin four-year cycle becomes less about predicting an exact top and more about understanding probabilities and positioning. That is closer to what Woo’s onchain philosophy encourages: follow the data, track regime shifts, and respect the complexity of a growing market.

Why “Smooth Readability” Beats Over-Optimization

A common SEO mistake is repeating a keyword so aggressively that the article reads like a machine. The irony is that true search performance increasingly depends on human engagement: time on page, clarity, flow, and genuine usefulness.

So while the Bitcoin four-year cycle keyword is central to this topic, the better strategy is to integrate it naturally, support it with LSI keywords like on-chain metrics, Bitcoin halving, capital flows, institutional adoption, and macro liquidity, and write with a coherent narrative that matches reader intent.

Conclusion

The debate about whether the Bitcoin four-year cycle is dead often says more about human impatience than about Bitcoin itself. People want simple scripts in a complex market. When the script breaks, they declare the whole concept invalid.

Willy Woo’s defense offers a more grounded middle path. Bitcoin’s cycle structure—anchored by the Bitcoin halving, shaped by on-chain data, and fueled or restrained by liquidity—has not disappeared. What’s changing is the way the cycle expresses: timing can shift, amplitude can compress, and new participants can alter the surface-level pattern. But beneath that surface, the familiar rhythm remains visible through long-term holder behavior, inflow regimes, and supply dynamics.

If you want a durable lens for understanding Bitcoin, treat the Bitcoin four-year cycle as a regime framework, not a prophecy. Watch behavior, follow liquidity, respect uncertainty, and avoid the temptation to declare permanent truths from temporary noise.

FAQs

Q: What exactly is the Bitcoin four-year cycle?

The Bitcoin four-year cycle is a recurring market rhythm historically associated with the Bitcoin halving, where Bitcoin’s new supply issuance is reduced roughly every four years. The cycle often includes phases of accumulation, expansion, and reset.

Q: Why does Willy Woo think the Bitcoin four-year cycle still matters?

Willy Woo argues the cycle remains visible through on-chain data and behavior-based signals, even if institutions, ETFs, and macro conditions change the timing and magnitude of market moves.

Q: Does the Bitcoin halving still impact price in today’s market?

The Bitcoin halving still reduces new supply and affects miner economics, which can influence supply pressure. However, price impact depends on demand and liquidity conditions, so timing and intensity can vary.

Q: What does “death of the pattern” mean in Bitcoin discussions?

“Death of the pattern” refers to the claim that Bitcoin no longer follows the familiar halving-linked cycle behavior. This narrative often appears when Bitcoin diverges from a simplified historical script.

Q: What should I watch if I want to track the cycle realistically?

To track the Bitcoin four-year cycle without rigid predictions, focus on long-term holder behavior, capital inflows, demand strength, and macro liquidity conditions, rather than relying on a fixed calendar timeline.

Also More: Bitcoin Eyes Longest Winning Run as Asian Session Spurs Rally